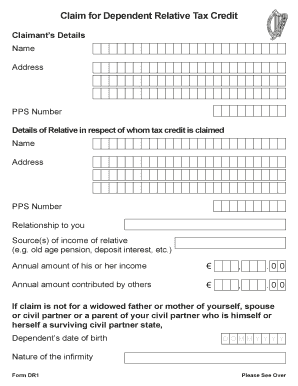

Claim for Dependent Relative Tax Credit Form DR1 Revenue 2013

What is the Claim For Dependent Relative Tax Credit Form DR1 Revenue

The Claim For Dependent Relative Tax Credit Form DR1 is a tax form used to claim a tax credit for supporting a dependent relative. This form is typically utilized by taxpayers who provide financial assistance to relatives who qualify as dependents under the tax code. The credit can help reduce the overall tax liability, making it an important tool for those who are financially responsible for their relatives.

How to use the Claim For Dependent Relative Tax Credit Form DR1 Revenue

To use the Claim For Dependent Relative Tax Credit Form DR1, taxpayers must first ensure they meet the eligibility criteria for claiming a dependent relative. Once eligibility is confirmed, the form can be filled out with the necessary information, including details about the taxpayer, the dependent relative, and the nature of the support provided. After completing the form, it should be submitted according to the specified filing methods.

Steps to complete the Claim For Dependent Relative Tax Credit Form DR1 Revenue

Completing the Claim For Dependent Relative Tax Credit Form DR1 involves several key steps:

- Gather required information, including personal details and financial support records.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form through the appropriate method, whether online, by mail, or in person.

Eligibility Criteria

To qualify for the tax credit claimed through the DR1 form, certain eligibility criteria must be met. Generally, the taxpayer must provide financial support to a relative who lives with them or is dependent on their income. The relative must meet specific relationship and income requirements as defined by tax regulations. It is essential to review these criteria carefully to ensure compliance and maximize potential tax benefits.

Required Documents

When completing the Claim For Dependent Relative Tax Credit Form DR1, several documents may be required to substantiate the claim. These documents typically include:

- Proof of relationship to the dependent relative, such as birth certificates or marriage licenses.

- Documentation of financial support, like bank statements or receipts.

- Identification numbers for both the taxpayer and the dependent relative.

Form Submission Methods

The Claim For Dependent Relative Tax Credit Form DR1 can be submitted through various methods. Taxpayers have the option to file the form online, which may offer a faster processing time. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own guidelines and timelines, so it is important to choose the one that best suits the taxpayer's needs.

Quick guide on how to complete claim for dependent relative tax credit form dr1 revenue

Complete Claim For Dependent Relative Tax Credit Form DR1 Revenue effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents since you can access the appropriate form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Claim For Dependent Relative Tax Credit Form DR1 Revenue on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest method to alter and eSign Claim For Dependent Relative Tax Credit Form DR1 Revenue without hassle

- Obtain Claim For Dependent Relative Tax Credit Form DR1 Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the files or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiling documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Claim For Dependent Relative Tax Credit Form DR1 Revenue to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for dependent relative tax credit form dr1 revenue

Create this form in 5 minutes!

How to create an eSignature for the claim for dependent relative tax credit form dr1 revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Claim For Dependent Relative Tax Credit Form DR1 Revenue?

The Claim For Dependent Relative Tax Credit Form DR1 Revenue is a tax form used in Ireland to claim tax credits for dependent relatives. This form allows taxpayers to reduce their tax liability by claiming credits for caring for a dependent relative. Understanding how to fill out this form correctly can help maximize your tax benefits.

-

How can airSlate SignNow help with the Claim For Dependent Relative Tax Credit Form DR1 Revenue?

airSlate SignNow provides an efficient platform for completing and eSigning the Claim For Dependent Relative Tax Credit Form DR1 Revenue. Our user-friendly interface simplifies the process, ensuring that you can fill out and submit your form quickly and securely. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Claim For Dependent Relative Tax Credit Form DR1 Revenue?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our easy-to-use platform for managing documents like the Claim For Dependent Relative Tax Credit Form DR1 Revenue. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax forms like the Claim For Dependent Relative Tax Credit Form DR1 Revenue. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to streamline your workflow when dealing with the Claim For Dependent Relative Tax Credit Form DR1 Revenue and other tax documents. Integrating these tools can enhance productivity and ensure seamless data transfer.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Claim For Dependent Relative Tax Credit Form DR1 Revenue, provides numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for sensitive information. Our platform also allows for easy collaboration with tax professionals.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax information, such as the Claim For Dependent Relative Tax Credit Form DR1 Revenue, is protected. We use advanced encryption and security protocols to safeguard your data throughout the signing process.

Get more for Claim For Dependent Relative Tax Credit Form DR1 Revenue

Find out other Claim For Dependent Relative Tax Credit Form DR1 Revenue

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy