Form 593 Calkain Companies

What is the Form 593 Calkain Companies

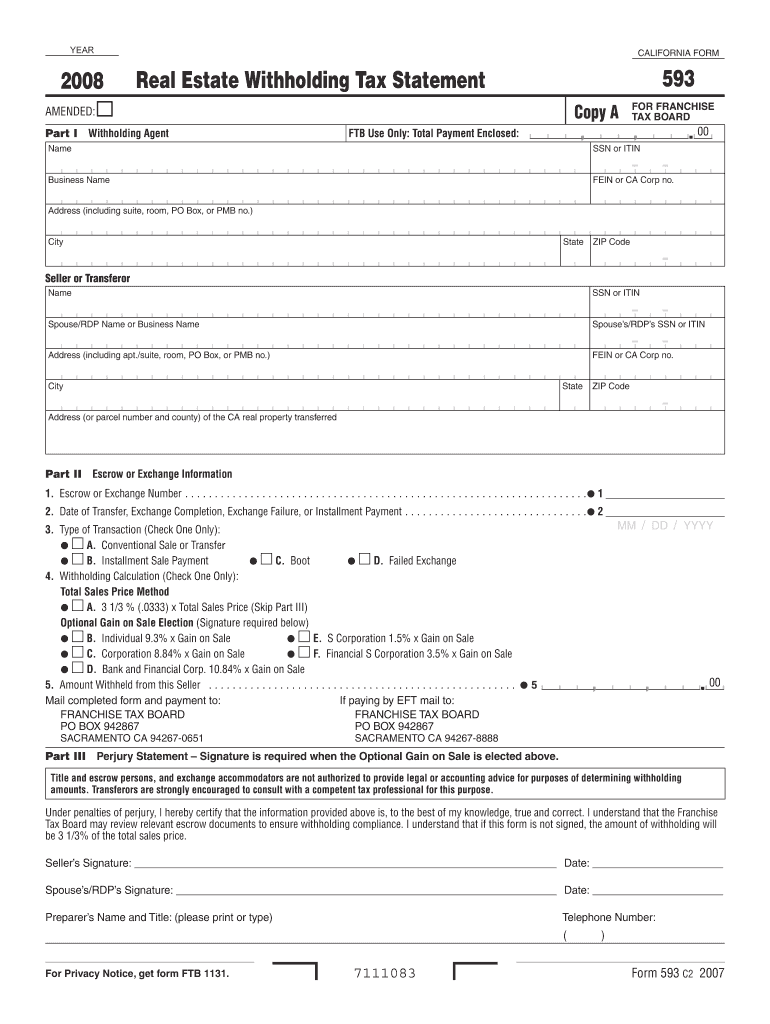

The Form 593 Calkain Companies is a tax-related document used primarily in the United States for reporting certain transactions involving real estate. This form is essential for businesses and individuals involved in property transactions, particularly for those who are required to report the sale or transfer of real estate interests. It provides the necessary information to the Internal Revenue Service (IRS) regarding the nature of the transaction, the parties involved, and any applicable tax implications.

How to use the Form 593 Calkain Companies

Using the Form 593 Calkain Companies involves accurately filling out the required sections to report real estate transactions. This includes entering details about the property, the buyer, the seller, and the transaction amount. It is crucial to ensure that all information is correct and complete to avoid any potential issues with the IRS. Once completed, the form must be submitted according to the specific filing guidelines established by the IRS.

Steps to complete the Form 593 Calkain Companies

Completing the Form 593 Calkain Companies requires a series of methodical steps:

- Gather all necessary information about the real estate transaction, including property details and parties involved.

- Fill in the form with accurate data, ensuring that each section is completed as required.

- Review the form for any errors or omissions to ensure accuracy.

- Submit the form as per IRS guidelines, either electronically or via mail.

Legal use of the Form 593 Calkain Companies

The legal use of the Form 593 Calkain Companies is governed by IRS regulations. It is essential for individuals and businesses to understand the legal implications of filing this form, as it relates to tax obligations and compliance. Proper use of the form helps ensure that all parties involved in a real estate transaction fulfill their tax responsibilities and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 Calkain Companies are critical to ensure compliance with tax regulations. Typically, the form must be submitted by the due date of the tax return for the year in which the transaction occurred. It is advisable to check the IRS website or consult a tax professional for specific deadlines, as these may vary based on individual circumstances and changes in tax laws.

Required Documents

To complete the Form 593 Calkain Companies, certain documents are typically required. These may include:

- Proof of ownership of the property being sold or transferred.

- Documentation of the transaction, such as a sales contract or closing statement.

- Identification information for all parties involved in the transaction.

Penalties for Non-Compliance

Failure to properly file the Form 593 Calkain Companies can result in penalties imposed by the IRS. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses to understand the importance of timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 593 calkain companies

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed papers, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 593 Calkain Companies

Create this form in 5 minutes!

How to create an eSignature for the form 593 calkain companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 593 Calkain Companies?

Form 593 Calkain Companies is a tax form used for reporting California source income. It is essential for businesses operating in California to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and send Form 593 Calkain Companies securely.

-

How can airSlate SignNow help with Form 593 Calkain Companies?

airSlate SignNow streamlines the process of completing and signing Form 593 Calkain Companies. Our platform allows you to fill out the form digitally, ensuring accuracy and efficiency. With our eSignature feature, you can obtain signatures quickly, making tax reporting hassle-free.

-

What are the pricing options for using airSlate SignNow for Form 593 Calkain Companies?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for managing documents like Form 593 Calkain Companies. Visit our pricing page for detailed information on plans and features.

-

Are there any integrations available for Form 593 Calkain Companies?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for Form 593 Calkain Companies. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage your documents efficiently. These integrations help streamline the process of sending and signing forms.

-

What are the benefits of using airSlate SignNow for Form 593 Calkain Companies?

Using airSlate SignNow for Form 593 Calkain Companies offers numerous benefits, including time savings and improved accuracy. Our platform reduces the risk of errors associated with manual entry and provides a secure environment for document handling. Additionally, you can track the status of your forms in real-time.

-

Is airSlate SignNow secure for handling Form 593 Calkain Companies?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Form 593 Calkain Companies and other documents are protected. We use advanced encryption and comply with industry standards to safeguard your data. You can trust us to keep your sensitive information secure.

-

Can I customize Form 593 Calkain Companies using airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form 593 Calkain Companies to meet your specific needs. You can add fields, adjust layouts, and include branding elements to ensure the form aligns with your business identity. This customization enhances the professionalism of your documents.

Get more for Form 593 Calkain Companies

Find out other Form 593 Calkain Companies

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement