YEAR Nonresident Withholding Exemption Certificate for Previously Reported Income CALIFORNIA FORM 590 P Keep This Form with Your

Understanding the YEAR Nonresident Withholding Exemption Certificate

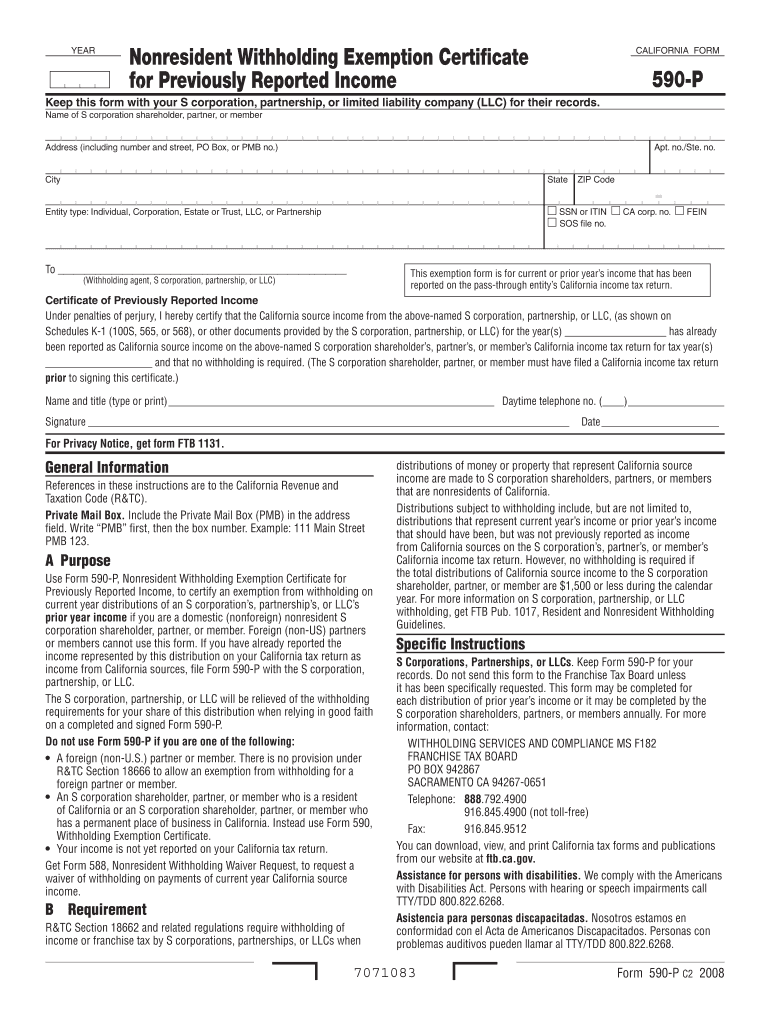

The YEAR Nonresident Withholding Exemption Certificate for Previously Reported Income, commonly referred to as California Form 590 P, is a crucial document for nonresident individuals or entities receiving income from California sources. This form allows recipients to claim an exemption from withholding on certain types of income that have already been reported. By using this certificate, nonresidents can ensure that they are not over-withheld, thereby improving their cash flow and simplifying tax reporting. It is essential for S Corporations, partnerships, and limited liability companies (LLCs) to maintain this form for their records, as it serves as proof of the exemption claimed.

Steps to Complete the YEAR Nonresident Withholding Exemption Certificate

Completing the YEAR Nonresident Withholding Exemption Certificate involves several key steps to ensure accuracy and compliance. Begin by downloading the form from the California Franchise Tax Board website. Fill in the required information, including your name, address, and taxpayer identification number. Indicate the type of income for which you are claiming the exemption and provide any necessary supporting documentation. Review the completed form for accuracy before signing and dating it. Finally, submit the form to the appropriate withholding agent, such as your S Corporation, partnership, or LLC, for their records.

Legal Use of the YEAR Nonresident Withholding Exemption Certificate

The legal use of the YEAR Nonresident Withholding Exemption Certificate is governed by California tax laws. This form is specifically designed for nonresidents who have previously reported income and wish to avoid unnecessary withholding. It is important to understand that misuse of this form can lead to penalties or additional tax liabilities. Nonresidents should ensure that they meet the eligibility criteria for claiming the exemption and maintain accurate records to support their claims in case of an audit.

Key Elements of the YEAR Nonresident Withholding Exemption Certificate

The YEAR Nonresident Withholding Exemption Certificate contains several key elements that are vital for proper completion. These include the taxpayer's identification information, the type of income being exempted, and the reason for the exemption. Additionally, the form requires a signature and date, confirming that the information provided is accurate and complete. Understanding these elements helps ensure that the form is filled out correctly, reducing the risk of errors that could lead to withholding complications.

Eligibility Criteria for the YEAR Nonresident Withholding Exemption Certificate

To be eligible for the YEAR Nonresident Withholding Exemption Certificate, individuals or entities must meet specific criteria set forth by California tax regulations. Generally, the applicant must be a nonresident receiving income from California sources that has already been reported. It is also necessary to demonstrate that the income qualifies for exemption under applicable tax laws. Nonresidents should review these criteria carefully to ensure they qualify before submitting the form.

Obtaining the YEAR Nonresident Withholding Exemption Certificate

Obtaining the YEAR Nonresident Withholding Exemption Certificate is a straightforward process. The form can be accessed online through the California Franchise Tax Board's official website. It is advisable to download the most current version of the form to ensure compliance with any recent changes in tax regulations. Once downloaded, the form can be printed and filled out as needed. For those who prefer a digital approach, the form may also be completed electronically, depending on the tools available.

Quick guide on how to complete year nonresident withholding exemption certificate for previously reported income california form 590 p keep this form with

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select signNow sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P Keep This Form With Your

Create this form in 5 minutes!

How to create an eSignature for the year nonresident withholding exemption certificate for previously reported income california form 590 p keep this form with

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P?

The YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P is a tax form that allows nonresidents to claim an exemption from withholding on income that has already been reported. This form is essential for S Corporations, Partnerships, or Limited Liability Companies (LLCs) to maintain accurate records and ensure compliance with California tax regulations.

-

How do I complete the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P?

To complete the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P, you need to provide your personal information, the income details, and the reason for the exemption. Make sure to follow the instructions carefully and keep this form with your S Corporation, Partnership, or Limited Liability Company LLC for their records.

-

Who needs to file the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P?

Nonresidents who have previously reported income in California and wish to claim an exemption from withholding must file the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P. This is particularly important for those involved with S Corporations, Partnerships, or Limited Liability Companies (LLCs) to ensure proper tax handling.

-

What are the benefits of using airSlate SignNow for managing the YEAR Nonresident Withholding Exemption Certificate?

Using airSlate SignNow to manage the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P streamlines the signing and storage process. It provides a secure, easy-to-use platform that allows businesses to send, eSign, and keep track of important documents, ensuring compliance and reducing administrative burdens.

-

Is there a cost associated with using airSlate SignNow for the YEAR Nonresident Withholding Exemption Certificate?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on features and usage, allowing you to choose the best option that fits your needs for managing the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P.

-

Can airSlate SignNow integrate with other software for managing tax documents?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage tax documents like the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P. This ensures that your workflow remains efficient and that all necessary documents are easily accessible.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents, including the YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P. The platform employs advanced encryption and security protocols to protect sensitive information, ensuring that your documents are safe and secure.

Get more for YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P Keep This Form With Your

Find out other YEAR Nonresident Withholding Exemption Certificate For Previously Reported Income CALIFORNIA FORM 590 P Keep This Form With Your

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement