Ny Form

What is the NY Form?

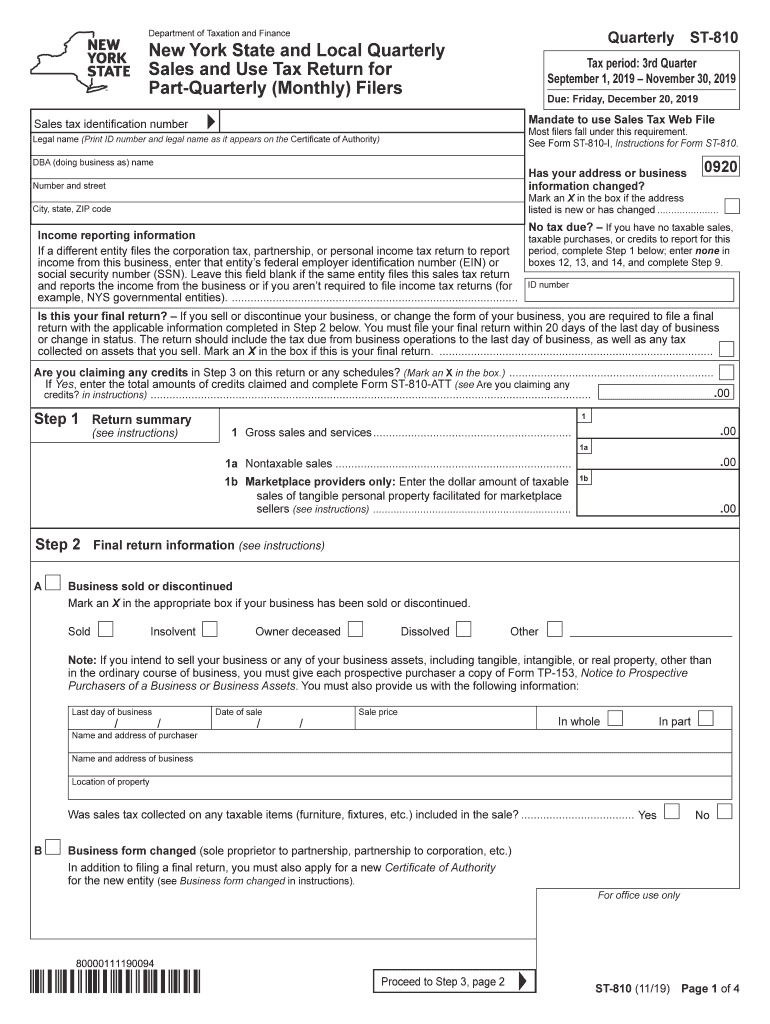

The NY Form, specifically the tr570 form, is a crucial document used in the state of New York for tax purposes. It is primarily associated with the New York State Department of Taxation and Finance and is essential for businesses to report sales tax information. This form is particularly relevant for entities that need to request information related to their sales tax obligations. Understanding the purpose and requirements of the tr570 form is vital for compliance and accurate reporting.

Steps to Complete the NY Form

Completing the tr570 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and sales tax identification number. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your sales activity. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, either online or by mail, ensuring that you meet any relevant deadlines.

Legal Use of the NY Form

The tr570 form is legally binding when completed and submitted correctly. To ensure its legal validity, it must be signed by an authorized representative of the business. Additionally, compliance with relevant laws, such as the Electronic Signatures in Global and National Commerce Act (ESIGN), is essential when submitting the form electronically. Businesses must also retain copies of submitted forms for their records to verify compliance during audits or inquiries.

Filing Deadlines / Important Dates

Timely submission of the tr570 form is critical to avoid penalties. The filing deadlines may vary based on your business's sales tax reporting period. Generally, forms are due quarterly, with specific dates set by the New York State Department of Taxation and Finance. It is essential to stay informed about these deadlines to ensure that your submissions are timely and compliant with state regulations.

Form Submission Methods

The tr570 form can be submitted through various methods, providing flexibility for businesses. Options include online submission through the New York State Department of Taxation and Finance website, mailing a physical copy of the form, or delivering it in person to a designated office. Each method has its own requirements and processing times, so businesses should choose the one that best suits their needs while ensuring compliance with submission guidelines.

Key Elements of the NY Form

Understanding the key elements of the tr570 form is essential for accurate completion. The form typically includes sections for business identification, sales tax identification number, reporting period, and detailed sales information. Additionally, it may require specific calculations related to sales tax collected and any exemptions claimed. Familiarity with these elements will help ensure that the form is filled out correctly and submitted on time.

Quick guide on how to complete form st 8101119new york state and local quarterly sales and use tax return for part quarterly filersst810

Complete Ny Form effortlessly on any gadget

Digital document management has become trendy among businesses and individuals. It offers a splendid eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the proper format and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Ny Form on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Ny Form without hassle

- Locate Ny Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to send your document: by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ny Form and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 8101119new york state and local quarterly sales and use tax return for part quarterly filersst810

How to create an eSignature for the Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 in the online mode

How to create an electronic signature for your Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 in Google Chrome

How to create an electronic signature for signing the Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 in Gmail

How to make an electronic signature for the Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 from your mobile device

How to make an eSignature for the Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 on iOS

How to generate an eSignature for the Form St 8101119new York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filersst810 on Android

People also ask

-

What is the TR 570 form and why is it important?

The TR 570 form is a crucial document used for tax-related purposes in certain jurisdictions. It helps businesses and individuals report specific financial information accurately, ensuring compliance with local regulations and facilitating smooth financial processes.

-

How can airSlate SignNow assist with completing the TR 570 form?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the TR 570 form. With our electronic signature capabilities and document templates, users can easily input required information and obtain signatures quickly, streamlining the filing process.

-

What are the pricing options for airSlate SignNow when dealing with the TR 570 form?

Our pricing plans for airSlate SignNow are designed to be budget-friendly, catering to both individuals and businesses. Depending on your needs for the TR 570 form and other features, you can choose from several subscription levels, ensuring you only pay for what you use.

-

Is the TR 570 form compatible with mobile devices using airSlate SignNow?

Yes, the TR 570 form can be accessed and completed via mobile devices using the airSlate SignNow app. Our mobile-friendly platform ensures that you can fill out, sign, and send documents on-the-go, making it convenient for busy professionals.

-

Does airSlate SignNow offer templates for the TR 570 form?

Absolutely! airSlate SignNow provides customizable templates for the TR 570 form. This feature allows users to pre-fill information, saving time and ensuring accuracy when preparing important tax documents.

-

Can airSlate SignNow integrate with other software for handling the TR 570 form?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage the TR 570 form alongside your existing tools. This integration enhances workflow efficiency and ensures that all necessary data is synchronized across platforms.

-

What benefits does airSlate SignNow offer for managing the TR 570 form?

Using airSlate SignNow for managing the TR 570 form provides numerous benefits, including improved efficiency, enhanced security, and ease of use. Our platform reduces the need for paper-based processes and offers secure, legally binding eSignatures.

Get more for Ny Form

- Printable will forms pdf fill online printable fillable blank

- Application for search of wills notice form

- Politically exposed persons declaration form home trust

- Application for search of wills notice 11976199 form

- Sell house contract template form

- Sell used car contract template form

- Sell puppies contract template form

- Sell property contract template form

Find out other Ny Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors