Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL Form

What is the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

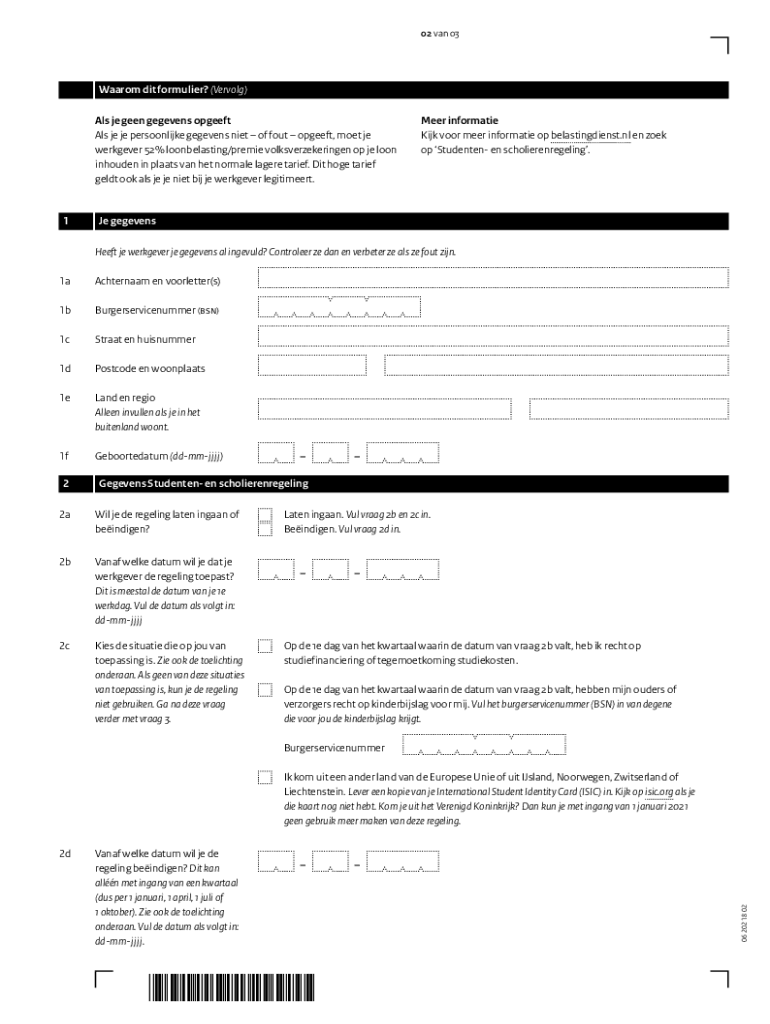

The Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL is a specific form used in the Netherlands for reporting income and tax information related to students and scholars. This form is essential for ensuring that the correct tax deductions are applied to earnings from student jobs or scholarships. It helps employers determine the appropriate tax rate for their student employees, ensuring compliance with local tax regulations.

How to use the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

Using the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL involves filling out the required fields accurately. Students must provide personal information, including their name, address, and tax identification number. Additionally, they should include details about their income and any applicable deductions. Once completed, the form should be submitted to the employer, who will use it to calculate the correct tax withholdings.

Steps to complete the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

Completing the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL involves several key steps:

- Gather necessary personal information, including your tax identification number.

- Fill in your name, address, and contact details on the form.

- Provide information about your income sources, including any student jobs or scholarships.

- Include any deductions you may qualify for, such as educational expenses.

- Review the completed form for accuracy before submission.

- Submit the form to your employer for processing.

Legal use of the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

The legal use of the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL is crucial for compliance with tax laws. This form ensures that students are taxed appropriately based on their income levels and student status. Employers are obligated to use the information provided on this form to determine the correct tax rates and withholdings, thus protecting both the employer and employee from potential legal issues related to tax misreporting.

Eligibility Criteria

To be eligible to use the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL, individuals must meet specific criteria. Primarily, they must be enrolled in an educational institution and be classified as a student or scholar. Additionally, their income from part-time work or scholarships must fall within designated thresholds set by tax authorities. Meeting these criteria ensures that students can benefit from appropriate tax treatment under the student and scholar regulation.

Form Submission Methods

The Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL can be submitted through various methods. Typically, students provide the completed form directly to their employers. This can be done in person or via email, depending on the employer's preferred process. It is essential to ensure that the form is submitted before any payroll processing to guarantee that the correct tax deductions are applied.

Quick guide on how to complete model opgaaf gegevens voor de loonheffingen studenten en scholierenregeling lh 202 1b18fol

Complete Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed forms, enabling you to locate the necessary document and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL without hassle

- Locate Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL to ensure superb communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct model opgaaf gegevens voor de loonheffingen studenten en scholierenregeling lh 202 1b18fol

Create this form in 5 minutes!

How to create an eSignature for the model opgaaf gegevens voor de loonheffingen studenten en scholierenregeling lh 202 1b18fol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

The Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL is a standardized form used in the Netherlands for taxation purposes related to students and scholars. This document helps employers report earnings accurately for tax calculations under the student and scholar scheme, ensuring compliance with local regulations.

-

How can airSlate SignNow help with the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

airSlate SignNow streamlines the process of completing and signing the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL. With our platform, users can easily fill out the document, obtain electronic signatures, and securely store copies for their records, signNowly reducing paperwork hassle.

-

What are the features of airSlate SignNow that support the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

Key features of airSlate SignNow include customizable templates, mobile access, and automated workflows that simplify the management of documents like the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL. These features enhance efficiency and ensure all parties involved can review and sign the document quickly.

-

Is there a cost associated with using airSlate SignNow for the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

Yes, while airSlate SignNow offers competitive pricing, the cost may vary depending on the plan selected. Our pricing structure is designed to be budget-friendly, making it accessible for businesses and individuals needing to manage the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL efficiently.

-

Can airSlate SignNow integrate with other tools for managing the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and email platforms, facilitating the workflow associated with the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL. This integration enhances your document management capabilities and ensures a cohesive user experience.

-

What are the benefits of using airSlate SignNow for the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL?

Using airSlate SignNow for the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced document security. Our solution enables you to handle important tax documents easily and with confidence.

-

Is the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL compliant with local regulations when using airSlate SignNow?

Yes, airSlate SignNow ensures that the Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL can be completed in compliance with local regulations. By using our platform, users can trust that their documents meet legal requirements.

Get more for Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

- Supplement schedule for refund of louisiana citizens property revenue louisiana form

- Pelvic floor impact questionnaireshort form 7 pfiq 7

- Ashi instructor application home page ashinstitute org form

- 5 elevator pitch worksheet 1 westminster college westminstercollege form

- Bp s235 form

- Separate series agreement clint coons esq form

- Itemization of amount financed form

- Forms mc 406a and mc 406b courts mi

Find out other Model Opgaaf Gegevens Voor De Loonheffingen Studenten En Scholierenregeling LH 202 1B*18FOL

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple