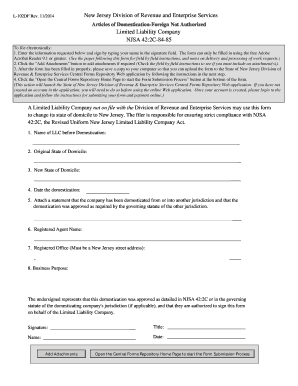

L 102DF Rev Form

What is the L 102DF Rev

The L 102DF Rev is a specific form used primarily for tax purposes in the United States. It is designed to assist taxpayers in reporting certain financial information to the Internal Revenue Service (IRS). This form is crucial for ensuring compliance with federal tax regulations and helps in the accurate calculation of tax liabilities. Understanding the purpose and requirements of the L 102DF Rev is essential for individuals and businesses alike, as it can impact financial planning and tax obligations.

How to use the L 102DF Rev

Using the L 102DF Rev involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form by entering the required information in the appropriate fields. It is important to double-check all entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferences and requirements of the taxpayer.

Steps to complete the L 102DF Rev

Completing the L 102DF Rev requires a systematic approach. Follow these steps for effective completion:

- Gather Information: Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Review Instructions: Familiarize yourself with the form's instructions to understand the required information.

- Fill Out the Form: Enter your information accurately in each section of the form.

- Review for Errors: Check for any mistakes or missing information before finalizing the form.

- Submit the Form: Choose your submission method, whether electronically or by mail, and ensure it is sent by the deadline.

Legal use of the L 102DF Rev

The L 102DF Rev must be used in accordance with IRS regulations and guidelines. It is important for taxpayers to ensure that they are using the most current version of the form to avoid legal complications. Misuse or incorrect submission of the form can lead to penalties or audits by the IRS. Therefore, understanding the legal implications and requirements surrounding the L 102DF Rev is essential for compliance and to protect against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the L 102DF Rev are crucial for taxpayers to observe. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth. However, specific circumstances, such as extensions or special filing situations, may alter these deadlines. It is advisable for taxpayers to keep track of important dates related to the L 102DF Rev to ensure timely compliance and avoid late fees or penalties.

Examples of using the L 102DF Rev

There are various scenarios where the L 102DF Rev may be applicable. For instance, self-employed individuals often use this form to report income and expenses related to their business activities. Additionally, small business owners may utilize the L 102DF Rev to ensure proper reporting of their financial activities for tax purposes. Understanding these examples can help taxpayers identify when and how to effectively use the form in their financial reporting.

Quick guide on how to complete l 102df rev

Effortlessly Prepare L 102DF Rev on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage L 102DF Rev on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Efficiently Modify and eSign L 102DF Rev with Ease

- Find L 102DF Rev and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign L 102DF Rev to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l 102df rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the L 102DF Rev. and how does it work with airSlate SignNow?

The L 102DF Rev. is a specific document format that can be seamlessly integrated with airSlate SignNow. It allows users to send, sign, and manage documents efficiently. The platform ensures that your L 102DF Rev. documents are legally binding and securely stored.

-

How much does it cost to use the L 102DF Rev. feature with airSlate SignNow?

Using the L 102DF Rev. feature comes at a competitive price, tailored to suit various business needs. airSlate SignNow offers flexible subscription plans that include access to the L 102DF Rev. documents. Check our pricing page for detailed options and to find the best plan for your organization.

-

What are the key features of airSlate SignNow with L 102DF Rev.?

The airSlate SignNow platform equipped with the L 102DF Rev. feature includes easy document creation, customizable templates, and a user-friendly interface. It also offers features like real-time tracking, reminders, and mobile signing. This ensures a streamlined and efficient document workflow.

-

Can I integrate L 102DF Rev. with other software applications?

Yes, airSlate SignNow supports integrations with a wide range of software applications, making it easy to use L 102DF Rev. documents across different systems. Popular integrations include CRM systems, project management tools, and cloud storage services. This interoperability enhances productivity and document management.

-

What are the benefits of using L 102DF Rev. documentation with airSlate SignNow?

Utilizing the L 102DF Rev. documentation with airSlate SignNow brings numerous benefits, including faster turnaround times, enhanced security, and improved compliance. The electronic signing process streamlines your workflow, saves time, and ultimately increases productivity within your organization.

-

Is there a mobile app for managing L 102DF Rev. documents?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage your L 102DF Rev. documents on-the-go. The app provides the same features as the desktop version, enabling you to send and sign documents from your smartphone or tablet effortlessly. This flexibility helps keep your business operations running smoothly, regardless of your location.

-

How secure is my data when using L 102DF Rev. with airSlate SignNow?

Security is a top priority for airSlate SignNow, and your L 102DF Rev. data is protected with advanced encryption and secure storage solutions. The platform complies with industry standards for data protection and privacy, ensuring that your sensitive information remains safe. You can rest assured knowing your documents are in trusted hands.

Get more for L 102DF Rev

- Instructions california wage theft prevention act wtpa form

- Centrally stored medication and destruction record form

- Dcradcbbl ez online form

- Claims attachment cover sheet indianamedicaid com form

- Lc 142 instructions form

- Unit 3 inside the system form

- Sc1040tc tax credits sc department of revenue form

- 24 irs form 2678 employer appointment of agent

Find out other L 102DF Rev

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe