Claim for Dependent Relative Tax Credit Dependent Relative Tax Credit 2024-2026

Understanding the Claim for Dependent Relative Tax Credit

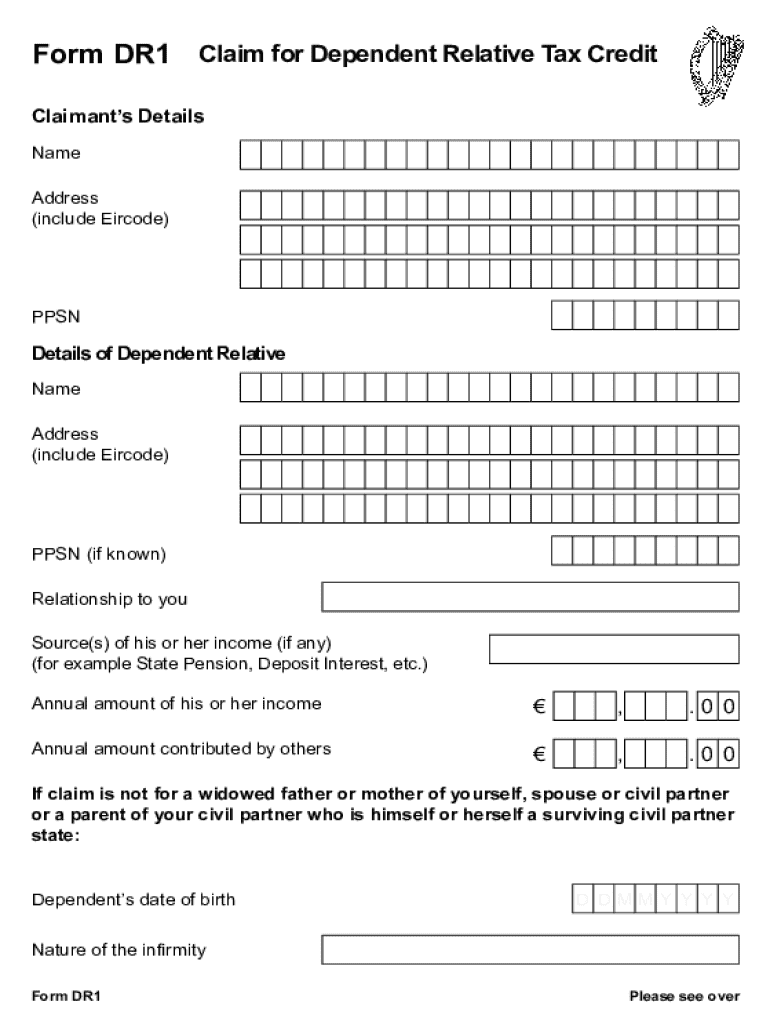

The Claim for Dependent Relative Tax Credit is a tax benefit designed to assist individuals who provide care for a dependent relative. This credit can help reduce the overall tax liability for caregivers, making it an essential consideration for those supporting family members who may require additional assistance. The credit is particularly relevant for taxpayers who have taken on the responsibility of caring for elderly parents or relatives with disabilities.

Steps to Complete the Claim for Dependent Relative Tax Credit

Completing the Claim for Dependent Relative Tax Credit involves several key steps:

- Gather necessary documentation, including proof of relationship and financial support provided to the dependent.

- Complete the appropriate sections of the form, ensuring all required information is accurately filled out.

- Calculate the credit amount based on the specific criteria outlined by the IRS.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Claim for Dependent Relative Tax Credit

To qualify for the Claim for Dependent Relative Tax Credit, taxpayers must meet certain eligibility criteria. Generally, the dependent must be a relative who resides with the taxpayer for more than half the year and for whom the taxpayer provides significant financial support. Additionally, the dependent's income must fall below a specified threshold. Understanding these criteria is crucial for determining eligibility and ensuring compliance with tax regulations.

Required Documents for the Claim for Dependent Relative Tax Credit

When filing for the Claim for Dependent Relative Tax Credit, it is important to have the following documents ready:

- Proof of relationship to the dependent, such as birth certificates or legal documents.

- Financial records demonstrating support provided to the dependent, including bank statements or receipts.

- Any relevant tax forms that may be necessary for the submission process.

Form Submission Methods for the Claim for Dependent Relative Tax Credit

Taxpayers can submit the Claim for Dependent Relative Tax Credit through various methods. These include:

- Online submission via the IRS e-file system.

- Mailing a paper form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

IRS Guidelines for the Claim for Dependent Relative Tax Credit

The IRS provides specific guidelines regarding the Claim for Dependent Relative Tax Credit. These guidelines outline eligibility requirements, documentation needed, and the calculation process for the credit. It is essential for taxpayers to familiarize themselves with these guidelines to ensure accurate filing and to maximize potential benefits.

Quick guide on how to complete claim for dependent relative tax credit dependent relative tax credit

Prepare Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without hindrances. Manage Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

The easiest way to alter and eSign Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit with ease

- Locate Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for dependent relative tax credit dependent relative tax credit

Create this form in 5 minutes!

How to create an eSignature for the claim for dependent relative tax credit dependent relative tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form dr1 and how can it be used?

The form dr1 is a specific document template that can be utilized for various business needs. With airSlate SignNow, you can easily create, send, and eSign the form dr1, streamlining your document management process. This ensures that your business remains compliant and efficient.

-

How much does it cost to use the form dr1 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to use the form dr1. Depending on your business needs, you can choose from various subscription options that provide access to all features, including eSigning and document management. Visit our pricing page for detailed information.

-

What features are included when using the form dr1?

When you use the form dr1 with airSlate SignNow, you gain access to a range of features such as customizable templates, secure eSigning, and real-time tracking. These features enhance your workflow and ensure that your documents are processed efficiently. Additionally, you can integrate the form dr1 with other applications for seamless operations.

-

Can I integrate the form dr1 with other software?

Yes, airSlate SignNow allows you to integrate the form dr1 with various third-party applications. This includes popular tools like Google Drive, Salesforce, and more, enabling you to streamline your document workflows. Integrations help you manage your documents more effectively and enhance productivity.

-

What are the benefits of using the form dr1 for my business?

Using the form dr1 can signNowly improve your business efficiency by reducing the time spent on document management. With airSlate SignNow, you can quickly send, receive, and eSign the form dr1, ensuring faster turnaround times. This not only saves time but also enhances customer satisfaction.

-

Is the form dr1 secure for sensitive information?

Absolutely! The form dr1 processed through airSlate SignNow is secured with advanced encryption and compliance with industry standards. Your sensitive information is protected throughout the signing process, ensuring that your documents remain confidential and secure.

-

How can I track the status of my form dr1?

With airSlate SignNow, you can easily track the status of your form dr1 in real-time. The platform provides notifications and updates on when the document is viewed, signed, or completed. This feature helps you stay informed and manage your document workflow effectively.

Get more for Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit

- Chexsystems notice of action based on information contained in a consumer report

- Us bank power of attorney form

- Declaration intent repairs form

- Ilovepdfonline tools fr pdf liebhaber form

- October reading log quakertown community school district qcsd form

- State of illinois uniform grant budget template section a

- Booth space application syracuse city parks amp recreation form

- Senior planning worksheet form

Find out other Claim For Dependent Relative Tax Credit Dependent Relative Tax Credit

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document