New Mexico W 9 Form

What is the New Mexico W-9 Form

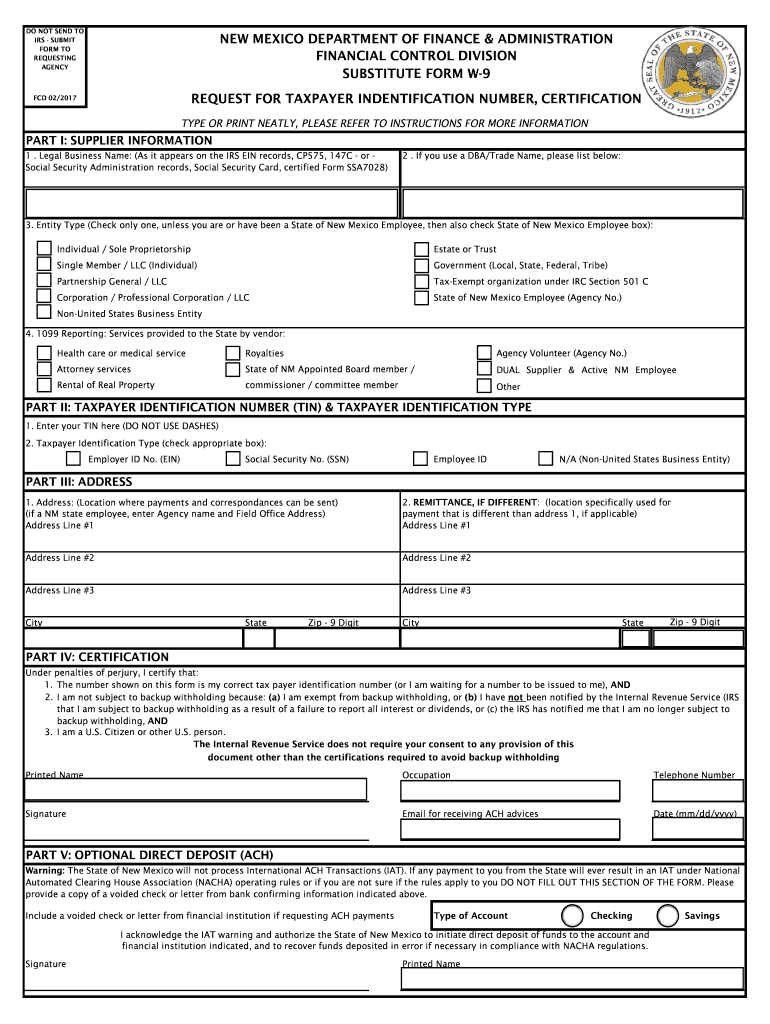

The New Mexico W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to entities that require it for tax reporting purposes. This form is essential for reporting income to the Internal Revenue Service (IRS) and is particularly relevant for freelancers, contractors, and vendors working with businesses in New Mexico. The information collected on this form includes the name, address, and taxpayer identification number (TIN) of the individual or entity completing it.

How to use the New Mexico W-9 Form

Using the New Mexico W-9 form involves filling out the required fields accurately to ensure proper tax reporting. Once completed, the form should be submitted to the requesting entity, such as an employer or client, rather than directly to the IRS. It is important to keep a copy for your records. The form can be filled out electronically or printed and completed by hand, depending on the preferences of the entity requesting it.

Steps to complete the New Mexico W-9 Form

Completing the New Mexico W-9 form involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- Provide your business name if applicable.

- Fill in your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Certify that the information provided is accurate by signing and dating the form.

Legal use of the New Mexico W-9 Form

The New Mexico W-9 form is legally binding when filled out correctly. It serves as a formal declaration of your taxpayer information, which is crucial for compliance with federal tax laws. Using this form helps ensure that the entity requesting it can accurately report payments made to you to the IRS. It is important to provide truthful and accurate information to avoid potential legal issues or penalties.

Required Documents

To complete the New Mexico W-9 form, you typically need to provide specific documentation that verifies your identity and taxpayer status. This may include:

- Your Social Security card or Employer Identification Number documentation.

- Government-issued identification that includes your name and address.

- Any additional documents requested by the entity requiring the W-9 form.

Penalties for Non-Compliance

Failing to submit a completed New Mexico W-9 form when requested can lead to significant penalties. The IRS may impose fines for not providing accurate taxpayer information, which can result in backup withholding on payments made to you. It is essential to respond promptly to any requests for this form to avoid complications with your tax obligations.

Quick guide on how to complete w 9 new mexico department of finance ampamp administration nm dfa

Effortlessly Prepare New Mexico W 9 Form on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without holdups. Handle New Mexico W 9 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Alter and eSign New Mexico W 9 Form with Ease

- Find New Mexico W 9 Form and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a classic wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign New Mexico W 9 Form and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 new mexico department of finance ampamp administration nm dfa

How to create an electronic signature for your W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa online

How to make an electronic signature for the W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa in Chrome

How to make an eSignature for signing the W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa in Gmail

How to create an eSignature for the W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa from your mobile device

How to create an eSignature for the W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa on iOS

How to create an eSignature for the W 9 New Mexico Department Of Finance Ampamp Administration Nm Dfa on Android OS

People also ask

-

What is nmdfa in the context of eSigning?

The term nmdfa refers to the standards and regulations that govern electronic signatures. With airSlate SignNow, users can be assured that their eSigning processes comply with nmdfa, ensuring security and legality in document transactions.

-

How does airSlate SignNow ensure compliance with nmdfa?

airSlate SignNow complies with nmdfa by employing encryption and authentication measures that secure document integrity. This compliance helps businesses maintain trust and legality in their electronic signing processes.

-

What features does airSlate SignNow offer that align with nmdfa regulations?

airSlate SignNow provides numerous features that support nmdfa regulations, such as user authentication, audit trails, and document tracking. These features not only enhance security but also ensure that every signed document is legally binding.

-

Is airSlate SignNow cost-effective for businesses focusing on nmdfa compliance?

Absolutely! airSlate SignNow offers a cost-effective solution while ensuring full compliance with nmdfa. Businesses can save time and money by choosing SignNow for their eSigning needs without sacrificing legal integrity.

-

How can airSlate SignNow integrate with other platforms while complying with nmdfa?

airSlate SignNow seamlessly integrates with various platforms such as CRM and document management systems, all while adhering to nmdfa standards. This allows businesses to streamline their workflows without compromising document security.

-

What are the benefits of using airSlate SignNow for nmdfa-compliant electronic signatures?

Using airSlate SignNow for nmdfa-compliant electronic signatures streamlines the signing process, reduces turnaround time, and enhances security. Businesses can experience signNow efficiency gains while ensuring that their documents meet legal standards.

-

Can airSlate SignNow help with remote signing in relation to nmdfa?

Yes, airSlate SignNow facilitates remote signing, ensuring that all electronic signatures comply with nmdfa regulations. This feature is especially beneficial for businesses that require secure and efficient signing solutions from any location.

Get more for New Mexico W 9 Form

- Process server application state court fulton county form

- Georgia executors form

- Child abandonment warrant 404765344 form

- Defendants response to plaintiffs first and continuing form

- Www cobbcounty orgcourtsprobate courtprobate court formscobb county georgia

- Georgia quitclaim deed 495582190 form

- Caregiver excuse for jury duty form

- Marriage certificatenevada county ca form

Find out other New Mexico W 9 Form

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter