Rp 425 E Form

What is the RP-425 E?

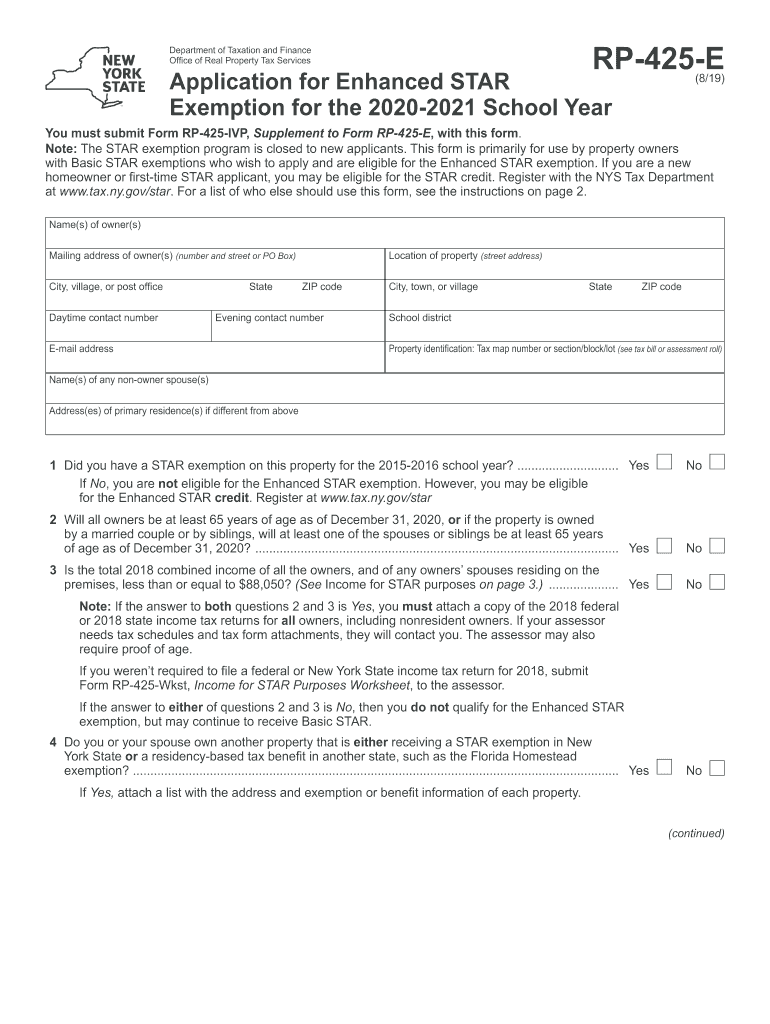

The RP-425 E, commonly known as the enhanced star form, is a crucial document used in New York State for the enhanced star exemption program. This program is designed to provide property tax relief to eligible homeowners, particularly seniors and those with disabilities. The form collects essential information about the applicant's residency and income, which determines their eligibility for the exemption. Understanding the RP-425 E is vital for homeowners seeking to benefit from reduced property taxes.

How to Use the RP-425 E

Using the RP-425 E involves several straightforward steps. First, ensure that you meet the eligibility criteria for the enhanced star program. Next, download the form from the New York State Department of Taxation and Finance website or obtain a physical copy from your local assessor's office. Fill out the form accurately, providing all required information, including your name, address, and income details. Once completed, submit the form to your local assessor's office by the specified deadline to ensure your exemption is processed.

Steps to Complete the RP-425 E

Completing the RP-425 E requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as proof of income and residency.

- Download or request the RP-425 E form.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form to your local assessor’s office by the deadline.

Eligibility Criteria

To qualify for the enhanced star exemption through the RP-425 E, applicants must meet specific criteria. Generally, the applicant must be a homeowner and a resident of New York State. Additionally, applicants must be at least sixty-five years old or have a disability. Income limits apply, so it is essential to review the current income guidelines set by the New York State Department of Taxation and Finance. Meeting these criteria is crucial for successfully obtaining the exemption.

Required Documents

When completing the RP-425 E, certain documents are necessary to support your application. These typically include:

- Proof of age or disability, such as a birth certificate or disability documentation.

- Income verification, which may include tax returns or Social Security statements.

- Proof of residency, such as a utility bill or lease agreement.

Having these documents ready will streamline the application process and help ensure that your form is processed without delays.

Form Submission Methods

The RP-425 E can be submitted through various methods, providing flexibility for applicants. Homeowners can choose to submit the form online, if available, or send it via mail to their local assessor's office. In-person submissions are also an option, allowing for direct communication with local officials. It is important to check the specific submission methods accepted by your local assessor to ensure compliance.

Quick guide on how to complete form rp 425 rnw taxnygov new york state

Complete Rp 425 E effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Rp 425 E on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Rp 425 E with ease

- Obtain Rp 425 E and click on Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, a process that takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form hunting, or mistakes that necessitate new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Rp 425 E to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 rnw taxnygov new york state

How to create an eSignature for the Form Rp 425 Rnw Taxnygov New York State online

How to create an eSignature for the Form Rp 425 Rnw Taxnygov New York State in Google Chrome

How to make an eSignature for signing the Form Rp 425 Rnw Taxnygov New York State in Gmail

How to make an electronic signature for the Form Rp 425 Rnw Taxnygov New York State straight from your mobile device

How to create an eSignature for the Form Rp 425 Rnw Taxnygov New York State on iOS

How to create an eSignature for the Form Rp 425 Rnw Taxnygov New York State on Android devices

People also ask

-

What are enhanced star forms?

Enhanced star forms are advanced digital forms that allow for seamless data capture and eSignature integration. These forms enable users to collect information more efficiently while ensuring compliance and accuracy in document handling.

-

How can I benefit from using enhanced star forms?

By using enhanced star forms, businesses can streamline their document workflows, reduce turnaround times, and enhance overall productivity. These forms also improve user experience by providing a straightforward interface for completing and signing documents.

-

Are there any pricing plans for enhanced star forms?

AirSlate SignNow offers various pricing plans that include access to enhanced star forms. Our affordable solutions cater to different organizational needs, ensuring you can find the right package that fits your budget and requirements.

-

Can I customize enhanced star forms for my business?

Yes, enhanced star forms can be easily customized to align with your business's branding and specific requirements. You can modify fields, design layouts, and tailor functionalities to ensure they serve your unique needs effectively.

-

What integrations are available with enhanced star forms?

Enhanced star forms can be integrated with numerous third-party applications, including CRM systems, payment processors, and cloud storage services. This connectivity ensures a smoother workflow and centralizes your document management processes.

-

Is it easy to implement enhanced star forms in my existing workflow?

Absolutely! Enhanced star forms are designed for easy implementation and can be adapted to your current workflow without signNow disruptions. Our user-friendly platform allows for a quick setup and transition to digital forms.

-

Are enhanced star forms secure for sensitive data?

Yes, enhanced star forms prioritize security, incorporating strong encryption and compliance measures to protect sensitive data. This ensures that all information captured through the forms remains confidential and secure throughout the document lifecycle.

Get more for Rp 425 E

- Instrucciones para el formulario 2290sp rev julio instrucciones para el formulario 2290sp declaracin del impuesto sobre el uso

- Instructions for form it 204 ip new york partners schedule k 1 tax year

- Constuction contract template form

- Service provider contract template form

- Service provision contract template form

- Service rendered contract template form

- Service termination contract template form

- Service renewal contract template form

Find out other Rp 425 E

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online