812 1099 Form

What is the

The form is a specific type of tax document used in the United States for reporting various types of income. This form is particularly relevant for individuals and businesses that need to report income that is not classified as wages or salaries. The is essential for ensuring compliance with IRS regulations and helps taxpayers accurately report their income to avoid penalties.

How to use the

Using the form involves several steps to ensure accurate reporting. First, gather all necessary information regarding income received during the tax year. This includes details such as the payer's name, address, and taxpayer identification number, as well as the total amount of income received. Once you have this information, you can fill out the form, ensuring that all entries are correct. After completing the form, it must be submitted to the IRS and provided to the income recipient by the specified deadlines.

Steps to complete the

Completing the form requires careful attention to detail. Follow these steps:

- Collect all necessary income documentation.

- Fill in your personal information, including your name and taxpayer identification number.

- Enter the recipient's information accurately.

- Report the total amount of income paid to the recipient.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS and provide a copy to the recipient.

Legal use of the

The legal use of the form is crucial for maintaining compliance with federal tax laws. This form serves as an official record of income and must be filed accurately to avoid legal repercussions. Misreporting or failing to file can lead to penalties, including fines and interest on unpaid taxes. It is essential for both the payer and the recipient to keep copies of the form for their records.

Filing Deadlines / Important Dates

Filing deadlines for the form are critical to ensure compliance with IRS regulations. Typically, the form must be submitted to the IRS by January thirty-first of the year following the reporting year. Additionally, recipients should receive their copies by the same date. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS updates.

Who Issues the Form

The form is typically issued by businesses or individuals who have made payments to another party that require reporting to the IRS. This includes various entities such as corporations, partnerships, and sole proprietors. The responsibility for issuing the form lies with the payer, who must ensure that all information is accurate and submitted on time to comply with tax regulations.

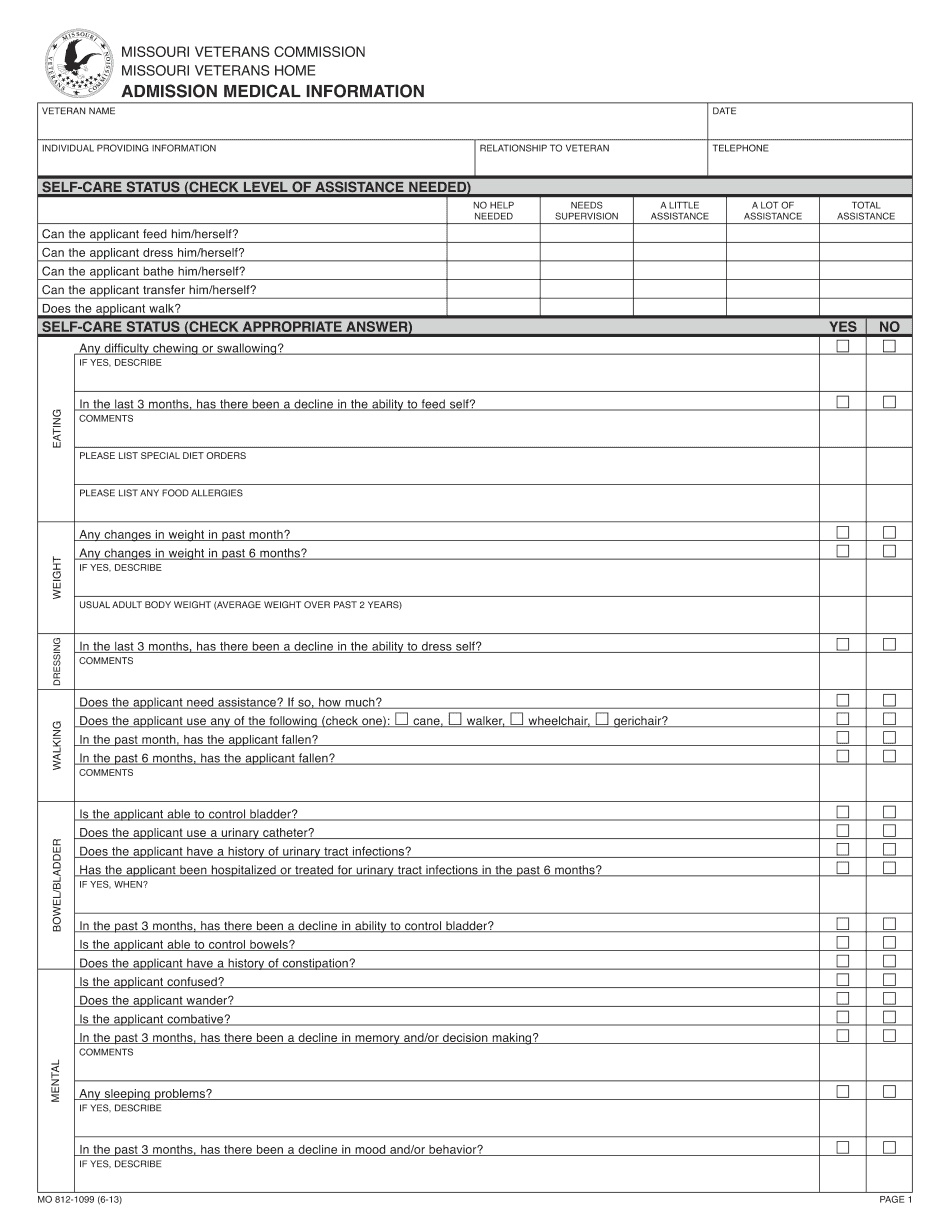

Quick guide on how to complete veteran name

Complete 812 1099 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage 812 1099 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign 812 1099 effortlessly

- Obtain 812 1099 and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device of your choice. Modify and eSign 812 1099 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the veteran name

How to make an electronic signature for the Veteran Name in the online mode

How to make an eSignature for the Veteran Name in Google Chrome

How to generate an eSignature for putting it on the Veteran Name in Gmail

How to create an eSignature for the Veteran Name straight from your smart phone

How to create an electronic signature for the Veteran Name on iOS

How to generate an eSignature for the Veteran Name on Android OS

People also ask

-

What is the 812 1099 form and why is it important?

The 812 1099 form is a tax document used to report various types of income other than wages, salaries, and tips. It is essential for businesses to accurately report income to the IRS, ensuring compliance and avoiding penalties. Using airSlate SignNow makes it easy to prepare, send, and eSign your 812 1099 forms securely.

-

How can airSlate SignNow help me with my 812 1099 documents?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your 812 1099 documents quickly. Our solution streamlines the entire process, making it easier for businesses to manage their tax documentation efficiently and securely, reducing errors and saving time.

-

What features does airSlate SignNow offer for managing 812 1099 forms?

With airSlate SignNow, you can create customizable templates for your 812 1099 forms, enabling quick adjustments for each recipient. The platform also offers automated reminders, tracking, and secure storage, ensuring that your documents are always accessible and compliant.

-

Is airSlate SignNow cost-effective for handling multiple 812 1099 forms?

Yes, airSlate SignNow is a cost-effective solution for businesses handling multiple 812 1099 forms. Our pricing plans are designed to accommodate various business sizes and needs, allowing you to save on printing and mailing costs while enhancing your document management process.

-

Can I integrate airSlate SignNow with my existing accounting software for 812 1099 processing?

Absolutely! airSlate SignNow offers integrations with popular accounting software, enabling seamless data transfer when managing your 812 1099 forms. This integration helps streamline your workflow, reducing manual entry and improving accuracy in your financial reporting.

-

What security measures does airSlate SignNow have in place for 812 1099 documents?

airSlate SignNow prioritizes the security of your documents, including 812 1099 forms. We employ advanced encryption, secure cloud storage, and multi-factor authentication to protect your sensitive information from unauthorized access.

-

How long does it take to set up airSlate SignNow for 812 1099 document management?

Setting up airSlate SignNow for managing your 812 1099 documents is quick and straightforward. Most users can complete the setup within minutes, allowing you to start sending and eSigning documents right away without extensive training or IT support.

Get more for 812 1099

- Model opgaaf gegevens voor de loonheffingen studenten en scholierenregeling lh 202 1b18fol form

- Application at the augsburg university of hochschule augsburg form

- Ad appel ona form

- Multinational industrial security working group form

- Krazydad jigsaw sudoku form

- Autorisation de type 2 pour le transport d animaux cantal gouv form

- How would you describe the vibe of your campus youtube form

- Im yeri adresi yurt d form

Find out other 812 1099

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure