Sales Use Tax Certificate Form

What is the uniform sales and use tax certificate?

The uniform sales and use tax certificate is a crucial document used by businesses in the United States to claim exemption from sales tax on purchases intended for resale or for use in manufacturing. This certificate allows eligible purchasers to avoid paying sales tax upfront, thereby streamlining the purchasing process. It is widely recognized across various states, providing a standardized approach to sales tax exemption.

This certificate is essential for businesses that operate in multiple states, as it simplifies compliance with different state tax regulations. By presenting this document at the time of purchase, businesses can ensure they are not charged sales tax on items that are exempt under state law.

How to use the uniform sales and use tax certificate

To effectively use the uniform sales and use tax certificate, a business must fill out the form accurately, providing necessary details such as the purchaser's name, address, and the nature of the goods or services being purchased. It is important to specify that the items are intended for resale or other exempt purposes.

Once completed, the certificate should be presented to the seller at the time of purchase. The seller will retain a copy for their records, ensuring compliance with tax regulations. This process helps both parties avoid the unnecessary payment of sales tax on exempt purchases.

Steps to complete the uniform sales and use tax certificate

Completing the uniform sales and use tax certificate involves several straightforward steps:

- Obtain the correct form, which can typically be found on state tax authority websites.

- Fill in the purchaser's name and address accurately.

- Indicate the type of goods or services being purchased and their intended use.

- Sign and date the certificate to validate its authenticity.

- Provide the completed certificate to the seller at the time of purchase.

Ensuring all information is correct and complete is vital to avoid any issues during transactions.

Key elements of the uniform sales and use tax certificate

Several key elements must be included in the uniform sales and use tax certificate to ensure its validity:

- Purchaser Information: Full name and address of the purchaser.

- Seller Information: Name and address of the seller.

- Description of Goods: Clear description of the items being purchased.

- Intended Use: A statement indicating that the items are for resale or other exempt purposes.

- Signature: The purchaser's signature and date to authenticate the certificate.

Including all these elements helps ensure compliance with state regulations and protects both the buyer and seller during the transaction.

Legal use of the uniform sales and use tax certificate

The legal use of the uniform sales and use tax certificate is governed by state tax laws. Businesses must ensure they are eligible to use the certificate for the intended purpose, such as resale or manufacturing. Misuse of the certificate can lead to penalties and back taxes owed.

It is important for businesses to stay informed about their state's specific regulations regarding the use of this certificate, as laws can vary significantly. Proper documentation and adherence to legal requirements help maintain compliance and avoid potential legal issues.

State-specific rules for the uniform sales and use tax certificate

Each state may have its own rules and requirements regarding the uniform sales and use tax certificate. It is essential for businesses to familiarize themselves with these state-specific regulations to ensure compliance. Some states may require additional documentation or have different rules for what qualifies as exempt purchases.

Businesses operating in multiple states should be particularly diligent in understanding the nuances of each state's tax laws to avoid complications. Regularly checking for updates on state tax authority websites can help businesses stay compliant.

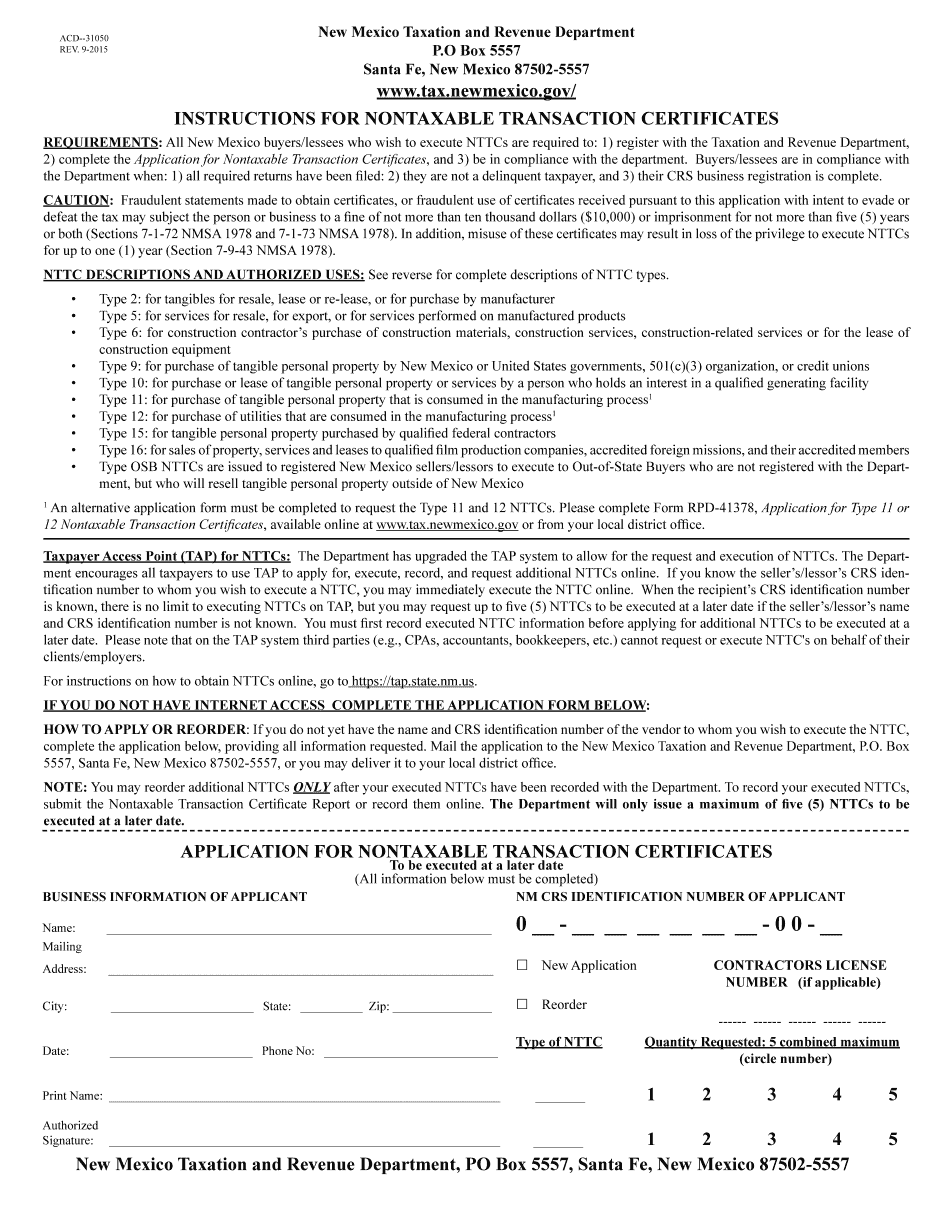

Quick guide on how to complete instructions for nontaxable transaction certificates

Complete Sales Use Tax Certificate effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it in the cloud. airSlate SignNow provides all the resources you need to create, amend, and electronically sign your documents swiftly and without holdups. Manage Sales Use Tax Certificate on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The easiest method to modify and eSign Sales Use Tax Certificate without stress

- Locate Sales Use Tax Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Sales Use Tax Certificate and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for nontaxable transaction certificates

How to make an eSignature for the Instructions For Nontaxable Transaction Certificates in the online mode

How to generate an electronic signature for the Instructions For Nontaxable Transaction Certificates in Chrome

How to make an electronic signature for putting it on the Instructions For Nontaxable Transaction Certificates in Gmail

How to create an eSignature for the Instructions For Nontaxable Transaction Certificates straight from your smartphone

How to generate an electronic signature for the Instructions For Nontaxable Transaction Certificates on iOS

How to create an eSignature for the Instructions For Nontaxable Transaction Certificates on Android devices

People also ask

-

What is a sales use tax certificate, and why do I need one?

A sales use tax certificate is a document that allows businesses to purchase goods or services without paying sales tax when the items will be resold or used in production. This certificate is essential for companies looking to manage their tax obligations efficiently and save on unnecessary expenses. Utilizing a sales use tax certificate can also streamline your accounting processes and avoid potential tax liabilities.

-

How can airSlate SignNow help me manage my sales use tax certificates?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning your sales use tax certificates quickly and securely. With its automation features, you can easily track and manage multiple certificates, ensuring compliance with tax regulations. By simplifying the documentation process, airSlate SignNow allows you to focus more on your business operations.

-

Are there any costs associated with using airSlate SignNow for sales use tax certificates?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the one that best fits your requirements for managing sales use tax certificates. Each plan includes access to essential features, including document eSigning and tracking functionalities. You can start with a free trial to explore how airSlate SignNow can benefit your business before committing.

-

What features does airSlate SignNow offer for sales use tax certificate management?

airSlate SignNow offers numerous features to streamline the management of sales use tax certificates, such as customizable templates, automated reminders, and document workflow tracking. These capabilities signNowly reduce the time spent on paperwork and enhance your team’s efficiency. Additionally, the platform provides secure storage for all your documentation, ensuring easy access and compliance.

-

Can I integrate airSlate SignNow with other software for handling sales use tax certificates?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, including CRM systems and accounting software, to simplify your management of sales use tax certificates. This integration allows for better data flow and overall efficiency in handling your documents. Leveraging these integrations can enhance your business processes even further.

-

Is airSlate SignNow compliant with tax regulation when using sales use tax certificates?

Yes, airSlate SignNow is designed with compliance in mind, helping you manage your sales use tax certificates in accordance with current tax regulations. The platform's features ensure that your documents are securely stored and easily accessible for audits or reviews. By using airSlate SignNow, you can feel confident that you're meeting your tax obligations.

-

How does airSlate SignNow enhance the security of my sales use tax certificates?

Security is a top priority at airSlate SignNow. The platform employs robust encryption methods, secure cloud storage, and user authentication to protect your sales use tax certificates from unauthorized access. This commitment to security ensures that your sensitive tax information remains confidential and secure.

Get more for Sales Use Tax Certificate

- Date rcvd date to parks form

- Bath police department 250 water st bath me police form

- Vendor ownership certification form cartersville medical center

- Student learn contract template form

- Student loan contract template form

- Student work contract template form

- Student teacher contract template form

- Student placement contract template form

Find out other Sales Use Tax Certificate

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement