PROPERTY TAX ABATEMENT INSTRUCTIONS Town of Tewksbury Form

What is the Property Tax Abatement Instructions for the Town of Tewksbury

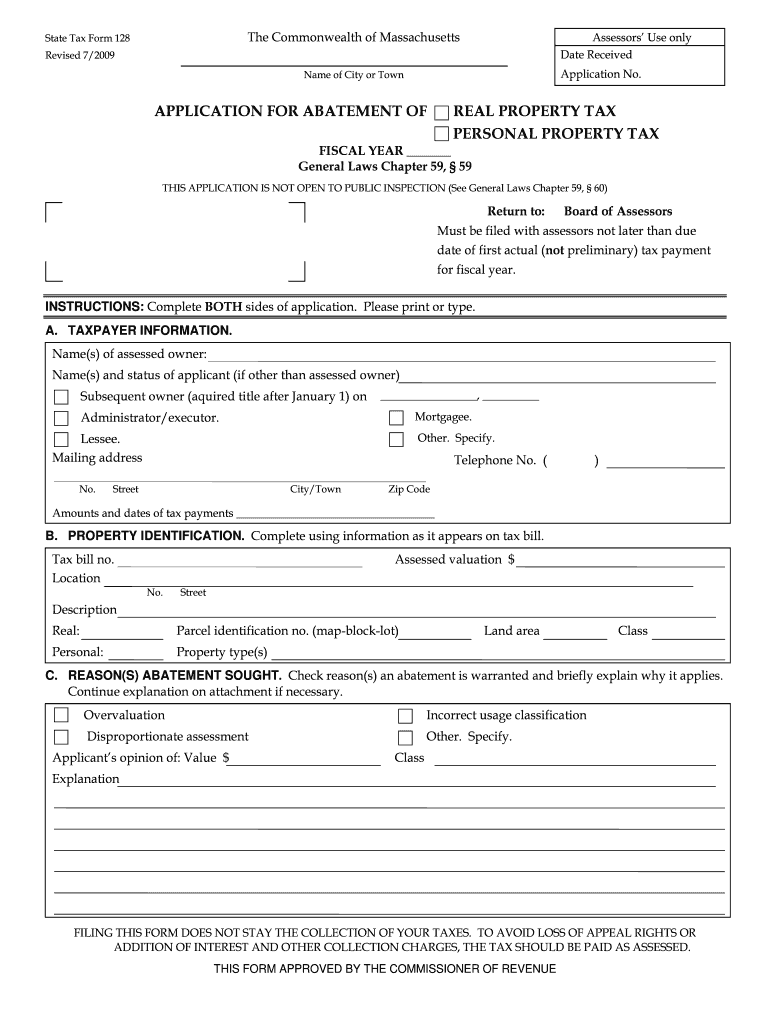

The Property Tax Abatement Instructions for the Town of Tewksbury provide guidelines for property owners seeking to reduce their property tax assessments. This process allows eligible taxpayers to request a review of their property’s assessed value, which may lead to a decrease in their tax obligations if the assessment is found to be inaccurate. The instructions detail the eligibility criteria, necessary documentation, and the procedural steps required to file for an abatement.

Eligibility Criteria for Property Tax Abatement

To qualify for property tax abatement in Tewksbury, property owners must meet specific eligibility requirements. Generally, the applicant must be the owner of the property in question and have received a tax bill for the current fiscal year. Additionally, the property must be assessed at a value that exceeds its fair market value. It is important for applicants to review the local guidelines to ensure they meet all necessary conditions before proceeding with their application.

Steps to Complete the Property Tax Abatement Application

Completing the Property Tax Abatement application involves several key steps:

- Gather necessary documentation, including the current tax bill and any supporting evidence of the property’s market value.

- Obtain the Property Tax Abatement application form from the Town of Tewksbury’s official website or municipal office.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the completed application along with any supporting documents to the appropriate municipal office by the specified deadline.

Required Documents for Property Tax Abatement

When applying for a property tax abatement, applicants must provide several documents to support their request. These typically include:

- A copy of the most recent property tax bill.

- Evidence of the property’s fair market value, such as a recent appraisal or comparative market analysis.

- Any additional documentation that may substantiate the claim for abatement, such as photographs or repair estimates if applicable.

Form Submission Methods for Property Tax Abatement

The Town of Tewksbury allows property tax abatement applications to be submitted through various methods. Applicants can choose to:

- Submit the application in person at the municipal office during business hours.

- Mail the completed application and supporting documents to the designated office address.

- Utilize any available online submission options if provided by the town’s official website.

Filing Deadlines for Property Tax Abatement

It is crucial for applicants to be aware of the filing deadlines for property tax abatement requests. In Tewksbury, applications typically must be submitted within a specific timeframe following the issuance of the tax bill. Missing this deadline may result in the inability to contest the assessment for that fiscal year. Property owners should check the town’s official communications for the exact dates and any updates regarding the process.

Quick guide on how to complete property tax abatement instructions town of tewksbury

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without any hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax abatement instructions town of tewksbury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the PROPERTY TAX ABATEMENT INSTRUCTIONS for the Town Of Tewksbury?

The PROPERTY TAX ABATEMENT INSTRUCTIONS for the Town Of Tewksbury provide detailed guidelines on how to apply for a property tax abatement. This includes eligibility criteria, necessary documentation, and the application process. Following these instructions ensures that residents can effectively submit their requests for tax relief.

-

How can I access the PROPERTY TAX ABATEMENT INSTRUCTIONS for the Town Of Tewksbury?

You can access the PROPERTY TAX ABATEMENT INSTRUCTIONS for the Town Of Tewksbury through the official town website or by visiting the local tax assessor's office. These resources provide comprehensive information and downloadable forms needed for the application process. Make sure to check for any updates or changes to the instructions.

-

What documents are required for the PROPERTY TAX ABATEMENT INSTRUCTIONS in the Town Of Tewksbury?

To complete the PROPERTY TAX ABATEMENT INSTRUCTIONS in the Town Of Tewksbury, you will typically need proof of ownership, income documentation, and any relevant property assessments. It's important to gather all necessary documents before starting your application to avoid delays. Check the town's website for a complete list of required documents.

-

Is there a fee associated with the PROPERTY TAX ABATEMENT application in Tewksbury?

There is no fee to apply for a property tax abatement in the Town Of Tewksbury. The process is designed to be accessible for all residents seeking tax relief. However, it’s advisable to confirm this information with the local tax office, as policies may change.

-

How long does it take to process the PROPERTY TAX ABATEMENT application in Tewksbury?

The processing time for the PROPERTY TAX ABATEMENT application in the Town Of Tewksbury can vary, but it typically takes several weeks. Once your application is submitted, the tax assessor's office will review it and notify you of their decision. Staying informed about the timeline can help you plan accordingly.

-

What are the benefits of following the PROPERTY TAX ABATEMENT INSTRUCTIONS in Tewksbury?

Following the PROPERTY TAX ABATEMENT INSTRUCTIONS in the Town Of Tewksbury can lead to signNow savings on your property taxes. It allows eligible residents to reduce their tax burden, making homeownership more affordable. Additionally, understanding the process can empower residents to advocate for their financial interests.

-

Can I appeal a decision made regarding my PROPERTY TAX ABATEMENT application in Tewksbury?

Yes, if your PROPERTY TAX ABATEMENT application is denied in the Town Of Tewksbury, you have the right to appeal the decision. The appeal process is outlined in the PROPERTY TAX ABATEMENT INSTRUCTIONS and typically involves submitting additional documentation or attending a hearing. It's important to act promptly to ensure your appeal is considered.

Get more for PROPERTY TAX ABATEMENT INSTRUCTIONS Town Of Tewksbury

- Part time temporary evaluation fillable form

- Office of faculty affairs complete form and send to the avp

- Request for restricted use of personal health plan information

- Family care amp medical leave of absence request san jose state form

- Complete one form per registrant

- Accountable plan worksheet instructions form

- New apush dbq rubric btomricheybbnetb form

- Www chick fil a comcontact supportcustomer servicechick fil a form

Find out other PROPERTY TAX ABATEMENT INSTRUCTIONS Town Of Tewksbury

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free