Michigan Tax Form 1040

What is the Michigan Tax Form 1040

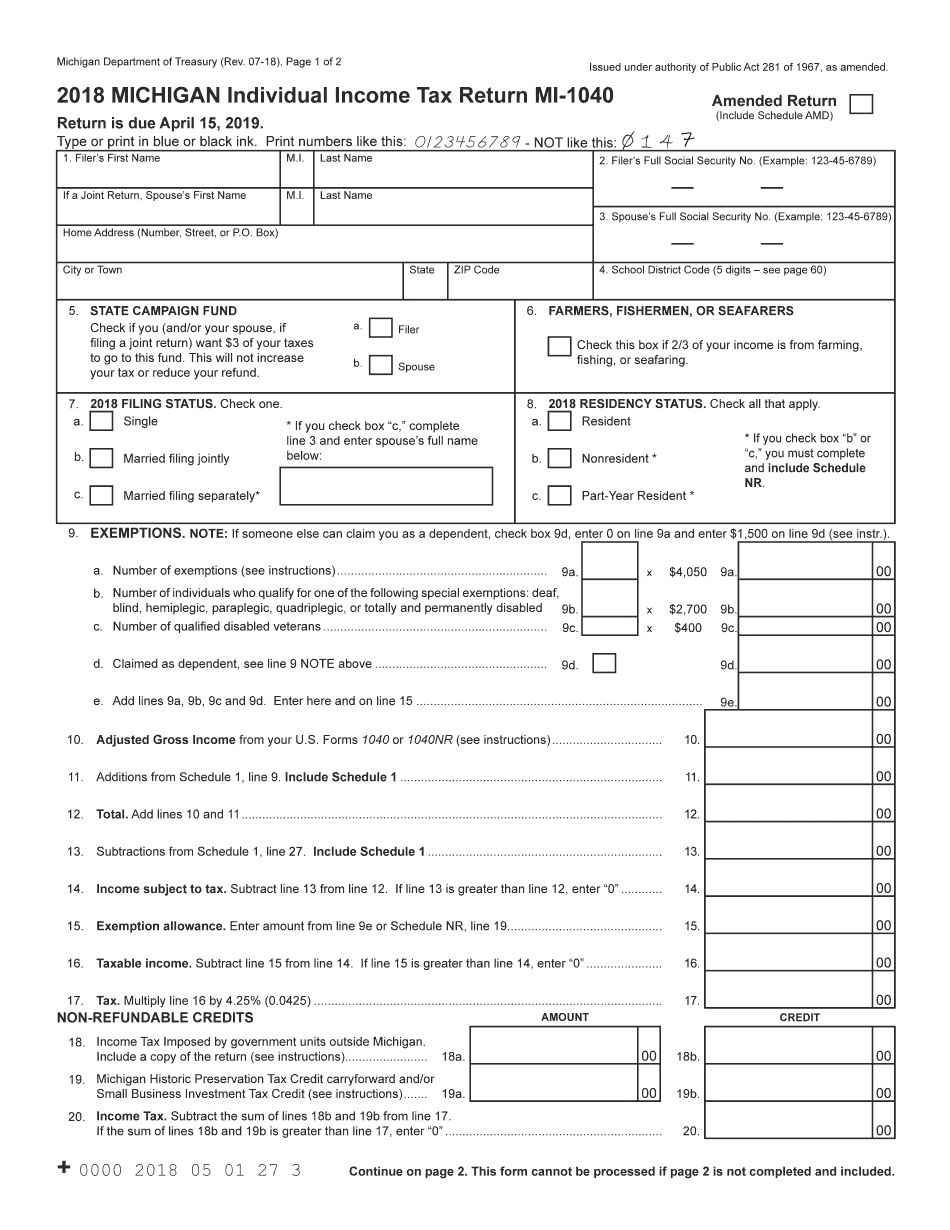

The Michigan Tax Form 1040 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. This form is essential for individuals earning income in Michigan, as it allows taxpayers to claim deductions, credits, and exemptions specific to the state. The 2018 MI 1040 form is designed to capture various income types, including wages, self-employment income, and investment earnings, ensuring that all sources of income are accounted for when determining tax obligations.

Steps to complete the Michigan Tax Form 1040

Completing the Michigan Tax Form 1040 involves several key steps to ensure accuracy and compliance with state tax regulations:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, dividends, and business income.

- Claim any deductions and credits applicable to your situation, such as the Homestead Property Tax Credit.

- Calculate your total tax liability based on the income reported and the deductions claimed.

- Sign and date the form, ensuring all required signatures are included.

How to obtain the Michigan Tax Form 1040

The Michigan Tax Form 1040 can be obtained through various methods to accommodate different preferences. Taxpayers can download the form directly from the Michigan Department of Treasury's website or request a paper copy to be mailed to their address. Additionally, many tax preparation software programs provide the option to fill out and submit the MI 1040 electronically, simplifying the process for those who prefer digital solutions.

Legal use of the Michigan Tax Form 1040

The legal use of the Michigan Tax Form 1040 is governed by state tax laws, which require all residents earning income to file a return. This form must be completed accurately to ensure compliance with tax regulations. Failure to file or inaccuracies can lead to penalties, interest, and potential audits. Using a reliable eSignature solution, like signNow, can help ensure that the form is signed and submitted securely, maintaining its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Tax Form 1040 are crucial for taxpayers to be aware of to avoid penalties. Typically, the deadline to file is April 15 of the following year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available and the deadlines associated with them.

Required Documents

To complete the Michigan Tax Form 1040 accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions and credits claimed, such as property tax statements

Having these documents ready will streamline the process of filling out the form and ensure all necessary information is included.

Quick guide on how to complete 2018 michigan individual income tax return mi 1040 2018 michigan individual income tax return mi 1040

Complete Michigan Tax Form 1040 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Tax Form 1040 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Michigan Tax Form 1040 with ease

- Locate Michigan Tax Form 1040 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight necessary sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunts, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Michigan Tax Form 1040 and ensure top-notch communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 michigan individual income tax return mi 1040 2018 michigan individual income tax return mi 1040

How to generate an eSignature for the 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 online

How to make an eSignature for your 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 in Google Chrome

How to make an electronic signature for putting it on the 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 in Gmail

How to create an eSignature for the 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 right from your smart phone

How to create an eSignature for the 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 on iOS devices

How to make an electronic signature for the 2018 Michigan Individual Income Tax Return Mi 1040 2018 Michigan Individual Income Tax Return Mi 1040 on Android devices

People also ask

-

What is the 2018 mi 1040 form?

The 2018 mi 1040 form is a tax form used by residents of Michigan to report their income and calculate state taxes owed. It's crucial for accurate tax filing to ensure compliance with state regulations. Completing and filing your 2018 mi 1040 form can impact your tax return signNowly.

-

How can airSlate SignNow help with my 2018 mi 1040 form?

airSlate SignNow provides a user-friendly platform to easily eSign your 2018 mi 1040 form and send it for approval. The features include document tracking, secure storage, and streamlined workflows to expedite your tax submission process. This ensures you stay compliant without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for the 2018 mi 1040 form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including individual and business plans. The cost is designed to be cost-effective, ensuring you get great value for the ability to easily manage your 2018 mi 1040 form and other documents. Check our pricing page for more details.

-

What features does airSlate SignNow offer for managing the 2018 mi 1040 form?

airSlate SignNow includes several features that enhance your experience with the 2018 mi 1040 form, such as customizable templates, automatic reminders, and audit trails. These tools simplify completion and ensure you can manage deadlines effectively. This allows for a smooth and hassle-free filing experience.

-

Can I integrate airSlate SignNow with other software to handle my 2018 mi 1040 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your 2018 mi 1040 form and other documents from a centralized location. Popular integrations include Google Drive, Dropbox, and various accounting software platforms, making it easier to access and file your tax forms.

-

What benefits can I expect from using airSlate SignNow for my 2018 mi 1040 form?

Using airSlate SignNow for your 2018 mi 1040 form provides numerous benefits like enhanced efficiency, better document control, and improved compliance. The platform ensures your tax forms are securely handled while giving you peace of mind with legally binding eSignatures. This means you can focus more on your business.

-

How secure is my data when filing my 2018 mi 1040 form with airSlate SignNow?

Your data's security is a top priority at airSlate SignNow. When you file your 2018 mi 1040 form, it is protected with industry-leading encryption and compliance standards. This ensures that your personal and financial information remains secure during the eSigning process.

Get more for Michigan Tax Form 1040

- Acc form template usedoc

- Delta sigma theta sorority inc scholarship application form

- Environmental impact statement for an early site permit esp form

- Incident report oak lawn hometown school district 123 d123 form

- South holland oversize load permit bapplicationb village of south bb southholland form

- Application for city of springfield plumbing permit springfield il form

- Oh application water service form

- Payment form 45169282

Find out other Michigan Tax Form 1040

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure