Form G 61 Rev Export Exemption Certificate for General Excise and Liquor Taxes Forms

Understanding the Form G 61 Rev Export Exemption Certificate

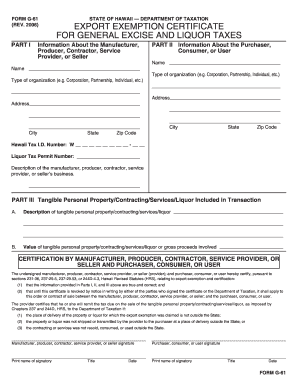

The Form G 61 Rev Export Exemption Certificate is a crucial document used in the context of general excise and liquor taxes. This form is specifically designed for businesses that engage in the export of goods, allowing them to claim exemptions from certain taxes imposed by the state. By utilizing this certificate, eligible businesses can reduce their tax liabilities, making it an essential tool for financial management and compliance.

Steps to Complete the Form G 61 Rev Export Exemption Certificate

Completing the Form G 61 Rev requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including business details and tax identification numbers.

- Clearly indicate the type of goods being exported and their intended destination.

- Provide accurate financial information to support the exemption claim.

- Review the form for completeness and accuracy before submission.

Ensuring that all sections are filled out correctly is vital to avoid delays or rejections.

Obtaining the Form G 61 Rev Export Exemption Certificate

The Form G 61 Rev can typically be obtained through state tax authority websites or directly from their offices. Businesses may also find the form available at local government offices or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Key Elements of the Form G 61 Rev Export Exemption Certificate

Several key elements must be included in the Form G 61 Rev to ensure its validity:

- Business Information: Name, address, and contact details of the business.

- Tax Identification Number: Essential for identifying the business in tax records.

- Export Details: Description of the goods being exported and their destination.

- Signature: An authorized representative must sign the form to validate the information provided.

These elements are critical for the form to be processed correctly by tax authorities.

Legal Use of the Form G 61 Rev Export Exemption Certificate

The legal use of the Form G 61 Rev is governed by state tax laws. It is essential for businesses to understand their eligibility for exemptions and to use the form in accordance with the regulations. Misuse of the form can lead to penalties or fines, making it important to maintain accurate records and ensure compliance with all legal requirements.

Examples of Using the Form G 61 Rev Export Exemption Certificate

Businesses that export goods such as alcoholic beverages or other taxable products often utilize the Form G 61 Rev. For instance, a brewery exporting craft beer to an international market would complete this form to claim exemption from state liquor taxes. Similarly, a manufacturer exporting machinery may use the form to avoid general excise taxes on those goods. These examples illustrate the practical applications of the form in various industries.

Quick guide on how to complete form g 61 rev export exemption certificate for general excise and liquor taxes forms

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly solution to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms

Create this form in 5 minutes!

How to create an eSignature for the form g 61 rev export exemption certificate for general excise and liquor taxes forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

The Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms is a document used by businesses to claim exemptions from certain taxes on exported goods. This form is essential for ensuring compliance with tax regulations while facilitating international trade.

-

How can airSlate SignNow help with the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms. Our user-friendly interface simplifies the process, ensuring that your documents are completed accurately and promptly.

-

What are the pricing options for using airSlate SignNow for the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, ensuring you have access to the tools necessary for managing the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms efficiently.

-

What features does airSlate SignNow offer for managing the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to streamline the management of the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms. These tools enhance productivity and ensure compliance with tax regulations.

-

Are there any integrations available for airSlate SignNow when handling the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to manage the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms alongside your existing workflows, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms?

Using airSlate SignNow for the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. Our solution empowers businesses to focus on their core operations while ensuring compliance with tax requirements.

-

Is it easy to eSign the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms. With just a few clicks, users can securely sign documents from anywhere, ensuring a smooth and efficient signing process.

Get more for Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms

- A rounding exercise form

- Citizenship in the world workbook form

- List of proposed witnesses form

- Alabama migratory bird stamp form

- Tauhara north grants form

- Operating and maintenance manual of the tracklaying vehicle snow form

- Healthy living word search answer key form

- Pediatric patient intake form lighthouse chiropractic

Find out other Form G 61 Rev Export Exemption Certificate For General Excise And Liquor Taxes Forms

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter