Form Fl

What is the Form F-1120?

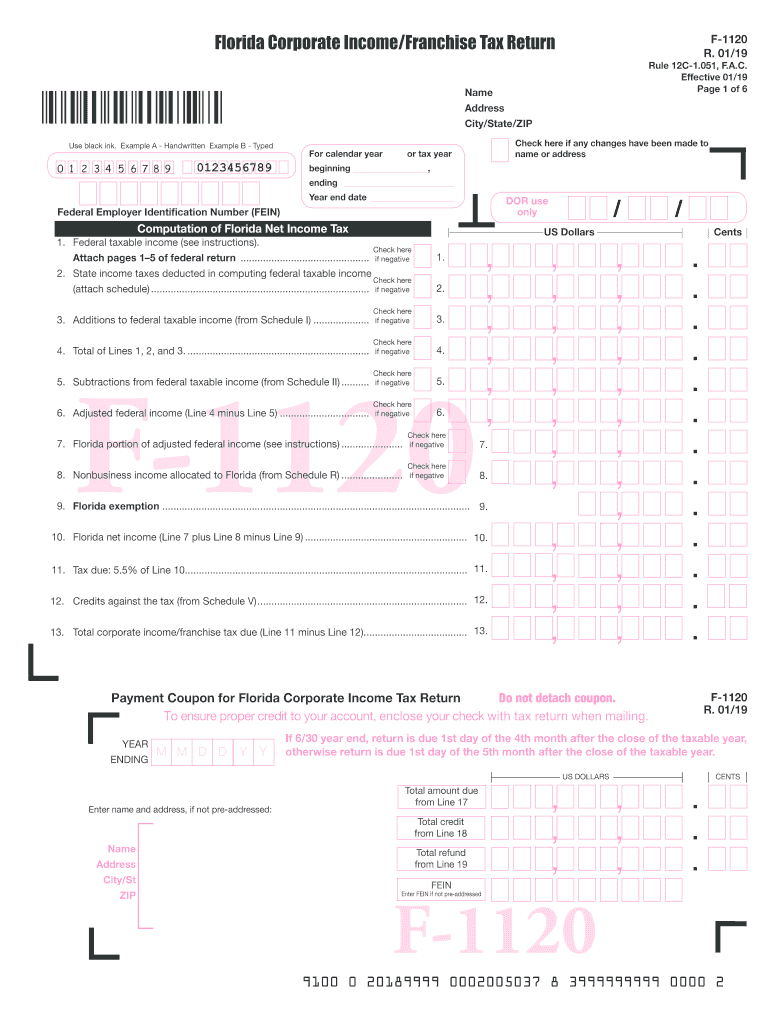

The 2019 Florida Form F-1120 is a corporate income tax return used by corporations operating in Florida. This form is essential for reporting income, deductions, and credits, allowing the Florida Department of Revenue to assess the tax liability of corporations. It is specifically designed for Florida corporations, including those that are part of a consolidated group. Proper completion of this form ensures compliance with state tax laws and regulations.

Steps to Complete the Form F-1120

Completing the 2019 Florida Form F-1120 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Fill out the basic information section, including the corporation's name, address, and federal employer identification number (FEIN).

- Report total income, including gross receipts and other income sources, on the designated lines.

- Calculate allowable deductions, such as operating expenses and depreciation, to determine taxable income.

- Apply any credits for which the corporation is eligible, such as the Florida corporate income tax credit.

- Review the completed form for accuracy and ensure all required signatures are included before submission.

Filing Deadlines / Important Dates

The filing deadline for the 2019 Florida Form F-1120 is typically the first day of the fourth month following the end of the corporation's fiscal year. For most corporations operating on a calendar year basis, this means the form is due by April 1, 2020. Corporations may request an extension, but it is crucial to pay any estimated taxes owed by the original due date to avoid penalties.

Legal Use of the Form F-1120

The 2019 Florida Form F-1120 is legally binding when completed and submitted according to state regulations. Corporations must ensure that the information provided is accurate and reflects their financial status. Failure to comply with the legal requirements can result in penalties, including fines and interest on unpaid taxes. Using a reliable electronic signature tool can enhance the legal validity of the submission, ensuring compliance with eSignature regulations.

Required Documents

To successfully complete the 2019 Florida Form F-1120, corporations need to gather several key documents:

- Federal Form 1120 or 1120-S, if applicable.

- Financial statements, including income statements and balance sheets.

- Records of all income sources and deductions claimed.

- Documentation supporting any tax credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods

Corporations can submit the 2019 Florida Form F-1120 through various methods:

- Online via the Florida Department of Revenue's e-filing system.

- By mail, sending the completed form to the appropriate address specified by the Florida Department of Revenue.

- In-person at designated Florida Department of Revenue offices.

Quick guide on how to complete the secret service uses this massive ink library to catch

Effortlessly Prepare Form Fl on Any Device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Form Fl on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form Fl with ease

- Find Form Fl and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form Fl and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the secret service uses this massive ink library to catch

How to generate an eSignature for the The Secret Service Uses This Massive Ink Library To Catch in the online mode

How to create an eSignature for the The Secret Service Uses This Massive Ink Library To Catch in Google Chrome

How to make an electronic signature for signing the The Secret Service Uses This Massive Ink Library To Catch in Gmail

How to generate an eSignature for the The Secret Service Uses This Massive Ink Library To Catch right from your mobile device

How to generate an eSignature for the The Secret Service Uses This Massive Ink Library To Catch on iOS

How to generate an electronic signature for the The Secret Service Uses This Massive Ink Library To Catch on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform for completing form f 1120 instructions 2019?

airSlate SignNow offers robust features including document templates, eSignature capabilities, and real-time collaboration tools. These features simplify the process of completing form f 1120 instructions 2019, enabling users to create, send, and obtain signatures efficiently. With user-friendly navigation, businesses can focus more on their tasks and less on the paperwork.

-

How does airSlate SignNow help with the compliance of form f 1120 instructions 2019?

Using airSlate SignNow ensures all documents are compliant and follow the necessary guidelines for form f 1120 instructions 2019. The platform automatically archives signed documents and offers audit trails to track changes, making it easier for businesses to ensure compliance. This reduces the risk of errors and enhances record-keeping.

-

Is there a cost associated with using airSlate SignNow for form f 1120 instructions 2019?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those specifically for handling form f 1120 instructions 2019. These plans are cost-effective and designed to provide maximum value, ensuring teams of any size can access the tools they need. You can choose a plan that fits your budget and usage without sacrificing essential features.

-

Can I integrate airSlate SignNow with other software for managing form f 1120 instructions 2019?

Absolutely! airSlate SignNow seamlessly integrates with numerous business applications, enhancing your workflow when dealing with form f 1120 instructions 2019. This allows you to connect with customer relationship management (CRM) tools, cloud storage services, and more, streamlining your document management process.

-

What support is available for users having trouble with form f 1120 instructions 2019 on airSlate SignNow?

airSlate SignNow offers comprehensive support including a dedicated help center, tutorials, and live support options for users struggling with form f 1120 instructions 2019. Whether you need technical help or guidance on completing forms, our support team is here to assist you. You can access resources anytime to help you navigate any challenges.

-

How secure is the information submitted through airSlate SignNow for form f 1120 instructions 2019?

Security is a priority at airSlate SignNow. When dealing with form f 1120 instructions 2019, all information submitted is encrypted and stored securely. Our platform complies with industry-standard security protocols to protect sensitive data, ensuring that your documents are safe from unauthorized access.

-

What are the benefits of using airSlate SignNow specifically for form f 1120 instructions 2019?

Utilizing airSlate SignNow for form f 1120 instructions 2019 streamlines the document signing process, saving you time and reducing errors. The platform enhances collaboration among team members and clients, allowing for faster completion of necessary forms. Additionally, eSigning helps eliminate the hassle of printing and scanning paperwork.

Get more for Form Fl

- Persuasion packet aurora city school district form

- Ymca waiver 217099128 form

- Play school registration form doc

- Reset form ohio department of job and family servi

- Ged test application owens form

- Www chamberofcommerce comunited statesohiolisbon exempted village school board in lisbon oh 44432 form

- Payment method sample clauses 3k samples law insider form

- State archives archives ohio history connection form

Find out other Form Fl

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast