STATE of HAWAII DEPARTMENT of TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE Required for Lessee S Files PART I Informat

Understanding the General Excise Sublease Deduction Certificate

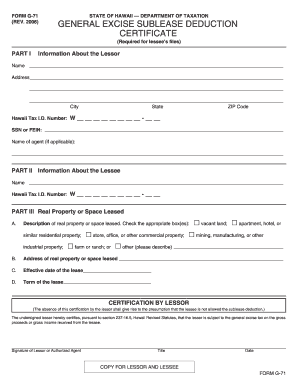

The General Excise Sublease Deduction Certificate is a crucial document for lessees in Hawaii. It enables them to claim a deduction for general excise taxes paid on subleases. This certificate is essential for maintaining accurate tax records and ensuring compliance with state tax regulations. The form must be filled out correctly to avoid issues with the Hawaii Department of Taxation.

Steps to Complete the Certificate

To complete the General Excise Sublease Deduction Certificate, follow these steps:

- Gather the required information about the lessor, including name, address, city, state, and ZIP code.

- Ensure you have the Hawaii Tax Identification Number of the lessor.

- Fill in the lessee's information accurately to reflect the current lease agreement.

- Review all entries for accuracy before submission.

Obtaining the Certificate

The General Excise Sublease Deduction Certificate can be obtained directly from the Hawaii Department of Taxation's website or by visiting their office. It is important to ensure that you are using the most current version of the form to avoid any potential issues during filing.

Legal Use of the Certificate

This certificate serves as a legal document that substantiates the lessee's claim for a deduction on general excise taxes. Proper use of the certificate is essential for compliance with Hawaii tax laws. Failure to provide accurate information may lead to penalties or disallowance of the deduction.

Key Elements of the Certificate

Key elements of the General Excise Sublease Deduction Certificate include:

- Name and address of the lessor.

- Hawaii Tax Identification Number of the lessor.

- Details about the lease agreement.

- Signature of the lessor or an authorized representative.

State-Specific Rules

Hawaii has specific rules regarding the use of the General Excise Sublease Deduction Certificate. It is essential to comply with these regulations to ensure that the deduction is valid. Familiarizing yourself with state tax laws can help avoid complications during the filing process.

Quick guide on how to complete state of hawaii department of taxation general excise sublease deduction certificate required for lessee s files part i

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method of sending the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the concerns of lost or misplaced documents, endless form hunting, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE Required For Lessee S Files PART I Informat

Create this form in 5 minutes!

How to create an eSignature for the state of hawaii department of taxation general excise sublease deduction certificate required for lessee s files part i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE?

The STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE is a document required for lessees to claim deductions on their general excise tax. It provides essential information about the lessor, including their name, address, city, state, ZIP code, and Hawaii Tax ID. This certificate is crucial for ensuring compliance with Hawaii tax regulations.

-

How can airSlate SignNow help with the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE?

airSlate SignNow simplifies the process of preparing and signing the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE. Our platform allows users to easily fill out the required information about the lessor and securely eSign the document. This streamlines the submission process and ensures that all necessary details are accurately captured.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers a range of features for managing tax-related documents, including customizable templates, secure eSigning, and document tracking. Users can create and store the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE and other tax forms in one place. This enhances organization and ensures that all documents are readily accessible when needed.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of documents like the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE. We recommend checking our pricing page for detailed information on the plans available.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your tax management processes. By integrating with accounting and tax software, you can easily manage the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE alongside your other financial documents, improving efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE?

Using airSlate SignNow for the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE offers numerous benefits, including time savings, enhanced security, and improved compliance. The platform allows for quick document preparation and eSigning, reducing the time spent on paperwork. Additionally, our secure environment ensures that sensitive information is protected.

-

How do I get started with airSlate SignNow for tax documents?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you can begin creating and managing documents like the STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE. Our user-friendly interface guides you through the process, making it accessible for everyone.

Get more for STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE Required For Lessee S Files PART I Informat

Find out other STATE OF HAWAII DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE Required For Lessee S Files PART I Informat

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document