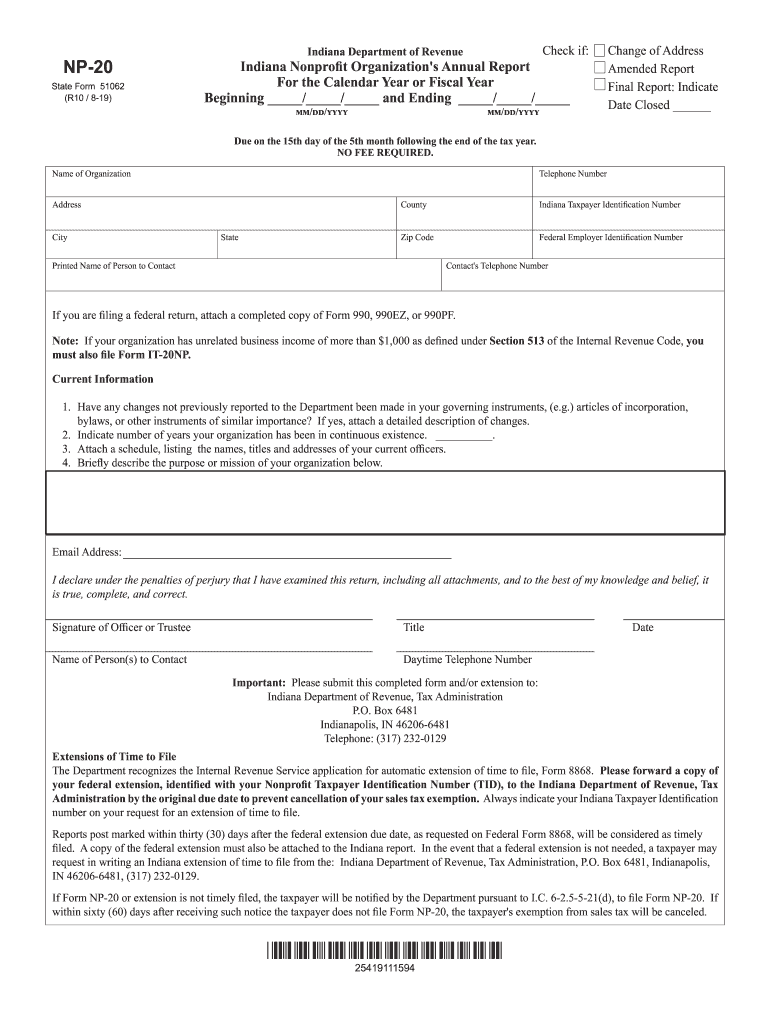

Np 20 Form

What is the NP 20?

The NP 20 is a form used in Indiana for various tax-related purposes. It is primarily associated with the filing of certain tax documents for businesses and organizations. Understanding the NP 20 is essential for ensuring compliance with state tax regulations. This form is often required for entities seeking to report income, deductions, and other pertinent financial information to the Indiana Department of Revenue.

Steps to Complete the NP 20

Completing the NP 20 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form, ensuring that all required fields are completed. Pay particular attention to sections that require specific figures, as errors can lead to delays or penalties. Once the form is filled out, review it for accuracy before submission.

Legal Use of the NP 20

The NP 20 must be filled out and submitted in accordance with Indiana state law. This means that all information provided must be truthful and accurate. Legal use of the NP 20 ensures that organizations remain compliant with tax obligations, thereby avoiding potential legal issues. It is crucial for businesses to understand the implications of submitting this form, as inaccuracies can lead to audits or penalties.

Form Submission Methods

The NP 20 can be submitted through various methods, including online, by mail, or in person. Submitting the form online is often the most efficient method, allowing for quicker processing times. If choosing to mail the form, ensure it is sent to the correct address and consider using a trackable mailing option. In-person submissions may be made at designated state offices, providing an opportunity to ask questions if needed.

Filing Deadlines / Important Dates

Filing deadlines for the NP 20 are critical to ensure compliance with state regulations. Typically, the form must be submitted by a specific date each year, often aligned with the end of the fiscal year for many businesses. It is important to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to the NP 20 can help organizations stay on track.

Required Documents

When filing the NP 20, certain documents may be required to support the information provided on the form. These documents can include financial statements, tax identification numbers, and previous tax returns. Having all required documentation ready can streamline the filing process and help ensure that the NP 20 is completed accurately.

Quick guide on how to complete due on the 15th day of the 5th month following the end of the tax year

Effortlessly Prepare Np 20 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Np 20 on any platform using the airSlate SignNow applications for Android or iOS, and streamline any document-centric process today.

How to Alter and eSign Np 20 with Ease

- Find Np 20 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Np 20 to ensure exceptional communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the due on the 15th day of the 5th month following the end of the tax year

How to generate an eSignature for the Due On The 15th Day Of The 5th Month Following The End Of The Tax Year online

How to make an eSignature for your Due On The 15th Day Of The 5th Month Following The End Of The Tax Year in Google Chrome

How to generate an eSignature for signing the Due On The 15th Day Of The 5th Month Following The End Of The Tax Year in Gmail

How to make an electronic signature for the Due On The 15th Day Of The 5th Month Following The End Of The Tax Year straight from your mobile device

How to make an electronic signature for the Due On The 15th Day Of The 5th Month Following The End Of The Tax Year on iOS

How to create an electronic signature for the Due On The 15th Day Of The 5th Month Following The End Of The Tax Year on Android

People also ask

-

What is filing NP 20 and how can airSlate SignNow assist with it?

Filing NP 20 refers to a specific form required for compliance in various business transactions. airSlate SignNow simplifies the process by allowing users to create, send, and eSign documents efficiently, ensuring all filing NP 20 requirements are met easily.

-

What features does airSlate SignNow offer for filing NP 20?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and automated workflows specifically designed for filing NP 20. These features help streamline the document management process, making it easier to prepare and submit your filings.

-

Is airSlate SignNow cost-effective for filing NP 20?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for filing NP 20. By reducing the time and resources needed for document processing, users can achieve signNow savings.

-

How can airSlate SignNow integrate with my existing systems for filing NP 20?

airSlate SignNow seamlessly integrates with various CRM, accounting, and cloud storage platforms to enhance the filing NP 20 process. This integration allows users to manage their documents more effectively while leveraging existing workflows.

-

What are the benefits of using airSlate SignNow for filing NP 20?

Using airSlate SignNow for filing NP 20 provides several benefits, including increased efficiency, reduced errors, and faster processing times. The platform's user-friendly interface makes it accessible for teams looking to enhance their document management practices.

-

Can I track the status of my filing NP 20 documents with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their filing NP 20 documents in real-time. This feature ensures that organizations stay updated on their document's progress and can manage deadlines effectively.

-

Is airSlate SignNow secure for sensitive filing NP 20 documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive filing NP 20 documents. The platform employs advanced encryption and authentication measures to protect user data throughout the signing process.

Get more for Np 20

- Name and address of the new employer date employment commences and the reason for the change in employment health ri form

- Form it 135 sales and use tax report for purchases of

- Form it 640 start up ny telecommunication services excise tax credit tax year

- Itel application form

- Average time to complete 10 minutesidentity theft form

- Contency recruit contract template form

- Software development contract template form

- Software e development agency contract template form

Find out other Np 20

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter