Business Loan Application Loan Application Updated January 20, Form

What is the Business Loan Application?

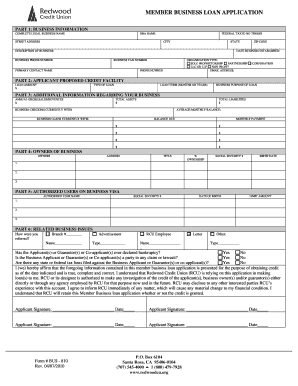

The Business Loan Application is a formal document used by businesses to request financing from lenders. This application outlines the financial needs of the business, including the amount of money requested, the purpose of the loan, and the repayment plan. It typically includes information about the business's financial status, credit history, and operational details. Understanding this application is crucial for business owners seeking to secure funding to support their operations or growth.

Key Elements of the Business Loan Application

A comprehensive Business Loan Application includes several key elements that lenders assess to determine eligibility. These elements often include:

- Business Information: Name, address, and type of business entity (e.g., LLC, corporation).

- Financial Statements: Recent income statements, balance sheets, and cash flow statements.

- Loan Purpose: A detailed explanation of how the loan will be used, such as for equipment purchase or operational expenses.

- Repayment Plan: Proposed terms for repayment, including duration and payment schedule.

- Owner Information: Personal details of business owners, including credit history and personal financial statements.

Steps to Complete the Business Loan Application

Completing the Business Loan Application involves several important steps to ensure accuracy and completeness:

- Gather Documentation: Collect all necessary financial documents and business information.

- Fill Out the Application: Carefully complete the application form, ensuring all sections are filled out accurately.

- Review and Edit: Proofread the application for any errors or omissions.

- Submit the Application: Send the completed application to the lender through the preferred submission method.

- Follow Up: Contact the lender to confirm receipt and inquire about the next steps in the approval process.

Eligibility Criteria for the Business Loan Application

Eligibility for a business loan varies by lender but generally includes several common criteria. Businesses must typically demonstrate:

- Established Business History: A minimum period of operation, often at least one to two years.

- Creditworthiness: A satisfactory credit score for both the business and its owners.

- Financial Stability: Evidence of consistent revenue and profitability.

- Purpose of the Loan: A clear and viable plan for how the loan funds will be used.

Required Documents for the Business Loan Application

When applying for a business loan, certain documents are typically required to support the application. These may include:

- Tax Returns: Personal and business tax returns for the past two to three years.

- Financial Statements: Income statements, balance sheets, and cash flow statements.

- Business Plan: A detailed business plan outlining goals, strategies, and financial projections.

- Legal Documents: Business licenses, registrations, and any relevant contracts.

Form Submission Methods

The Business Loan Application can be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer online portals for easy application submission.

- Mail: Physical copies can be mailed to the lender's address.

- In-Person: Some lenders may allow applicants to submit their application in person at a local branch.

Quick guide on how to complete business loan application loan application updated january 20

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal green alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that reason.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Loan Application Loan Application Updated January 20,

Create this form in 5 minutes!

How to create an eSignature for the business loan application loan application updated january 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Loan Application Loan Application Updated January 20,?

The Business Loan Application Loan Application Updated January 20, is a streamlined digital solution designed to simplify the process of applying for business loans. It allows users to fill out and submit loan applications electronically, ensuring a faster and more efficient experience.

-

How does airSlate SignNow enhance the Business Loan Application Loan Application Updated January 20, process?

airSlate SignNow enhances the Business Loan Application Loan Application Updated January 20, by providing an intuitive platform for eSigning and managing documents. This reduces paperwork and accelerates the approval process, making it easier for businesses to secure funding.

-

What are the pricing options for the Business Loan Application Loan Application Updated January 20,?

Pricing for the Business Loan Application Loan Application Updated January 20, varies based on the features and number of users. airSlate SignNow offers flexible plans to accommodate businesses of all sizes, ensuring that you only pay for what you need.

-

What features are included in the Business Loan Application Loan Application Updated January 20,?

The Business Loan Application Loan Application Updated January 20, includes features such as customizable templates, secure eSigning, document tracking, and integration with popular business tools. These features help streamline the loan application process and improve overall efficiency.

-

How can the Business Loan Application Loan Application Updated January 20, benefit my business?

Utilizing the Business Loan Application Loan Application Updated January 20, can signNowly reduce the time and effort required to apply for loans. By automating document management and eSigning, businesses can focus more on growth and less on paperwork.

-

Is the Business Loan Application Loan Application Updated January 20, secure?

Yes, the Business Loan Application Loan Application Updated January 20, is designed with security in mind. airSlate SignNow employs advanced encryption and compliance measures to protect sensitive information throughout the loan application process.

-

Can I integrate the Business Loan Application Loan Application Updated January 20, with other software?

Absolutely! The Business Loan Application Loan Application Updated January 20, can be easily integrated with various business applications such as CRM systems, accounting software, and more. This ensures a seamless workflow and enhances productivity.

Get more for Business Loan Application Loan Application Updated January 20,

- Va irp 1 form

- Personal recovery outcome measure pdf form

- Application for watercraft certificate of title va fillable form

- Mesopotamia timeline pdf form

- Subway menu pdf form

- Lateral transfer request form richland school district two richland2

- Appraisal experience log example form

- Lesson 4 homework practice powers of monomials 274550273 form

Find out other Business Loan Application Loan Application Updated January 20,

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe