Form 4970 OMB No

What is the Form 4970 OMB No

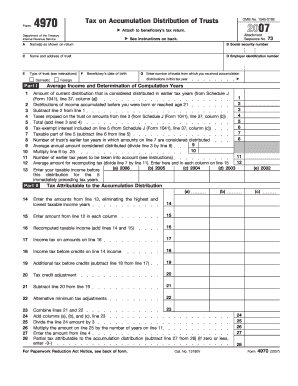

The Form 4970 OMB No is a tax form used by the Internal Revenue Service (IRS) in the United States. This form is specifically designed for beneficiaries of certain types of retirement accounts, including inherited IRAs and other pension plans. It helps report distributions that may be subject to an additional tax for early withdrawal. Understanding this form is crucial for ensuring compliance with tax obligations and avoiding potential penalties.

How to obtain the Form 4970 OMB No

To obtain the Form 4970 OMB No, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers may request a physical copy by contacting the IRS directly. It is essential to ensure that the most current version of the form is used, as tax regulations and forms can change annually.

Steps to complete the Form 4970 OMB No

Completing the Form 4970 OMB No involves several key steps. First, gather all necessary documentation, including information about the inherited retirement account and any distributions received. Next, accurately fill out the form by providing personal details, including your name, Social Security number, and the specifics of the distribution. Finally, review the completed form for accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4970 OMB No align with the general tax filing deadlines set by the IRS. Typically, this means that the form must be submitted by April 15 of the year following the tax year in which the distribution was made. However, if you file for an extension, be aware of the extended deadline and ensure timely submission to avoid penalties.

Legal use of the Form 4970 OMB No

The Form 4970 OMB No is legally required for reporting specific distributions from inherited retirement accounts. Failure to file this form when required can result in significant penalties, including additional taxes on the distribution. It is essential to understand the legal implications of the form and ensure compliance to avoid any issues with the IRS.

Key elements of the Form 4970 OMB No

Key elements of the Form 4970 OMB No include sections for personal identification, details about the inherited account, and the amount of distribution received. Additionally, the form includes calculations for any applicable taxes due on early withdrawals. Understanding these elements is vital for accurately completing the form and ensuring compliance with tax laws.

Quick guide on how to complete form 4970 omb no

Prepare [SKS] effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, since you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4970 OMB No

Create this form in 5 minutes!

How to create an eSignature for the form 4970 omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4970 OMB No. and why is it important?

Form 4970 OMB No. is a tax form used to report certain distributions from retirement plans. Understanding this form is crucial for ensuring compliance with IRS regulations and avoiding potential penalties. By using airSlate SignNow, you can easily eSign and manage your Form 4970 OMB No. efficiently.

-

How can airSlate SignNow help with completing Form 4970 OMB No.?

airSlate SignNow provides a user-friendly platform that simplifies the process of filling out and signing Form 4970 OMB No. Our solution allows you to collaborate with others, ensuring that all necessary signatures are obtained quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Form 4970 OMB No.?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure that you can manage your Form 4970 OMB No. and other documents without breaking the bank. Explore our pricing page for more details.

-

What features does airSlate SignNow offer for managing Form 4970 OMB No.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of Form 4970 OMB No. These tools streamline the process, making it easier to handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for Form 4970 OMB No.?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your Form 4970 OMB No. alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for Form 4970 OMB No.?

Using airSlate SignNow for Form 4970 OMB No. provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your business operations.

-

How secure is airSlate SignNow when handling Form 4970 OMB No.?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your Form 4970 OMB No. and other sensitive documents. You can trust that your information is safe with us.

Get more for Form 4970 OMB No

Find out other Form 4970 OMB No

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement