D 403 Nc Npa Form

What is the D-403 NC NPA?

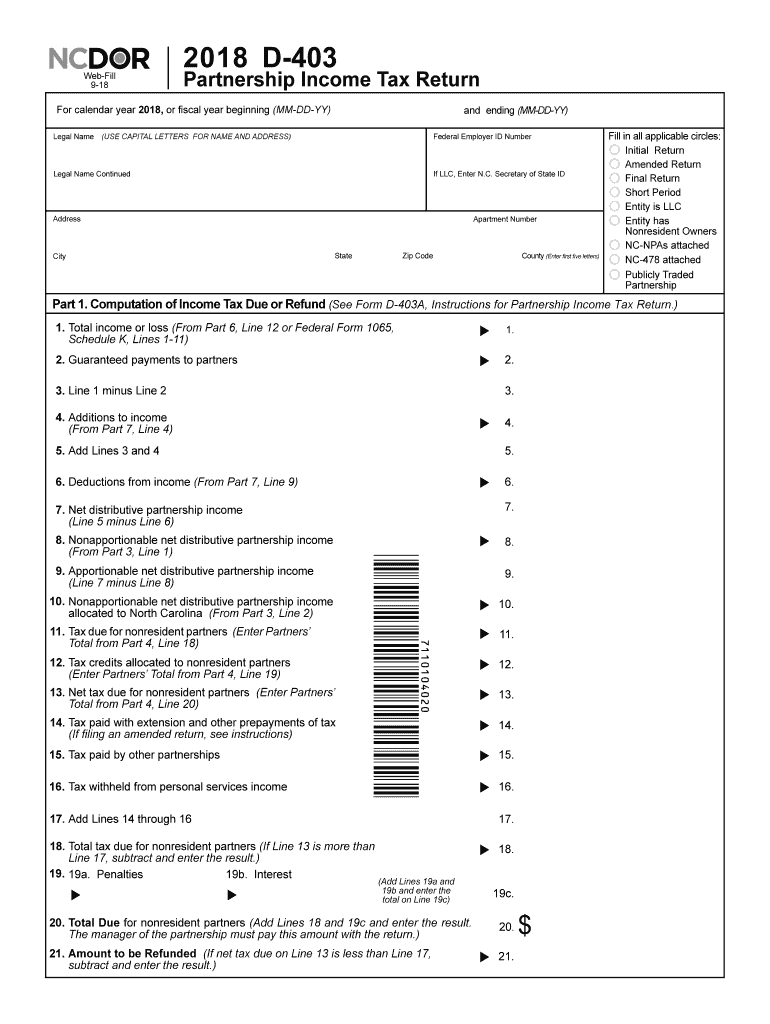

The D-403 NC NPA, or North Carolina Partnership Return, is a tax form specifically designed for partnerships operating within the state of North Carolina. This form is essential for reporting the income, deductions, and credits of partnerships, ensuring compliance with state tax regulations. Unlike individual tax returns, the D-403 NC NPA allows partnerships to report their collective financial activities, which are then passed through to the individual partners for personal tax reporting. Understanding the D-403 NC NPA is crucial for partnerships to accurately fulfill their tax obligations and maintain good standing with the North Carolina Department of Revenue.

Steps to Complete the D-403 NC NPA

Completing the D-403 NC NPA involves several steps to ensure accurate reporting of partnership income. First, gather all necessary financial documents, including income statements, expense reports, and any applicable tax credits. Next, fill out the form by entering the partnership's income, deductions, and credits in the designated sections. It's important to pay close attention to the instructions provided with the form to avoid errors. Once completed, review the form for accuracy and ensure all required signatures are obtained from the partners. Finally, submit the D-403 NC NPA by the specified filing deadline to avoid penalties.

How to Obtain the D-403 NC NPA

The D-403 NC NPA can be obtained from the North Carolina Department of Revenue's official website, where it is available for download in PDF format. This ensures that partnerships can access the most current version of the form. Additionally, physical copies may be available at local tax offices or through professional tax preparers. It is advisable for partnerships to use the latest version of the form to ensure compliance with any recent changes in tax law.

Legal Use of the D-403 NC NPA

The D-403 NC NPA must be used in accordance with North Carolina tax laws. This includes accurately reporting all income earned by the partnership and claiming eligible deductions and credits. Legal use of the form also involves timely submission to the North Carolina Department of Revenue, as late filings can result in penalties. Partnerships must maintain thorough records to support the information reported on the D-403 NC NPA, as these records may be required in the event of an audit.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the D-403 NC NPA to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by April 15. It is important to check for any specific extensions or changes in deadlines that may apply, especially in light of any recent tax law updates.

Required Documents

When completing the D-403 NC NPA, partnerships must gather several key documents to ensure accurate reporting. Required documents include:

- Income statements detailing all sources of partnership income.

- Expense reports that outline deductible business expenses.

- Records of any tax credits the partnership intends to claim.

- Partnership agreement, if applicable, which may outline profit-sharing and other financial arrangements.

Having these documents readily available will facilitate a smooth completion of the D-403 NC NPA and help ensure compliance with state tax regulations.

Quick guide on how to complete get a federal and state tax id number nc secretary of state

Complete D 403 Nc Npa effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage D 403 Nc Npa on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to edit and eSign D 403 Nc Npa with ease

- Locate D 403 Nc Npa and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign D 403 Nc Npa and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get a federal and state tax id number nc secretary of state

How to generate an eSignature for the Get A Federal And State Tax Id Number Nc Secretary Of State online

How to make an electronic signature for the Get A Federal And State Tax Id Number Nc Secretary Of State in Chrome

How to generate an electronic signature for signing the Get A Federal And State Tax Id Number Nc Secretary Of State in Gmail

How to make an eSignature for the Get A Federal And State Tax Id Number Nc Secretary Of State straight from your smart phone

How to make an eSignature for the Get A Federal And State Tax Id Number Nc Secretary Of State on iOS

How to generate an electronic signature for the Get A Federal And State Tax Id Number Nc Secretary Of State on Android OS

People also ask

-

What is the relationship between airSlate SignNow and NC state tax documents?

airSlate SignNow simplifies the process of signing and managing NC state tax documents. With our platform, you can eSign tax-related forms securely and efficiently, ensuring compliance with local regulations. Our user-friendly interface makes it easy for businesses to handle necessary documentation related to NC state tax.

-

How does airSlate SignNow ensure the security of NC state tax forms?

Security is our top priority at airSlate SignNow, especially for sensitive NC state tax forms. We employ state-of-the-art encryption and authentication measures to protect your documents. This way, you can be confident that your NC state tax information is secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for NC state tax preparation?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software. This capability streamlines your workflow, allowing you to easily eSign NC state tax forms in conjunction with your existing tools. By combining airSlate SignNow with other applications, you can enhance your management of NC state tax processes.

-

What are the pricing options for using airSlate SignNow for NC state tax documentation?

airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes handling NC state tax documentation. Our plans are designed to be cost-effective while providing robust features needed for effective document management. You can choose a plan that suits your business needs and budget, ensuring value with every transaction.

-

What features does airSlate SignNow provide for managing NC state tax documents?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning for NC state tax documents. These tools streamline document management and help you maintain compliance with state regulations. By leveraging these features, you can optimize your handling of NC state tax paperwork.

-

How can airSlate SignNow benefit my business in managing NC state tax forms?

airSlate SignNow empowers your business to manage NC state tax forms effortlessly, saving you time and reducing paperwork. With an easy-to-use interface, your team can quickly eSign and share documents, enhancing productivity. Additionally, our solution offers tracking capabilities for important NC state tax submissions, ensuring nothing is overlooked.

-

Is mobile access available for eSigning NC state tax documents with airSlate SignNow?

Yes, airSlate SignNow is accessible on mobile devices, enabling you to eSign NC state tax documents on the go. Our mobile application ensures that you can manage your tax-related paperwork anytime and anywhere, making it convenient for busy professionals. This mobility enhances your ability to complete important tasks related to NC state tax efficiently.

Get more for D 403 Nc Npa

Find out other D 403 Nc Npa

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online