Et 85 Form

What is the ET 85?

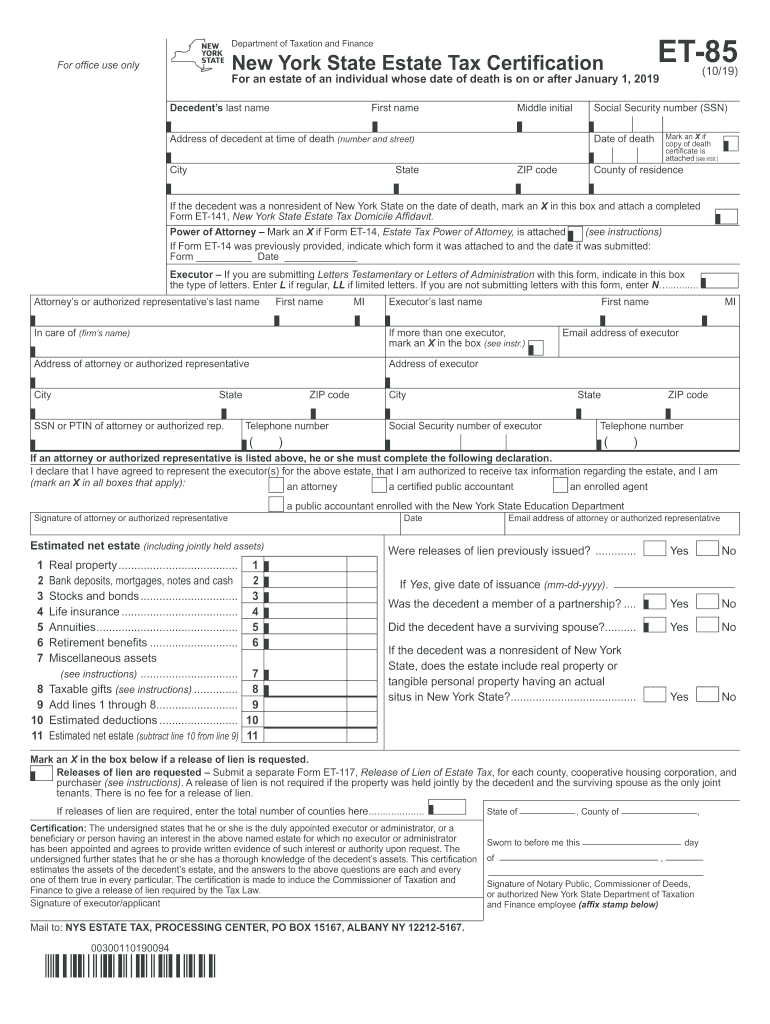

The ET 85 is a tax form used in New York State, specifically designed for the estate tax. It is essential for individuals who are responsible for filing estate tax returns on behalf of a deceased person. The form collects information about the decedent's assets, liabilities, and other relevant details necessary for calculating the estate tax owed. Understanding the ET 85 is crucial for executors and administrators to ensure compliance with state tax laws.

How to Use the ET 85

Using the ET 85 involves several steps, starting with gathering necessary information about the decedent's estate. This includes details on assets such as real estate, bank accounts, and investments. Once the information is compiled, the form must be accurately filled out, ensuring all sections are completed to avoid delays or penalties. After completing the form, it should be submitted to the appropriate state tax authority, either electronically or via mail, depending on the preferred submission method.

Steps to Complete the ET 85

Completing the ET 85 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documents related to the decedent's estate, including asset valuations and debts.

- Fill out the ET 85 form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions, as inaccuracies can lead to complications.

- Submit the completed form to the New York State Department of Taxation and Finance by the specified deadline.

Legal Use of the ET 85

The ET 85 must be used in accordance with New York State laws governing estate taxes. It serves as a legally binding document that reports the estate's value and determines the tax liability. Compliance with the legal requirements surrounding the ET 85 is essential to avoid penalties and ensure that the estate is settled correctly. Executors should familiarize themselves with the relevant laws to ensure that the form is used appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the ET 85 are critical for compliance. Generally, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important for executors to be aware of these deadlines to avoid late fees and interest charges on unpaid taxes. Keeping track of important dates ensures timely submission and compliance with state regulations.

Required Documents

When completing the ET 85, several documents are required to support the information provided on the form. These may include:

- Death certificate of the decedent.

- Asset valuations, including appraisals for real estate and other significant assets.

- Documentation of debts and liabilities owed by the estate.

- Previous tax returns, if applicable, to provide context for the estate's financial situation.

Form Submission Methods

The ET 85 can be submitted through various methods, allowing flexibility for executors. Options typically include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the designated address.

- In-person submission at local tax offices, if necessary.

Quick guide on how to complete form et 851019new york state estate tax certificationet85

Complete Et 85 effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Et 85 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Et 85 without hassle

- Obtain Et 85 and click Get Form to begin.

- Utilize the tools we offer to populate your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing out new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Et 85 and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form et 851019new york state estate tax certificationet85

How to create an eSignature for the Form Et 851019new York State Estate Tax Certificationet85 online

How to generate an electronic signature for the Form Et 851019new York State Estate Tax Certificationet85 in Chrome

How to make an electronic signature for signing the Form Et 851019new York State Estate Tax Certificationet85 in Gmail

How to create an electronic signature for the Form Et 851019new York State Estate Tax Certificationet85 right from your mobile device

How to create an eSignature for the Form Et 851019new York State Estate Tax Certificationet85 on iOS devices

How to generate an eSignature for the Form Et 851019new York State Estate Tax Certificationet85 on Android OS

People also ask

-

What is airSlate SignNow's et 85 pricing plan?

The et 85 pricing plan for airSlate SignNow offers a cost-effective solution designed for businesses of all sizes. With flexible subscription options, you can select a plan that best fits your needs while ensuring you get the necessary features for document eSigning and management.

-

What are the key features of airSlate SignNow that support the et 85?

airSlate SignNow includes essential features such as customizable templates, real-time tracking, and secure cloud storage, all optimized for the et 85. These features streamline the eSigning process, ensuring efficiency and user-friendly experience.

-

How does airSlate SignNow enhance productivity with the et 85 solution?

By utilizing the et 85 functionality, airSlate SignNow optimizes document workflows, allowing for faster turnaround times on contracts and agreements. This productivity boost translates to improved business operations and client satisfaction.

-

Is airSlate SignNow compatible with other software tools using et 85?

Yes, airSlate SignNow integrates seamlessly with various third-party applications using the et 85 platform. Whether it's CRM systems, cloud storage solutions, or project management tools, integration helps enhance overall efficiency and data flow.

-

What are the security measures in place for the et 85 eSigning process?

airSlate SignNow prioritizes security in its et 85 process, employing industry-standard encryption and compliance with legal regulations. This ensures that all signed documents are securely stored and protected from unauthorized access.

-

Can I customize my documents using airSlate SignNow with the et 85?

Absolutely! With the et 85 feature set, airSlate SignNow allows you to create and customize documents tailored to your business requirements. This personalization ensures that your documents meet your specific branding and compliance needs.

-

What mobile capabilities does airSlate SignNow offer with the et 85?

The mobile capabilities of airSlate SignNow using the et 85 allow users to send and sign documents on-the-go. This flexibility enhances accessibility and ensures you can manage your eSigning needs from anywhere, at any time.

Get more for Et 85

- Select jurors form

- Crime scene control form co wise tx

- Figure 19 tac 89 1175cauthorization for attorn form

- Deferred disposition 282590072 form

- Style of estate form

- Request for divorce decree seal doc form

- Barton county superior courtside name registration form

- Mag 40 04 affidavit of disposition of amv the administrative office georgiacourts form

Find out other Et 85

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract