990 Ez C Form

What is the 990 EZ C Form

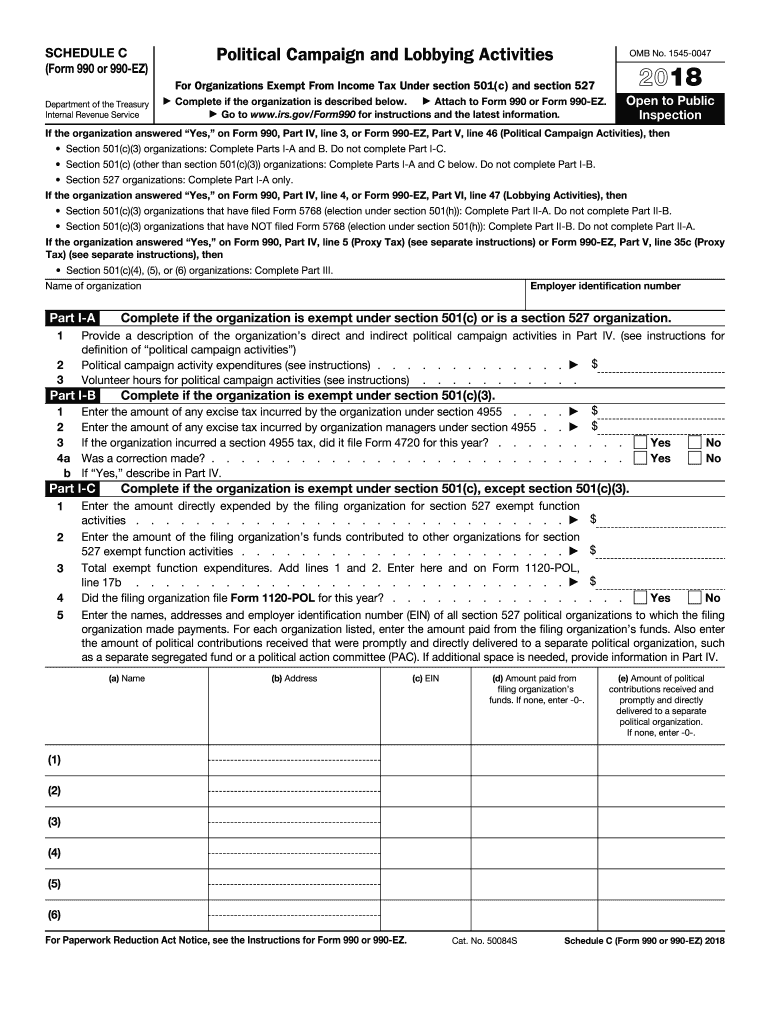

The 990 EZ C Form is a simplified version of the IRS Form 990, designed for smaller tax-exempt organizations. It provides a streamlined approach for reporting financial information, allowing eligible organizations to fulfill their annual filing requirements more efficiently. This form is particularly beneficial for organizations with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. By using the 990 EZ C Form, organizations can provide essential information about their operations, governance, and financial activities without the complexity of the full Form 990.

How to use the 990 EZ C Form

Using the 990 EZ C Form involves several key steps that ensure accurate and compliant reporting. First, organizations must determine their eligibility based on gross receipts and asset thresholds. Once confirmed, they can obtain the form from the IRS website or through tax preparation software. After gathering necessary financial data, organizations should carefully complete each section of the form, ensuring that all information is accurate and complete. It is crucial to review the form for any errors before submission, as inaccuracies can lead to penalties or delays in processing.

Steps to complete the 990 EZ C Form

Completing the 990 EZ C Form requires a systematic approach:

- Gather financial statements for the reporting period, including income, expenses, and balance sheets.

- Review the eligibility criteria to ensure the organization qualifies to use the 990 EZ C Form.

- Fill out the form, providing detailed information on revenue, expenses, and any changes in governance.

- Include any required schedules or attachments, such as Schedule A for public support.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate IRS address.

Legal use of the 990 EZ C Form

The legal use of the 990 EZ C Form is governed by IRS regulations, which require tax-exempt organizations to file annually to maintain their status. Compliance with these regulations is essential to avoid penalties and ensure transparency in financial reporting. The form must be filed by the fifteenth day of the fifth month after the end of the organization's fiscal year. Organizations should also be aware of any state-specific requirements that may apply, as some states have additional filing obligations for tax-exempt entities.

Filing Deadlines / Important Dates

Filing deadlines for the 990 EZ C Form are crucial for maintaining compliance with IRS regulations. The form is typically due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can request an automatic six-month extension by filing Form 8868, but this does not extend the time for payment of any taxes owed.

Required Documents

To complete the 990 EZ C Form, organizations must gather several key documents:

- Financial statements, including income statements and balance sheets.

- Details of contributions and grants received during the year.

- Information on program services and expenses.

- Documentation of governance policies and board meeting minutes.

- Any additional schedules or attachments required by the IRS.

Quick guide on how to complete form 990 or 990 ez sch c

Finalize 990 Ez C Form seamlessly on any device

Digital document administration has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can acquire the right format and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage 990 Ez C Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign 990 Ez C Form effortlessly

- Obtain 990 Ez C Form and click Get Form to initiate.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to keep your modifications.

- Select how you wish to share your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 990 Ez C Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 or 990 ez sch c

How to make an electronic signature for your Form 990 Or 990 Ez Sch C online

How to create an electronic signature for the Form 990 Or 990 Ez Sch C in Chrome

How to make an eSignature for putting it on the Form 990 Or 990 Ez Sch C in Gmail

How to make an eSignature for the Form 990 Or 990 Ez Sch C right from your smart phone

How to generate an eSignature for the Form 990 Or 990 Ez Sch C on iOS

How to make an electronic signature for the Form 990 Or 990 Ez Sch C on Android OS

People also ask

-

What is the form990ez schedule c and how does it relate to airSlate SignNow?

The form990ez schedule c is a component of the IRS Form 990, designed for tax-exempt organizations to report their income and expenses. airSlate SignNow simplifies the preparation and filing of this form by allowing users to easily eSign and send necessary documents, ensuring compliance and efficiency.

-

How does airSlate SignNow assist with the completion of form990ez schedule c?

airSlate SignNow provides templates and tools specifically designed to facilitate the completion of form990ez schedule c. Users can fill out the form digitally, utilize eSigning features, and securely send documents, making the process smoother and more organized.

-

Is there a subscription fee for using airSlate SignNow for form990ez schedule c?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features for handling form990ez schedule c. The cost-effective solution ensures that budgeting for document management and eSignature needs remains manageable for organizations.

-

What features does airSlate SignNow offer for managing form990ez schedule c?

airSlate SignNow includes features such as customizable templates, eSigning capabilities, secure document storage, and collaboration tools which are all beneficial for managing form990ez schedule c. These features enhance efficiency and reduce the likelihood of errors in your tax documents.

-

Can airSlate SignNow integrate with other software for form990ez schedule c management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software to help manage form990ez schedule c. This means you can streamline your workflow by connecting SignNow with your existing tools.

-

What benefits does airSlate SignNow provide for non-profits using form990ez schedule c?

For non-profits, airSlate SignNow offers signNow benefits such as reducing the time spent on paperwork, ensuring document security, and enhancing collaboration among team members. This allows organizations to focus more on their missions while managing their form990ez schedule c effectively.

-

Is airSlate SignNow user-friendly for those unfamiliar with form990ez schedule c?

Yes, airSlate SignNow is designed with user-friendliness in mind. Even users unfamiliar with form990ez schedule c can navigate the platform easily, thanks to its intuitive interface and helpful resources that guide you through the process.

Get more for 990 Ez C Form

Find out other 990 Ez C Form

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template