Electronic Filing Instructions Form

What is the Electronic Filing Instructions

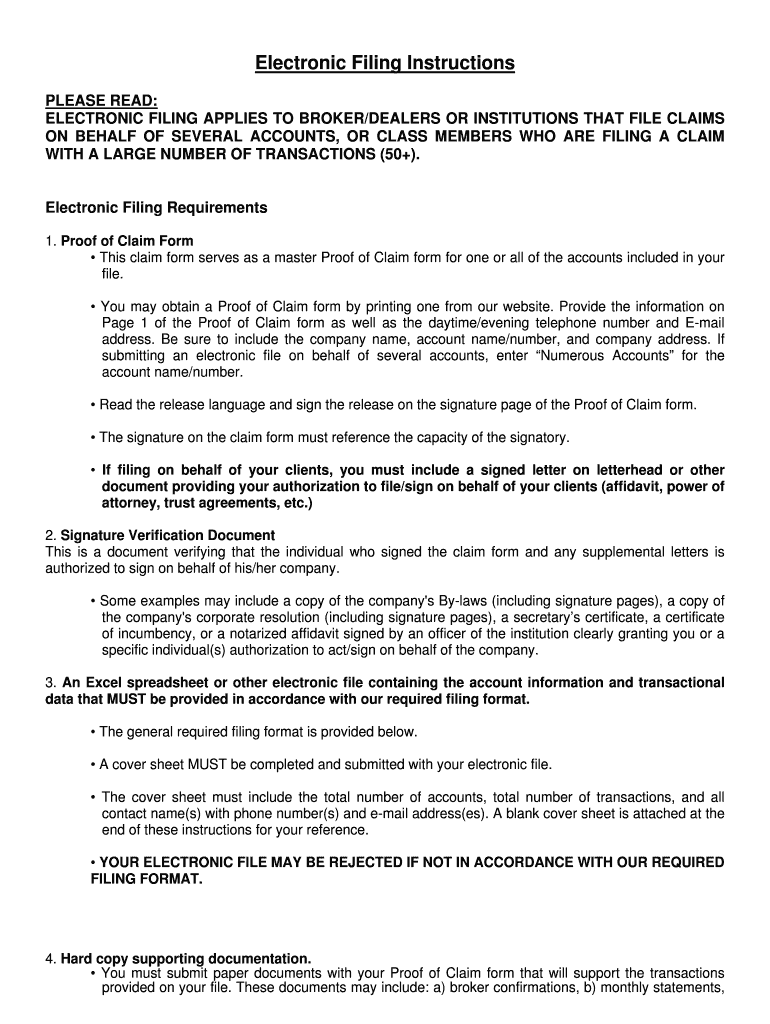

The Electronic Filing Instructions provide detailed guidance on how to file specific forms electronically, particularly in the context of tax submissions. These instructions are essential for ensuring compliance with federal and state regulations, allowing individuals and businesses to submit their information digitally. The instructions outline the necessary steps, required documents, and filing methods to facilitate a smooth electronic filing process.

How to use the Electronic Filing Instructions

Using the Electronic Filing Instructions involves several key steps. First, identify the specific form you need to file electronically. Next, gather all required documents, such as identification numbers and financial records. Follow the step-by-step guidance provided in the instructions to complete the form accurately. Once completed, submit the form through the designated electronic platform, ensuring you receive confirmation of submission for your records.

Steps to complete the Electronic Filing Instructions

To complete the Electronic Filing Instructions, follow these steps:

- Review the specific requirements for the form you are filing.

- Collect all necessary documentation, including any supporting materials.

- Access the electronic filing platform as indicated in the instructions.

- Fill out the form, ensuring all information is accurate and complete.

- Submit the form electronically and save any confirmation or receipt provided.

Required Documents

When preparing to use the Electronic Filing Instructions, it is crucial to have the following documents ready:

- Identification numbers, such as Social Security numbers or Employer Identification Numbers.

- Financial records relevant to the form, including income statements and expense reports.

- Previous year’s tax returns, if applicable, for reference.

- Any additional documentation specified in the instructions for the particular form.

Filing Deadlines / Important Dates

Filing deadlines are critical when using the Electronic Filing Instructions. Typically, federal tax forms must be submitted by April 15 each year, though this date may vary based on weekends or holidays. Additionally, state-specific deadlines may apply, and it is important to consult the instructions for any updates or changes. Marking these dates on your calendar can help ensure timely submissions and avoid penalties.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for electronic filing, which are integral to the Electronic Filing Instructions. These guidelines include requirements for security, data accuracy, and acceptable electronic formats. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors during the filing process.

Quick guide on how to complete electronic filing instructions

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or black out confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Electronic Filing Instructions

Create this form in 5 minutes!

How to create an eSignature for the electronic filing instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Electronic Filing Instructions?

Electronic Filing Instructions refer to the guidelines and steps provided for submitting documents electronically. With airSlate SignNow, these instructions help users navigate the eSigning process efficiently, ensuring that all necessary documents are filed correctly and on time.

-

How does airSlate SignNow simplify Electronic Filing Instructions?

airSlate SignNow simplifies Electronic Filing Instructions by providing a user-friendly interface that guides you through each step. Our platform offers templates and automated workflows that reduce the complexity of filing documents electronically, making it accessible for everyone.

-

Are there any costs associated with using airSlate SignNow for Electronic Filing Instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that enhance your experience with Electronic Filing Instructions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for Electronic Filing Instructions?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for your Electronic Filing Instructions. These tools help streamline the eSigning process and ensure that your documents are always accessible and organized.

-

Can I integrate airSlate SignNow with other applications for Electronic Filing Instructions?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your Electronic Filing Instructions workflow. This integration capability ensures that you can manage your documents efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for Electronic Filing Instructions?

Using airSlate SignNow for Electronic Filing Instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution empowers businesses to manage their documents electronically, saving time and resources while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses needing Electronic Filing Instructions?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our cost-effective solution provides essential tools for managing Electronic Filing Instructions without overwhelming users, making it an ideal choice for smaller teams.

Get more for Electronic Filing Instructions

Find out other Electronic Filing Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors