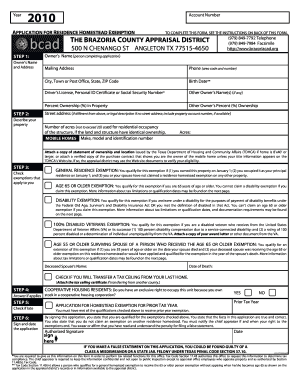

Application for Residence Homestead Exemption Form

What is the Application For Residence Homestead Exemption

The Application For Residence Homestead Exemption is a legal document that allows homeowners to apply for a property tax exemption on their primary residence. This exemption can significantly reduce the amount of property tax owed, making homeownership more affordable. The application is typically submitted to the local tax authority and is subject to specific eligibility criteria defined by state laws.

Eligibility Criteria

To qualify for the Residence Homestead Exemption, applicants generally must meet several criteria, which can vary by state. Common requirements include:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property.

- The applicant must meet certain income thresholds, if applicable.

- The application must be submitted within designated filing deadlines.

Steps to Complete the Application For Residence Homestead Exemption

Completing the Application For Residence Homestead Exemption involves several key steps:

- Gather necessary documentation, such as proof of residency and ownership.

- Obtain the application form from your local tax authority’s website or office.

- Fill out the application form accurately, providing all required information.

- Submit the application by the specified deadline, either online, by mail, or in person.

Required Documents

When applying for the Residence Homestead Exemption, applicants typically need to provide various documents to support their application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, like a deed or tax statement.

- Evidence of residency, which may include utility bills or bank statements.

Form Submission Methods

Applicants can submit the Application For Residence Homestead Exemption through various methods, depending on local regulations:

- Online submission via the local tax authority's website.

- Mailing the completed application to the designated office.

- In-person submission at the local tax authority office.

Filing Deadlines / Important Dates

Each state has specific deadlines for submitting the Application For Residence Homestead Exemption. It is crucial for applicants to be aware of these dates to ensure their application is considered. Common deadlines may include:

- Annual filing deadlines, which often fall on a specific date each year.

- Additional deadlines for late applications or appeals.

Quick guide on how to complete application for residence homestead exemption

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

The easiest way to edit and electronically sign [SKS] without stress

- Find [SKS] and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs within a few clicks from a device of your choice. Edit and electronically sign [SKS] while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for residence homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Residence Homestead Exemption?

The Application For Residence Homestead Exemption is a form that allows homeowners to apply for tax exemptions on their primary residence. This exemption can signNowly reduce property taxes, making it essential for eligible homeowners to complete the application accurately.

-

How can airSlate SignNow help with the Application For Residence Homestead Exemption?

airSlate SignNow provides an efficient platform for completing and eSigning the Application For Residence Homestead Exemption. With its user-friendly interface, you can easily fill out the necessary information and securely send the application to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for the Application For Residence Homestead Exemption?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that simplify the process of submitting the Application For Residence Homestead Exemption, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the Application For Residence Homestead Exemption?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which streamline the process of submitting the Application For Residence Homestead Exemption. These features enhance efficiency and ensure that your application is processed smoothly.

-

Can I integrate airSlate SignNow with other applications for the Application For Residence Homestead Exemption?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage your Application For Residence Homestead Exemption alongside other tools you use for business operations.

-

What are the benefits of using airSlate SignNow for my Application For Residence Homestead Exemption?

Using airSlate SignNow for your Application For Residence Homestead Exemption provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform ensures that your application is completed correctly and submitted on time, maximizing your chances of receiving the exemption.

-

How secure is my information when using airSlate SignNow for the Application For Residence Homestead Exemption?

airSlate SignNow prioritizes the security of your information. When you use the platform for the Application For Residence Homestead Exemption, your data is encrypted and stored securely, ensuring that your personal and financial information remains protected throughout the process.

Get more for Application For Residence Homestead Exemption

Find out other Application For Residence Homestead Exemption

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online