Form Il 1040x

What is the Form IL 1040X

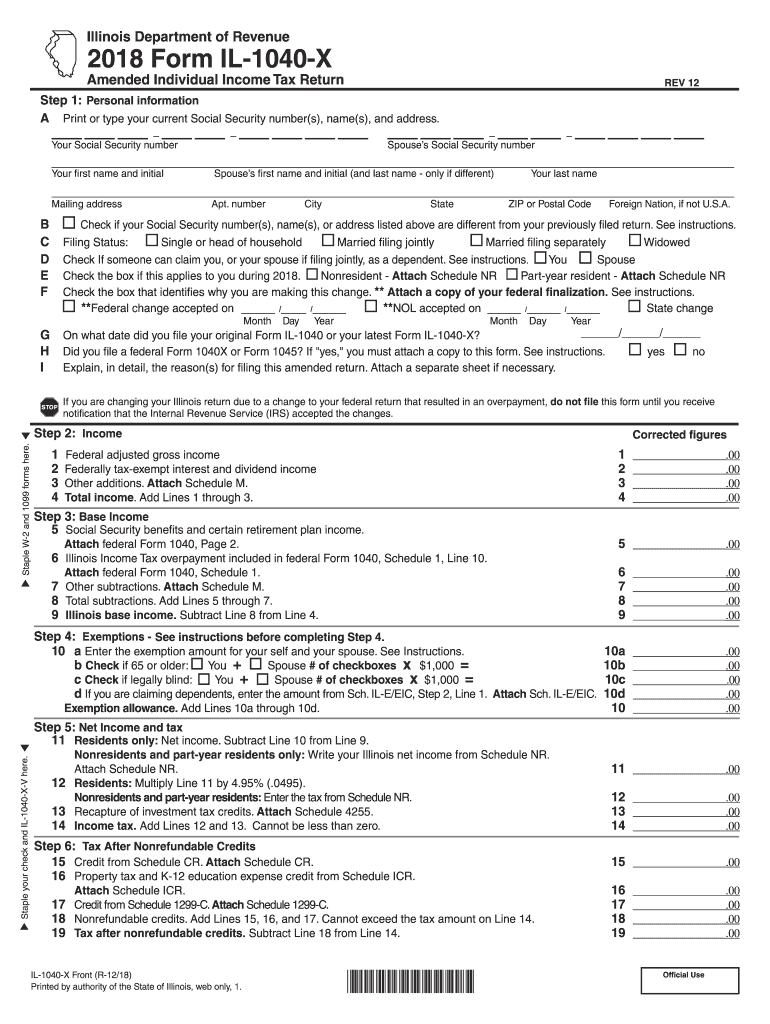

The Form IL 1040X is the Illinois Amended Individual Income Tax Return. This form is used by taxpayers who need to amend their previously filed Illinois income tax returns. It allows individuals to correct errors, update their filing status, or claim additional deductions or credits that were not included in the original submission. Filing this form ensures that your tax records are accurate and up to date with the Illinois Department of Revenue.

How to Use the Form IL 1040X

To use the Form IL 1040X, begin by obtaining the form from the Illinois Department of Revenue website or through authorized tax preparation software. Once you have the form, fill it out with the necessary information, including your personal details and the specific changes you are making. Be sure to include any required documentation that supports your amendments. After completing the form, review it for accuracy before submitting it to ensure compliance with state tax regulations.

Steps to Complete the Form IL 1040X

Completing the Form IL 1040X involves several key steps:

- Gather your original tax return and any supporting documents related to your amendments.

- Fill out the top portion of the form with your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide the details of the changes in the designated sections.

- Calculate the new tax liability or refund amount based on the amendments.

- Sign and date the form before submitting it to the Illinois Department of Revenue.

Legal Use of the Form IL 1040X

The Form IL 1040X is legally recognized as a valid document for amending tax returns in Illinois. It must be completed accurately and submitted within the appropriate time frame to ensure compliance with state tax laws. Failure to file this form correctly can result in penalties or delays in processing your amended return. It is essential to follow the guidelines set forth by the Illinois Department of Revenue to maintain the legal standing of your tax filings.

Filing Deadlines / Important Dates

When filing the Form IL 1040X, it is crucial to be aware of the deadlines. Generally, the form must be filed within three years of the original due date of the tax return being amended. This includes any extensions granted. Additionally, if you are claiming a refund, it is important to submit the form within the same timeframe to ensure you receive any owed amounts. Keeping track of these deadlines helps prevent complications with your tax records.

Form Submission Methods (Online / Mail / In-Person)

The Form IL 1040X can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online using approved tax software that supports electronic filing for amended returns. Alternatively, you can print the completed form and mail it to the appropriate address provided by the Illinois Department of Revenue. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if necessary.

Quick guide on how to complete 2018 form il 1040 x amended individual income tax return

Effortlessly Prepare Form Il 1040x on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily access the needed form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without any hold-ups. Manage Form Il 1040x on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Simplest Way to Modify and Electronically Sign Form Il 1040x with Ease

- Find Form Il 1040x and click Get Form to initiate the process.

- Utilize the features we offer to complete your form.

- Mark essential parts of your documents or obscure confidential details with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet-ink signature.

- Review all the details and click Done to save your modifications.

- Select your preferred delivery method for your form, whether it's via email, SMS, or an invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form Il 1040x, ensuring exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 form il 1040 x amended individual income tax return

How to make an eSignature for the 2018 Form Il 1040 X Amended Individual Income Tax Return online

How to make an eSignature for your 2018 Form Il 1040 X Amended Individual Income Tax Return in Google Chrome

How to create an electronic signature for signing the 2018 Form Il 1040 X Amended Individual Income Tax Return in Gmail

How to make an electronic signature for the 2018 Form Il 1040 X Amended Individual Income Tax Return from your mobile device

How to generate an eSignature for the 2018 Form Il 1040 X Amended Individual Income Tax Return on iOS

How to generate an electronic signature for the 2018 Form Il 1040 X Amended Individual Income Tax Return on Android

People also ask

-

What is the 2018 Illinois 1040X form used for?

The 2018 Illinois 1040X form is used to amend a previously filed Illinois income tax return. If you discover errors or need to change your filing status, claim additional deductions, or report additional income, this form allows you to correct those discrepancies.

-

How can airSlate SignNow help with the 2018 Illinois 1040X?

airSlate SignNow simplifies the process of completing and eSigning the 2018 Illinois 1040X form. Our easy-to-use platform ensures you can quickly fill out the document, sign it electronically, and send it directly to the Illinois Department of Revenue.

-

Is there a fee for using airSlate SignNow for the 2018 Illinois 1040X?

Yes, airSlate SignNow offers affordable pricing plans that cater to different business needs. By subscribing to our service, you gain access to features that streamline the filing of forms like the 2018 Illinois 1040X, making it a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for the 2018 Illinois 1040X?

With airSlate SignNow, you can easily create, edit, and securely eSign the 2018 Illinois 1040X form. Our platform also provides templates, cloud storage, and the ability to track document status, ensuring a seamless experience.

-

Can I integrate airSlate SignNow with other software for processing the 2018 Illinois 1040X?

Absolutely! airSlate SignNow integrates with various software tools, allowing you to connect your existing systems for efficient workflow management. This ensures that handling the 2018 Illinois 1040X fits smoothly into your overall business processes.

-

What benefits can I expect from using airSlate SignNow for the 2018 Illinois 1040X?

By using airSlate SignNow for the 2018 Illinois 1040X, you benefit from enhanced efficiency, reduced paperwork, and improved document security. Our solution not only simplifies the signing process but also ensures your amended return is submitted accurately and on time.

-

Is airSlate SignNow secure for filing the 2018 Illinois 1040X?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with regulations. When you use our service for your 2018 Illinois 1040X, you can rest assured that your sensitive information is protected throughout the entire process.

Get more for Form Il 1040x

- O casa volunteer oath of confidentiality nycourts form

- Report request new form

- Clackamas county jail visitor visitation request form

- General judgement eviction in california form

- Cause re enforcement of nationalparalegal form

- Washington legal name change form

- Washington renunciation and disclaimer of property from will by testate form

- Lost item report form duvallwa

Find out other Form Il 1040x

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement