Ft 943 Form

What is the FT 943?

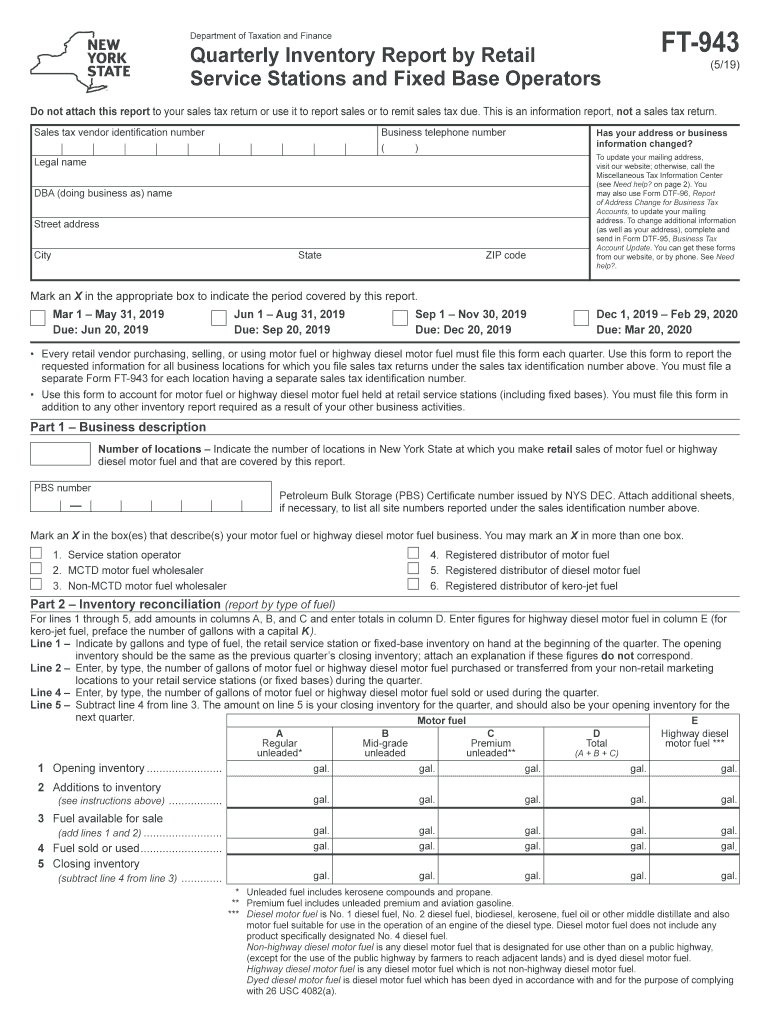

The FT 943 form, also known as the New York State Sales Tax Form FT 943, is a document used by businesses in New York to report and remit sales tax. This form is particularly relevant for those who have collected sales tax on taxable sales and need to report this information to the New York State Department of Taxation and Finance. The form captures essential details such as total sales, taxable sales, and the amount of sales tax collected. Proper completion of the FT 943 is crucial for compliance with state tax laws.

How to use the FT 943

Using the FT 943 form involves several steps to ensure accurate reporting of sales tax. First, businesses must gather all necessary sales records for the reporting period. This includes receipts, invoices, and any other documentation that reflects sales transactions. Next, businesses fill out the form by entering their total sales, taxable sales, and the sales tax collected. It is important to review the completed form for accuracy before submission. Once verified, the form can be submitted either online or via mail, depending on the preference of the business and the requirements set by the New York State Department of Taxation and Finance.

Steps to complete the FT 943

Completing the FT 943 form requires careful attention to detail. Here are the steps to follow:

- Gather documentation: Collect all sales records for the reporting period.

- Calculate total sales: Determine the total amount of sales made during the period.

- Identify taxable sales: Separate taxable sales from exempt sales.

- Calculate sales tax: Compute the total sales tax collected based on the taxable sales.

- Fill out the form: Enter the calculated figures into the FT 943 form accurately.

- Review the form: Double-check all entries for accuracy and completeness.

- Submit the form: Send the completed form to the appropriate tax authority.

Legal use of the FT 943

The FT 943 form is legally binding when completed and submitted according to New York State tax regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes accurate reporting of sales and tax collected, as well as timely submission of the form. Failure to comply with these regulations may result in penalties, fines, or other legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the FT 943 form is essential to avoid penalties. The filing deadlines vary based on the reporting period selected by the business. Generally, businesses must file the FT 943 either monthly, quarterly, or annually. It is important to check the New York State Department of Taxation and Finance website for specific deadlines related to each reporting period. Missing a deadline can lead to late fees and interest on unpaid sales tax.

Form Submission Methods

The FT 943 form can be submitted through various methods, providing flexibility for businesses. The options include:

- Online submission: Businesses can file the form electronically through the New York State Department of Taxation and Finance website.

- Mail submission: The completed form can be printed and mailed to the appropriate tax office.

- In-person submission: Businesses may also choose to deliver the form in person at designated tax offices.

Quick guide on how to complete visit our website otherwise call the

Complete Ft 943 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Manage Ft 943 on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to edit and eSign Ft 943 without breaking a sweat

- Locate Ft 943 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Ft 943 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the visit our website otherwise call the

How to make an electronic signature for your Visit Our Website Otherwise Call The online

How to create an eSignature for the Visit Our Website Otherwise Call The in Google Chrome

How to generate an electronic signature for putting it on the Visit Our Website Otherwise Call The in Gmail

How to make an eSignature for the Visit Our Website Otherwise Call The straight from your smart phone

How to generate an electronic signature for the Visit Our Website Otherwise Call The on iOS

How to make an electronic signature for the Visit Our Website Otherwise Call The on Android OS

People also ask

-

What is the Ft 943, and how does it relate to airSlate SignNow?

The Ft 943 is a key component of airSlate SignNow’s document management and e-signature platform. It allows businesses to streamline their document workflows and enhance collaboration by enabling easy signing and sharing of essential documents. By utilizing Ft 943, companies can improve efficiency and reduce turnaround times for document approvals.

-

How does pricing work for airSlate SignNow's Ft 943?

Pricing for airSlate SignNow, including features associated with Ft 943, is designed to be cost-effective and flexible to meet various business needs. Users can choose from different subscription plans that offer a range of features, ensuring that businesses can find an option that fits their budget. Additionally, there are often promotional offers available for new customers.

-

What features does the Ft 943 offer for document management?

The Ft 943 includes robust features such as customizable templates, real-time tracking of document status, and automated reminders for signers. These features help businesses manage their documents more effectively, ensuring that important contracts and agreements are signed promptly. The intuitive interface of airSlate SignNow makes these features easily accessible.

-

Can the Ft 943 integrate with other software applications?

Yes, the Ft 943 is designed to seamlessly integrate with a variety of third-party applications, enhancing its functionality within your existing workflow. Whether you use CRM systems, cloud storage, or project management tools, airSlate SignNow can connect with them to streamline your document processes. This integration capability is essential for maintaining a cohesive workflow.

-

What are the benefits of using the Ft 943 for e-signatures?

Using the Ft 943 for e-signatures provides numerous benefits, including increased speed and efficiency in obtaining signatures. With airSlate SignNow, businesses can eliminate the delays associated with traditional signing methods. Additionally, the Ft 943 ensures compliance with legal standards for electronic signatures, giving users peace of mind regarding the validity of their signed documents.

-

Is there a mobile app available for the Ft 943?

Yes, airSlate SignNow offers a mobile app that includes features related to the Ft 943, allowing users to manage their documents and obtain e-signatures on the go. The mobile app is user-friendly and ensures that you can access important documents anytime, anywhere. This flexibility is ideal for businesses that require mobility in their operations.

-

How does airSlate SignNow ensure the security of documents signed with Ft 943?

Security is a top priority for airSlate SignNow, and the Ft 943 is equipped with advanced security features to protect your documents. This includes encryption, secure storage, and compliance with industry standards for data protection. Businesses can trust that their sensitive information is safeguarded when using the Ft 943 for e-signatures.

Get more for Ft 943

- Please complete the name and address portion including your sales tax tax ny form

- Inps residenti allestero dichiarazione redditi portale inps form

- Steve robinson photography form

- Welcome to the coffeehouse a team accounting challenge form

- Supreme court of the state of new york county of x form

- Standard build contract template form

- Standard business contract template form

- Standard construction contract template form

Find out other Ft 943

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free