C #7209 Forms

What is the C #7209 Forms

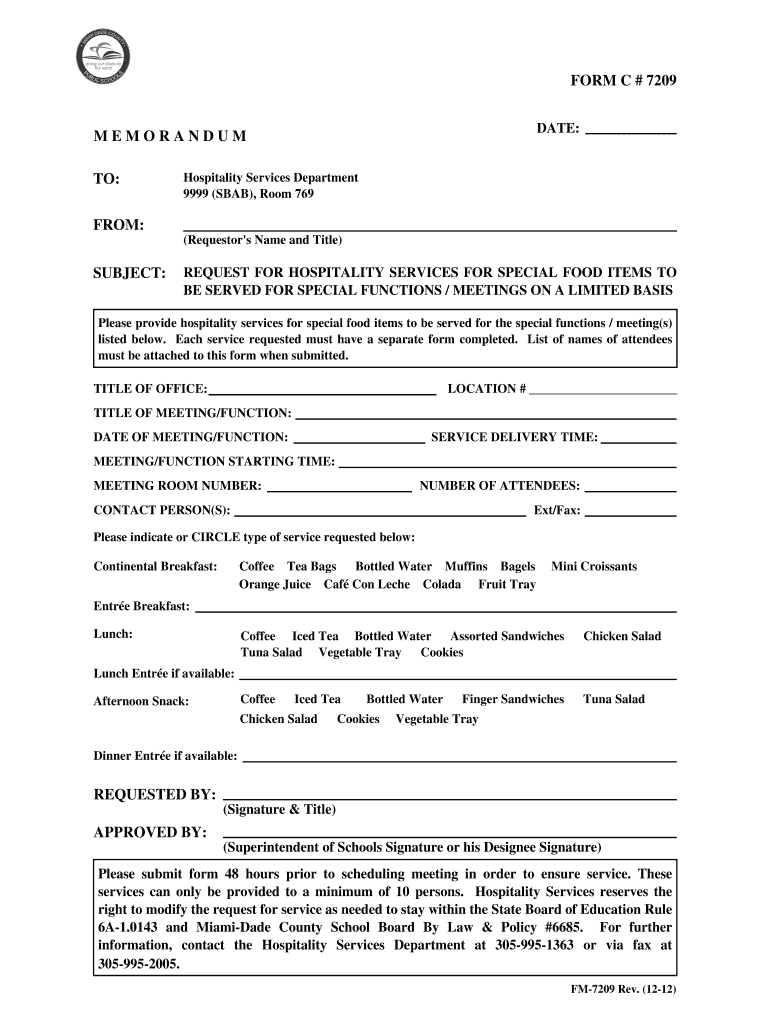

The C #7209 Forms are official documents used primarily for tax purposes in the United States. These forms are typically utilized by businesses and individuals to report specific financial information to the Internal Revenue Service (IRS). The C #7209 Forms serve as a means to ensure compliance with federal tax regulations and facilitate accurate reporting of income, expenses, and other pertinent financial data. Understanding the purpose and requirements of these forms is essential for maintaining proper tax records and fulfilling legal obligations.

How to use the C #7209 Forms

Using the C #7209 Forms involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements, receipts, and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to follow the instructions provided with the form to avoid errors. After completing the form, review it thoroughly before submission to ensure compliance with IRS guidelines. Finally, submit the form through the appropriate channels, whether online or by mail, based on your preference and requirements.

Steps to complete the C #7209 Forms

Completing the C #7209 Forms requires a systematic approach to ensure accuracy. Start by downloading the latest version of the form from the IRS website or obtaining it from a tax professional. Next, fill in your personal information, including your name, address, and taxpayer identification number. Then, proceed to report relevant financial data, such as income and deductions, in the designated sections. It is crucial to double-check all entries for accuracy and completeness. Once finished, sign and date the form before submission to confirm that the information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the C #7209 Forms are critical to avoid penalties and ensure compliance with IRS regulations. Typically, these forms must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may request an extension, which can provide additional time for submission. It is essential to keep track of any changes in deadlines announced by the IRS, as these can vary from year to year. Marking these dates on your calendar can help ensure timely filing and adherence to tax obligations.

Legal use of the C #7209 Forms

The legal use of the C #7209 Forms is governed by IRS regulations, which outline how and when these forms should be utilized. These forms must be completed accurately and submitted within the specified deadlines to avoid legal repercussions. Failure to comply with IRS requirements can result in penalties, including fines and interest on unpaid taxes. It is important to maintain copies of submitted forms for your records, as they may be required for future reference or audits. Understanding the legal implications of using these forms is vital for all taxpayers.

Key elements of the C #7209 Forms

The C #7209 Forms contain several key elements that are essential for accurate reporting. These include sections for personal information, income reporting, deductions, and credits. Each section is designed to capture specific financial details that the IRS requires for tax assessment. Additionally, the forms may include instructions for completing each section, which can provide valuable guidance. Understanding these key elements can help ensure that all necessary information is reported correctly, reducing the risk of errors and potential audits.

Quick guide on how to complete c 7209 forms

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform via airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign [SKS] With Ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to C #7209 Forms

Create this form in 5 minutes!

How to create an eSignature for the c 7209 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are C #7209 Forms and how can they benefit my business?

C #7209 Forms are specialized documents designed for efficient electronic signing and management. By utilizing airSlate SignNow, businesses can streamline their workflows, reduce paper usage, and enhance document security. This leads to faster turnaround times and improved customer satisfaction.

-

How much does it cost to use airSlate SignNow for C #7209 Forms?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses of all sizes. Depending on your requirements, you can choose from various subscription options that provide access to features specifically designed for managing C #7209 Forms. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for C #7209 Forms?

airSlate SignNow provides a range of features for C #7209 Forms, including customizable templates, automated workflows, and real-time tracking. These tools help ensure that your documents are processed efficiently and securely. Additionally, users can easily integrate with other applications to enhance functionality.

-

Can I integrate airSlate SignNow with other software for managing C #7209 Forms?

Yes, airSlate SignNow supports integration with various software applications, making it easy to manage C #7209 Forms alongside your existing tools. Popular integrations include CRM systems, cloud storage services, and productivity apps. This flexibility allows for a seamless workflow across platforms.

-

Is it easy to eSign C #7209 Forms using airSlate SignNow?

Absolutely! airSlate SignNow is designed to provide a user-friendly experience for eSigning C #7209 Forms. Users can sign documents electronically from any device, ensuring convenience and accessibility. The process is quick and straightforward, allowing you to complete transactions efficiently.

-

What security measures does airSlate SignNow implement for C #7209 Forms?

Security is a top priority at airSlate SignNow. For C #7209 Forms, we implement advanced encryption, secure cloud storage, and compliance with industry standards to protect your sensitive information. This ensures that your documents remain confidential and secure throughout the signing process.

-

How can airSlate SignNow improve the efficiency of handling C #7209 Forms?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of handling C #7209 Forms. The platform automates repetitive tasks, reduces manual errors, and accelerates the document signing process. This leads to improved productivity and allows teams to focus on more strategic initiatives.

Get more for C #7209 Forms

- Rental application lepman properties form

- Social skills checklist secondary form

- Irte workshop accreditation audit document gb irteworkshop org form

- Indian passport form

- Medical summary form

- Reconciliation form point loma credit union

- Software review job aid supplement 4 optional worksheets faa form

- Where can i find a copy of wvde policy 5310 form

Find out other C #7209 Forms

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will