Application or AGENCY DATA Cross Insurance Form

Understanding the Application OR AGENCY DATA Cross Insurance

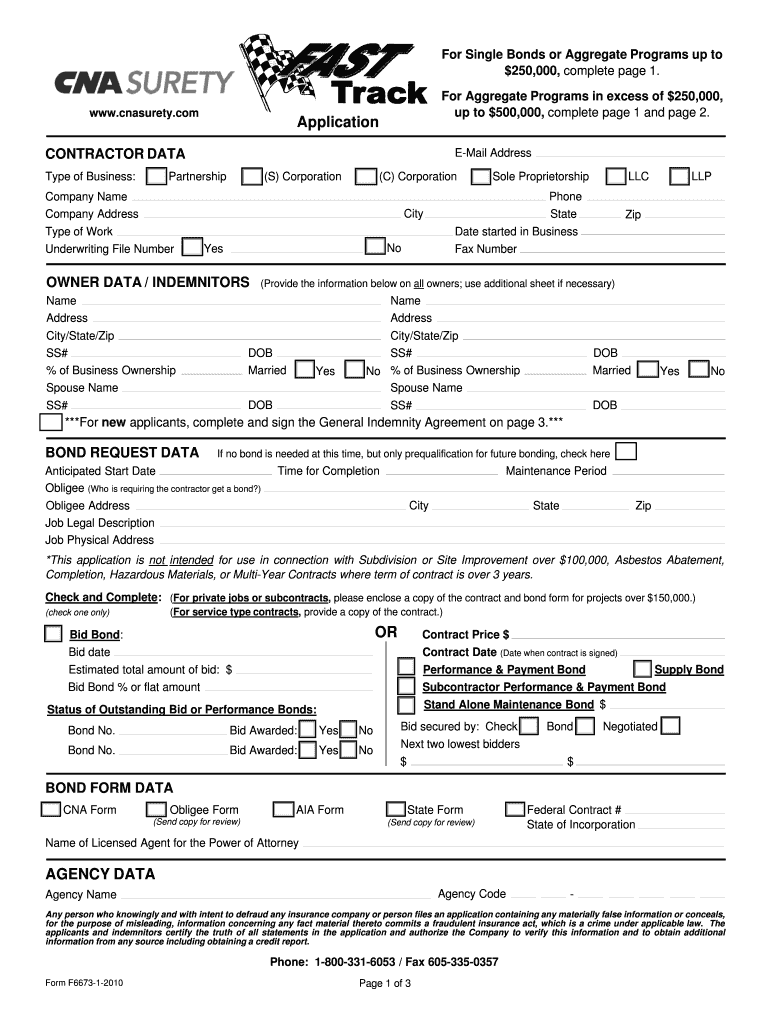

The Application OR AGENCY DATA Cross Insurance is a crucial document used primarily in the insurance industry to collect essential information about applicants and their agencies. This form serves as a foundational tool for insurance providers to assess risk, determine coverage options, and establish premium rates. It typically includes details such as the applicant's name, contact information, agency affiliation, and specific insurance needs. Understanding this form is vital for both individuals and agencies to ensure accurate and efficient processing of insurance applications.

Steps to Complete the Application OR AGENCY DATA Cross Insurance

Completing the Application OR AGENCY DATA Cross Insurance involves several key steps to ensure all necessary information is accurately provided. Begin by gathering all required documents, including identification and any previous insurance policies. Next, fill out the form with precise details, ensuring that all sections are completed. Pay special attention to the sections that require numerical data, such as income or asset values, as inaccuracies can lead to processing delays. Once completed, review the form for any errors or omissions before submission.

Required Documents for the Application OR AGENCY DATA Cross Insurance

To successfully submit the Application OR AGENCY DATA Cross Insurance, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport.

- Previous insurance policy documents, if applicable.

- Financial statements or tax returns to verify income.

- Business registration documents for agency applicants.

Having these documents ready can streamline the application process and reduce the likelihood of delays.

Legal Use of the Application OR AGENCY DATA Cross Insurance

The Application OR AGENCY DATA Cross Insurance is governed by various legal standards to protect both the applicant and the insurance provider. It is essential that the information provided is truthful and accurate, as providing false information can lead to legal consequences, including denial of coverage or potential fraud charges. Additionally, the form must comply with state regulations regarding data collection and privacy, ensuring that personal information is handled securely and responsibly.

Form Submission Methods for the Application OR AGENCY DATA Cross Insurance

Submitting the Application OR AGENCY DATA Cross Insurance can be done through multiple methods, catering to different preferences and situations. Common submission methods include:

- Online submission through the insurance provider's secure portal.

- Mailing a physical copy of the completed form to the designated office.

- In-person submission at a local insurance agency or office.

Choosing the appropriate method may depend on the urgency of the application and the applicant's access to technology.

Eligibility Criteria for the Application OR AGENCY DATA Cross Insurance

Eligibility for completing the Application OR AGENCY DATA Cross Insurance varies based on the type of insurance being applied for. Generally, applicants must meet specific criteria, which may include:

- Age requirements, typically at least eighteen years old.

- Residency in the state where the insurance is being applied.

- Provision of accurate financial and personal information.

Understanding these criteria helps applicants determine their eligibility and prepares them for potential follow-up questions from the insurance provider.

Quick guide on how to complete application or agency data cross insurance

Complete [SKS] effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your paperwork swiftly without delays. Handle [SKS] on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to alter and electronically sign [SKS] seamlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your choice. Alter and electronically sign [SKS] and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application OR AGENCY DATA Cross Insurance

Create this form in 5 minutes!

How to create an eSignature for the application or agency data cross insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Application OR AGENCY DATA Cross Insurance?

Application OR AGENCY DATA Cross Insurance refers to a comprehensive solution that allows businesses to manage their insurance applications and agency data efficiently. With airSlate SignNow, you can streamline the process of sending and eSigning documents related to insurance, ensuring compliance and accuracy.

-

How does airSlate SignNow enhance the Application OR AGENCY DATA Cross Insurance process?

airSlate SignNow enhances the Application OR AGENCY DATA Cross Insurance process by providing an intuitive platform for document management. Users can easily create, send, and track insurance applications, reducing the time spent on paperwork and improving overall efficiency.

-

What are the pricing options for using airSlate SignNow with Application OR AGENCY DATA Cross Insurance?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses utilizing Application OR AGENCY DATA Cross Insurance. Whether you are a small agency or a large enterprise, you can choose a plan that fits your budget while gaining access to essential features.

-

What features does airSlate SignNow offer for Application OR AGENCY DATA Cross Insurance?

Key features of airSlate SignNow for Application OR AGENCY DATA Cross Insurance include customizable templates, automated workflows, and secure eSigning capabilities. These features help streamline the insurance application process, making it easier for agencies to manage their data.

-

Can I integrate airSlate SignNow with other tools for Application OR AGENCY DATA Cross Insurance?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms that are commonly used in the insurance industry. This allows you to connect your Application OR AGENCY DATA Cross Insurance processes with CRM systems, document storage solutions, and more.

-

What are the benefits of using airSlate SignNow for Application OR AGENCY DATA Cross Insurance?

Using airSlate SignNow for Application OR AGENCY DATA Cross Insurance provides numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. By digitizing your document processes, you can save time and resources while ensuring that your agency data is secure.

-

Is airSlate SignNow secure for handling Application OR AGENCY DATA Cross Insurance?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Application OR AGENCY DATA Cross Insurance. The platform employs advanced encryption and security protocols to protect sensitive information throughout the document lifecycle.

Get more for Application OR AGENCY DATA Cross Insurance

Find out other Application OR AGENCY DATA Cross Insurance

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online