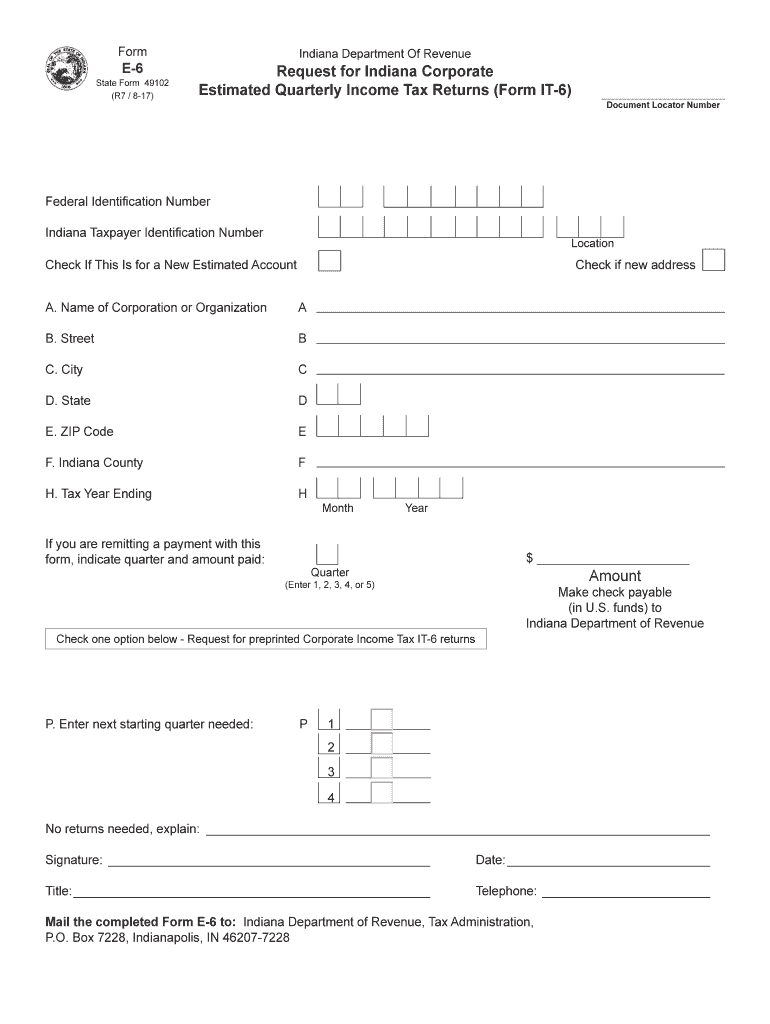

Indiana Form E 6

What is the Indiana Form IT-6WTH?

The Indiana Form IT-6WTH is a tax form used by individuals and businesses to request a quarterly return or estimated income tax payments in the state of Indiana. This form is essential for taxpayers who earn income that is not subject to withholding, allowing them to report and pay their estimated tax liabilities. Understanding the purpose and requirements of the IT-6WTH is crucial for compliance with Indiana tax laws.

Steps to Complete the Indiana Form IT-6WTH

Completing the Indiana Form IT-6WTH involves several key steps:

- Gather necessary financial information, including income sources and any applicable deductions.

- Fill out the personal information section, including your name, address, and Social Security number.

- Calculate your estimated income tax liability based on your projected income for the year.

- Determine the amount you wish to pay for the quarter and enter it on the form.

- Review the completed form for accuracy before submission.

How to Obtain the Indiana Form IT-6WTH

The Indiana Form IT-6WTH can be obtained from the Indiana Department of Revenue's official website. It is available for download in PDF format, making it easy to print and fill out. Additionally, taxpayers can request a physical copy by contacting the department directly. Ensuring you have the most current version of the form is important for compliance.

Legal Use of the Indiana Form IT-6WTH

The Indiana Form IT-6WTH is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it must be filled out accurately and submitted by the specified deadlines. Compliance with the Indiana tax code is essential to avoid penalties and ensure that your estimated tax payments are properly credited to your account.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana Form IT-6WTH are crucial for taxpayers to avoid late fees. Generally, the form must be submitted by the due date for each quarter, which falls on the 15th day of the month following the end of each quarter. For example, the deadline for the first quarter is April 15, the second quarter is July 15, the third quarter is October 15, and the fourth quarter is January 15 of the following year.

Form Submission Methods

The Indiana Form IT-6WTH can be submitted through various methods:

- Online: Taxpayers can file electronically through the Indiana Department of Revenue's e-filing system.

- Mail: Completed forms can be mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also submit the form in person at designated Indiana Department of Revenue offices.

Quick guide on how to complete request for indiana corporate estimated quarterly income tax

Effortlessly Prepare Indiana Form E 6 on Any Device

Virtual document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the instruments required to create, modify, and eSign your documents promptly without delays. Handle Indiana Form E 6 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Indiana Form E 6 with Ease

- Obtain Indiana Form E 6 and click Get Form to initiate the process.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of your documents or redact confidential details with tools that airSlate SignNow has specifically available for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Indiana Form E 6 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for indiana corporate estimated quarterly income tax

How to create an electronic signature for your Request For Indiana Corporate Estimated Quarterly Income Tax in the online mode

How to make an electronic signature for the Request For Indiana Corporate Estimated Quarterly Income Tax in Google Chrome

How to generate an electronic signature for signing the Request For Indiana Corporate Estimated Quarterly Income Tax in Gmail

How to generate an electronic signature for the Request For Indiana Corporate Estimated Quarterly Income Tax straight from your smart phone

How to generate an electronic signature for the Request For Indiana Corporate Estimated Quarterly Income Tax on iOS

How to create an electronic signature for the Request For Indiana Corporate Estimated Quarterly Income Tax on Android OS

People also ask

-

What is the Indiana Form E 6 and how can airSlate SignNow help?

The Indiana Form E 6 is a document required for various business transactions within Indiana. Using airSlate SignNow, you can easily prepare, send, and eSign the Indiana Form E 6, ensuring that your documents are processed quickly and securely. Our platform simplifies the signing process, making it easy for you and your clients to complete necessary paperwork.

-

How much does it cost to use airSlate SignNow for the Indiana Form E 6?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those specifically handling documents like the Indiana Form E 6. Our plans are cost-effective, allowing you to choose a package that fits your budget while providing all the essential features for document management and eSigning.

-

What features does airSlate SignNow offer for managing the Indiana Form E 6?

airSlate SignNow provides a range of features tailored for managing the Indiana Form E 6, including customizable templates, automated workflows, and real-time tracking. These features help streamline the signing process, making it easier for users to send, sign, and store documents securely without hassle.

-

Can I integrate airSlate SignNow with other software for handling the Indiana Form E 6?

Yes, airSlate SignNow offers robust integrations with popular software platforms, allowing you to handle the Indiana Form E 6 seamlessly alongside your existing tools. Whether you use CRM systems, project management apps, or cloud storage services, our integrations enhance your document workflow and improve efficiency.

-

Is airSlate SignNow secure for signing the Indiana Form E 6?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Indiana Form E 6 and all other documents are protected with advanced encryption and compliance with industry standards. You can confidently use our platform, knowing that your sensitive information is secure.

-

How can airSlate SignNow improve the efficiency of processing the Indiana Form E 6?

By using airSlate SignNow, you can signNowly enhance the efficiency of processing the Indiana Form E 6 through features like automated reminders, fast eSigning, and easy document management. This not only saves time but also reduces errors, allowing your business to operate more smoothly.

-

What support options are available for using airSlate SignNow with the Indiana Form E 6?

We offer extensive support options for users of airSlate SignNow, including tutorials, FAQs, and customer service assistance specifically for handling the Indiana Form E 6. Our team is dedicated to ensuring you have the help you need to navigate the eSigning process effectively.

Get more for Indiana Form E 6

- Take in depoe bays rural urban sights statesman journal form

- Addressamp39 title oregon form

- W oregon gov oregon form

- Form it 635 new york youth jobs program tax credit tax year

- Marketing fee agreement form

- Shingles shingrix vaccine consent form

- Software project contract template form

- Software sale contract template form

Find out other Indiana Form E 6

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement