Nys Form

What is the NYS IT-2104?

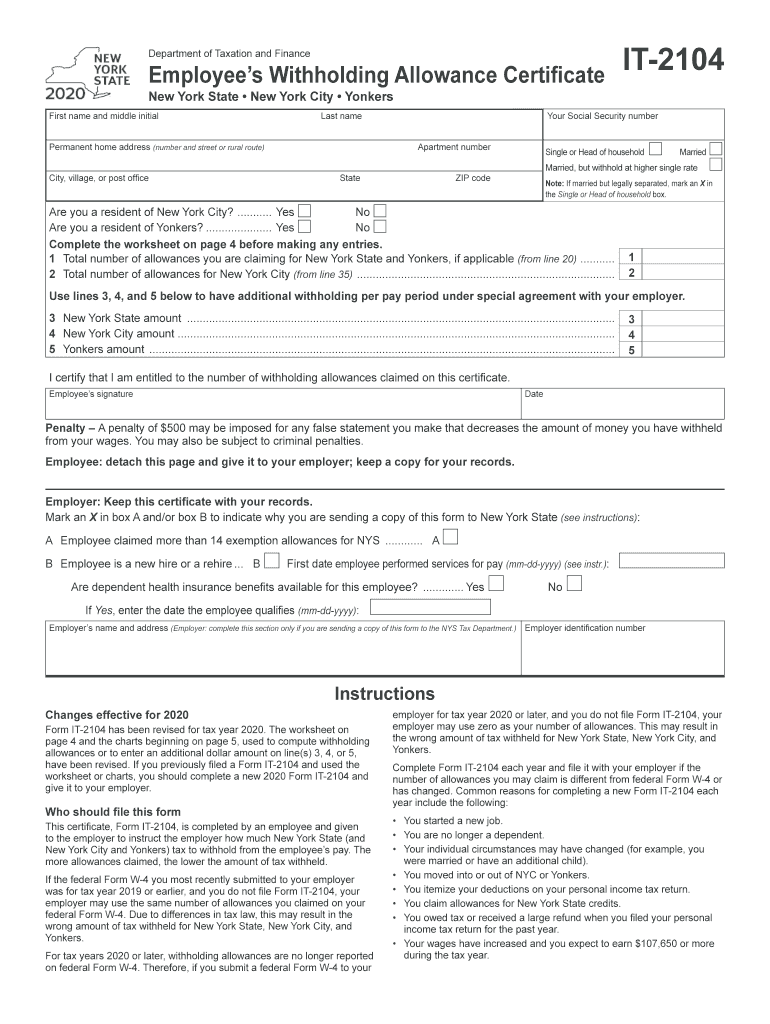

The NYS IT-2104 is a withholding certificate used by employees in New York State to determine the amount of state income tax to withhold from their paychecks. This form allows taxpayers to claim allowances based on their personal circumstances, such as marital status and dependents. By accurately completing the IT-2104, employees can ensure that they are not over- or under-withheld on their state income tax, which can have significant implications during tax season.

Steps to Complete the NYS IT-2104

Filling out the NYS IT-2104 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim the number of allowances you are entitled to based on your situation. Each allowance reduces the amount of tax withheld.

- If applicable, specify any additional amount you want withheld from your paychecks.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the NYS IT-2104

The NYS IT-2104 is legally binding once it is signed and submitted to your employer. It is essential for ensuring compliance with New York State tax laws. Employers are required to use the information provided on this form to calculate the correct amount of state income tax to withhold. Failure to submit a valid IT-2104 may result in incorrect withholding, leading to potential penalties or tax liabilities.

Filing Deadlines / Important Dates

It is crucial to submit the NYS IT-2104 promptly to avoid issues with tax withholding. Generally, employees should submit this form at the beginning of their employment or whenever there is a change in their personal situation that affects their withholding status. Additionally, if you need to make changes to your allowances, you can submit a new form at any time during the year.

Required Documents

When completing the NYS IT-2104, you may need to reference various documents to accurately determine your allowances. These may include:

- Your previous year's tax return, which can provide insights into your filing status and allowances.

- Documentation of dependents, such as birth certificates or Social Security cards.

- Any relevant financial documents that may affect your tax situation, such as W-2 forms from previous employers.

Form Submission Methods

The NYS IT-2104 can be submitted to your employer in several ways. The most common methods include:

- Handing a printed copy directly to your payroll department.

- Submitting the form via email if your employer allows digital submissions.

- Using an online employee portal if your employer has one in place for tax documents.

Quick guide on how to complete form it 21042020employees withholding allowance certificateit2104

Complete Nys effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Nys on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Nys with ease

- Locate Nys and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nys and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 21042020employees withholding allowance certificateit2104

How to generate an eSignature for your Form It 21042020employees Withholding Allowance Certificateit2104 online

How to make an eSignature for the Form It 21042020employees Withholding Allowance Certificateit2104 in Chrome

How to generate an electronic signature for signing the Form It 21042020employees Withholding Allowance Certificateit2104 in Gmail

How to generate an electronic signature for the Form It 21042020employees Withholding Allowance Certificateit2104 from your smartphone

How to create an eSignature for the Form It 21042020employees Withholding Allowance Certificateit2104 on iOS devices

How to create an eSignature for the Form It 21042020employees Withholding Allowance Certificateit2104 on Android OS

People also ask

-

What is a 2020 form PDF, and why is it important?

A 2020 form PDF refers to tax forms commonly used during the 2020 tax year, including important documents like W-2s or 1099s. Filing these forms accurately is crucial for compliance with tax regulations and to avoid penalties. Using tools like airSlate SignNow makes it easier to manage, fill out, and eSign these forms efficiently.

-

How can I securely eSign my 2020 form PDF using airSlate SignNow?

To securely eSign your 2020 form PDF using airSlate SignNow, simply upload the document to our platform, add your signature and any required fields, and send it for signing. Our solution ensures your documents are securely stored and that your personal information remains protected throughout the process. You can easily track the signing status of your 2020 form PDF as well.

-

Is there a cost associated with signing 2020 form PDFs on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including essential features for signing 2020 form PDFs. Our pricing is competitive and transparent, allowing you to choose a plan that works best for your budget. You can also try our service for free to evaluate its benefits.

-

What features does airSlate SignNow offer for managing 2020 form PDFs?

airSlate SignNow provides a range of features for managing 2020 form PDFs, including easy document uploads, customizable templates, and a user-friendly interface for eSigning. Additionally, our solution supports bulk sending and reminders to ensure timely completion of your documents. These features streamline the process of handling important forms effectively.

-

Can I integrate airSlate SignNow with other applications for handling 2020 form PDFs?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows you to manage your 2020 form PDFs directly within the tools you already use, enhancing your workflow and overall productivity. Integrations ensure a smoother experience when handling essential documents.

-

What benefits does airSlate SignNow provide for eSigning 2020 form PDFs?

Using airSlate SignNow for eSigning your 2020 form PDFs offers numerous benefits, including enhanced security, faster processing times, and reduced paper usage. Our digital solution makes it easy to store, access, and sign documents from anywhere, streamlining the signing process. This not only saves time but also increases efficiency in document management.

-

How does airSlate SignNow ensure the security of my 2020 form PDFs?

airSlate SignNow prioritizes the security of your 2020 form PDFs by employing industry-standard encryption protocols and secure data storage solutions. We implement key security features like two-factor authentication and audit trails to safeguard your documents and ensure compliance. You can trust our platform to keep your sensitive information safe and secure.

Get more for Nys

- Items 7 13 ampndash lnsamp39iamp39ruc1amp39lons this form is for reporting all interests required to be tn

- Tceq form op ar3 texas commission on environmental quality tceq texas

- Sc2 statutory sick pay ssp employees statement of sickness statutory sick pay is money paid by employers to their employeeswho form

- Antrag auf leistungen fr bildung und teilhabe 74000863 form

- Snapchat for parents contract template form

- Snow removal contract template form

- Snow removal service contract template form

- Sober liv contract template form

Find out other Nys

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors