Nm Fid 1 Form

What is the NM Fid 1?

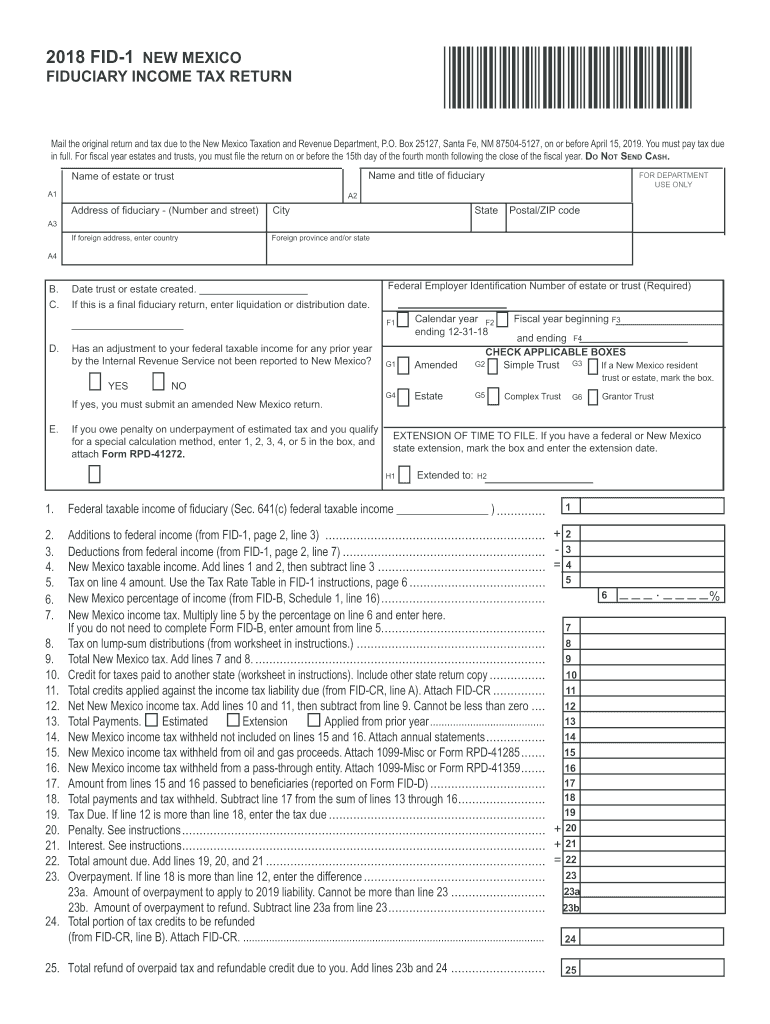

The NM Fid 1 form, also known as the New Mexico Fiduciary Income Tax Return, is a tax document used by fiduciaries to report income for estates and trusts. This form is essential for ensuring that any income generated by the estate or trust is properly reported to the New Mexico Taxation and Revenue Department. The NM Fid 1 is specifically designed for fiduciaries who manage assets on behalf of beneficiaries, ensuring compliance with state tax laws.

How to use the NM Fid 1

Using the NM Fid 1 involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary financial documents related to the estate or trust, including income statements, expenses, and any applicable deductions. Next, complete the form by entering the required information, such as the name and identification number of the estate or trust, as well as income details. Finally, review the completed form for accuracy before submitting it to the appropriate state authority.

Steps to complete the NM Fid 1

Completing the NM Fid 1 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the NM Fid 1 form from the New Mexico Taxation and Revenue Department.

- Fill in the fiduciary's name, address, and taxpayer identification number.

- Report all sources of income, including dividends, interest, and rental income.

- List any deductions applicable to the estate or trust, such as administrative expenses.

- Calculate the total income and tax liability, ensuring all figures are accurate.

- Sign and date the form before submitting it.

Legal use of the NM Fid 1

The NM Fid 1 form must be used in accordance with New Mexico tax laws. It is legally binding when completed accurately and submitted on time. Compliance with state regulations is crucial to avoid penalties. The form serves as an official record of the fiduciary's financial activities and is subject to review by tax authorities. Therefore, it is important to ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the NM Fid 1 are typically aligned with the tax year’s end. Fiduciaries must submit the form by the 15th day of the fourth month following the close of the tax year. For example, if the tax year ends on December 31, the NM Fid 1 must be filed by April 15 of the following year. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties.

Required Documents

To successfully complete the NM Fid 1, several documents are required:

- Income statements for the estate or trust.

- Records of expenses and deductions.

- Tax identification number for the estate or trust.

- Any prior year tax returns, if applicable.

Gathering these documents in advance can streamline the process of completing the NM Fid 1.

Quick guide on how to complete mail the original return and tax due to the new mexico taxation and revenue department p

Effortlessly prepare Nm Fid 1 on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely save it digitally. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without issues. Manage Nm Fid 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Nm Fid 1 stress-free

- Find Nm Fid 1 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to apply your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or save it to your computer.

Eliminate the concerns of lost or mislaid files, tedious document searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Nm Fid 1 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mail the original return and tax due to the new mexico taxation and revenue department p

How to generate an eSignature for your Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P online

How to create an eSignature for the Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P in Google Chrome

How to create an eSignature for signing the Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P in Gmail

How to create an electronic signature for the Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P straight from your mobile device

How to create an electronic signature for the Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P on iOS

How to make an electronic signature for the Mail The Original Return And Tax Due To The New Mexico Taxation And Revenue Department P on Android

People also ask

-

What are the benefits of using the 2019 form fid 1 new mexico fillable forms?

Using the 2019 form fid 1 new mexico fillable forms allows for efficient and accurate document handling. This digital solution minimizes errors, enhances compliance, and speeds up submission processes, making it ideal for businesses and individuals alike.

-

How do I access the 2019 form fid 1 new mexico fillable forms?

The 2019 form fid 1 new mexico fillable forms can be accessed via the airSlate SignNow platform. Simply sign up for an account, navigate to the forms section, and search for the specific form to begin filling it out securely.

-

Is there a cost associated with using the 2019 form fid 1 new mexico fillable forms?

While the 2019 form fid 1 new mexico fillable forms may be available for free, airSlate SignNow offers additional features at a competitive pricing structure. Explore our various subscription plans to find the one that fits your needs best for enhanced functionality.

-

Can I integrate the 2019 form fid 1 new mexico fillable forms with other software?

Yes, airSlate SignNow supports integration with numerous software applications. By using the 2019 form fid 1 new mexico fillable forms within our platform, you can link it to CRMs, cloud storage services, and more to streamline your workflow.

-

What features does airSlate SignNow offer for the 2019 form fid 1 new mexico fillable forms?

airSlate SignNow provides features like electronic signatures, form templates, and secure cloud storage specifically for the 2019 form fid 1 new mexico fillable forms. These tools ensure that your documents are processed efficiently and securely, enhancing your overall experience.

-

How secure is the process of filling out the 2019 form fid 1 new mexico fillable forms?

The security of your information is our priority. The process of filling out the 2019 form fid 1 new mexico fillable forms on airSlate SignNow employs encryption technology to protect your data, ensuring that it remains private and secure throughout.

-

Can the 2019 form fid 1 new mexico fillable forms be saved and edited later?

Yes, once you start filling out the 2019 form fid 1 new mexico fillable forms on airSlate SignNow, you can save your progress. This allows you to return and complete the form at a later time, offering flexibility in your submission process.

Get more for Nm Fid 1

- State of california audit renewal paramedic license application form

- State of california audit renewal paramedic form

- Authorization to close account form south shore bank

- Payroll direct deposit authorization needham bank form

- Sports team contract template form

- Spreadsheet management contract template form

- Spreadsheet contract template form

- Squarespace contract template form

Find out other Nm Fid 1

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online