Az Estimated Tax Forms

What is the Arizona Estimated Tax Form?

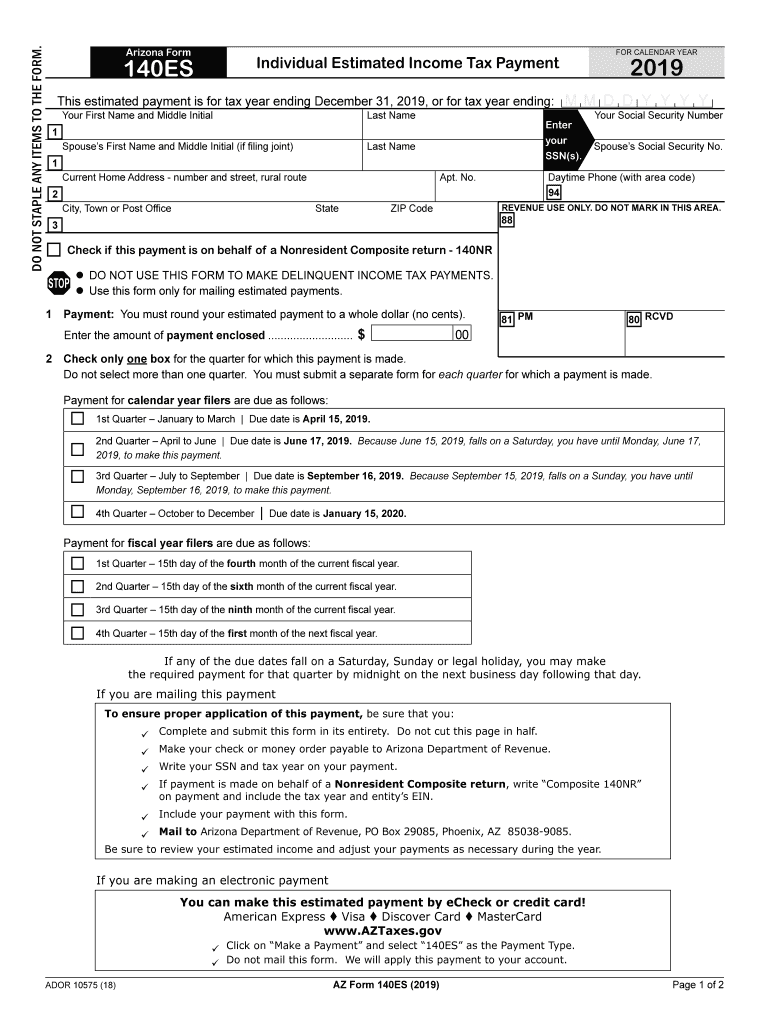

The Arizona Estimated Tax Form, specifically the 2019 Arizona 140 ES form, is designed for individuals who expect to owe tax of $1,000 or more when they file their annual income tax return. This form allows taxpayers to report their estimated income and calculate the amount of tax they expect to owe for the year. By submitting this form, taxpayers can make quarterly payments to the Arizona Department of Revenue, ensuring they meet their tax obligations and avoid penalties.

Steps to Complete the Arizona Estimated Tax Form

Completing the 2019 Arizona 140 ES form involves several key steps:

- Gather necessary financial documents, including income statements and any relevant deductions.

- Calculate your expected income for the year, considering all sources such as wages, self-employment income, and investment earnings.

- Determine your estimated tax liability using the current Arizona tax rates and applicable deductions.

- Fill out the form accurately, ensuring all calculations are correct to avoid discrepancies.

- Submit the form along with your estimated tax payment by the specified deadlines.

Legal Use of the Arizona Estimated Tax Form

The 2019 Arizona 140 ES form is legally binding when completed and submitted according to state regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes maintaining accurate records of income and expenses, as well as making timely payments. Failure to comply can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadlines for submitting the Arizona Estimated Tax Form are crucial for avoiding penalties. Payments are typically due on the following dates:

- First quarter: April 15, 2019

- Second quarter: June 17, 2019

- Third quarter: September 16, 2019

- Fourth quarter: January 15, 2020

Taxpayers should mark these dates on their calendars to ensure timely submissions.

Who Issues the Form?

The 2019 Arizona 140 ES form is issued by the Arizona Department of Revenue. This state agency is responsible for administering tax laws and collecting taxes in Arizona. Taxpayers can obtain the form directly from the Department of Revenue's website or through authorized distribution points.

Key Elements of the Arizona Estimated Tax Form

The 2019 Arizona 140 ES form includes several key elements that taxpayers must complete:

- Personal information: Name, address, and Social Security number.

- Estimated income: A detailed breakdown of expected income sources.

- Tax calculation: A section for calculating the estimated tax owed based on income and applicable deductions.

- Payment information: Details on how to make the estimated tax payments.

Completing these elements accurately is essential for proper tax reporting.

Quick guide on how to complete arizona form 140es

Prepare Az Estimated Tax Forms effortlessly on every device

Online document management has gained popularity among companies and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Az Estimated Tax Forms on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Az Estimated Tax Forms with ease

- Obtain Az Estimated Tax Forms and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Az Estimated Tax Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140es

How to generate an eSignature for the Arizona Form 140es in the online mode

How to make an eSignature for your Arizona Form 140es in Google Chrome

How to make an eSignature for putting it on the Arizona Form 140es in Gmail

How to generate an electronic signature for the Arizona Form 140es straight from your smartphone

How to create an electronic signature for the Arizona Form 140es on iOS

How to create an eSignature for the Arizona Form 140es on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow in 2019 Arizona estimated?

The pricing for airSlate SignNow in 2019 Arizona estimated varies based on the number of users and features chosen. Our plans are designed to be cost-effective, with options available for small businesses as well as larger enterprises. By evaluating your document signing needs, you can select the best plan that suits your budget.

-

What key features does airSlate SignNow offer?

airSlate SignNow offers a range of features that streamline the document signing process, crucial for those looking for 2019 Arizona estimated solutions. These features include eSigning, templates, document storage, and real-time tracking. This comprehensive approach ensures that businesses can efficiently manage their documents without any hassle.

-

How does airSlate SignNow benefit businesses in Arizona?

For businesses in Arizona, the 2019 Arizona estimated benefits of using airSlate SignNow include improved efficiency and reduced turnaround times for document processing. The platform is user-friendly and allows for easy collaboration among team members and clients. This leads to enhanced customer satisfaction and streamlined operations.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can seamlessly integrate with a variety of other software applications, which is an essential aspect when considering the 2019 Arizona estimated. This includes integrations with CRM systems, project management tools, and cloud storage services. Such flexibility allows businesses to create a cohesive workflow tailored to their specific needs.

-

Is airSlate SignNow compliant with legal regulations?

Absolutely, airSlate SignNow is designed to meet legal compliance standards, making it a reliable option for those looking for 2019 Arizona estimated services. Our platform complies with eSigning regulations such as the ESIGN Act and UETA, ensuring that every eSignature is legally binding. This compliance gives users peace of mind when managing critical documents.

-

What types of documents can I sign with airSlate SignNow?

With airSlate SignNow, you can sign various document types ranging from contracts to agreements, which is crucial for anyone evaluating the 2019 Arizona estimated. The platform supports multiple file formats, ensuring that you can handle all kinds of paperwork efficiently. Whether it's legal documents or simple forms, airSlate SignNow covers all your signing needs.

-

How do I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple and straightforward, especially for those interested in the 2019 Arizona estimated. You can begin by signing up for a free trial, allowing you to explore our features and functionalities. Once you're satisfied, you can choose a plan that best fits your requirements and business size.

Get more for Az Estimated Tax Forms

- Special olympics application form

- Letter of occupancy sample office de tourisme de fuveau form

- Speech therapy contract template form

- Special order contract template form

- Sperm donation contract template form

- Sponsorship contract template 787755872 form

- Sperm donor contract template form

- Spokesmodel contract template form

Find out other Az Estimated Tax Forms

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe