Ifta 105 Form

What is the IFTA 105 Form

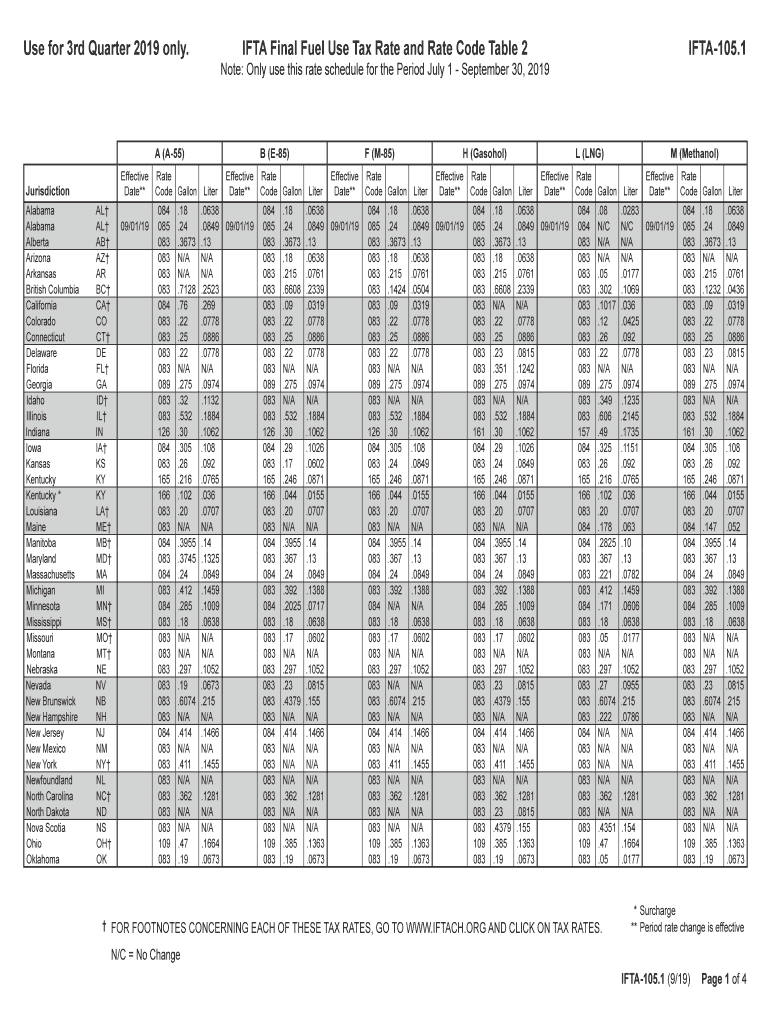

The IFTA 105 form is a critical document used by motor carriers to report and pay fuel taxes to the appropriate jurisdictions. The International Fuel Tax Agreement (IFTA) simplifies the reporting process for interstate motor carriers by allowing them to file a single fuel tax report instead of separate reports for each state. This form is essential for ensuring compliance with fuel tax regulations across multiple states, making it a key component in the operations of trucking and transportation businesses.

Steps to complete the IFTA 105 Form

Completing the IFTA 105 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including mileage and fuel purchase records for each jurisdiction. Next, accurately calculate the total miles driven and the total gallons of fuel purchased in each state. Afterward, fill out the form with these figures, ensuring that all calculations align with the requirements set by IFTA. Finally, review the completed form for any errors before submission to avoid penalties.

Legal use of the IFTA 105 Form

The IFTA 105 form holds legal significance as it serves as an official record of a motor carrier's fuel tax obligations. To be considered legally valid, the form must be completed accurately and submitted within the designated deadlines. Compliance with state and federal regulations is crucial, as failure to adhere to these guidelines can result in fines or other legal consequences. Utilizing a reliable eSignature solution can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 105 form are crucial for maintaining compliance. Typically, the form is filed quarterly, with specific due dates for each quarter. For example, the first quarter's filing is usually due by April 30, while the second quarter is due by July 31. It is essential for carriers to be aware of these deadlines to avoid late fees and potential penalties. Keeping a calendar of these important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The IFTA 105 form can be submitted through various methods, providing flexibility for motor carriers. Many jurisdictions allow for online submission, which is often the quickest and most efficient option. Alternatively, carriers can mail the completed form to the appropriate state agency or submit it in person at designated locations. Each method has its own advantages, and choosing the right one can depend on the carrier's preferences and the specific requirements of their state.

Key elements of the IFTA 105 Form

The IFTA 105 form includes several key elements that must be accurately reported. These elements typically consist of the carrier's information, total miles driven in each jurisdiction, total gallons of fuel purchased, and the calculated tax due for each state. Additionally, the form may require the carrier's signature and date to validate the submission. Understanding these components is essential for completing the form correctly and ensuring compliance with tax obligations.

Quick guide on how to complete ifta final fuel use tax rate and rate code

Effortlessly prepare Ifta 105 Form on any device

The management of online documents has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Ifta 105 Form across any platform using airSlate SignNow apps available for Android or iOS, and enhance any document-centered workflow today.

Steps to modify and eSign Ifta 105 Form with ease

- Acquire Ifta 105 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Adjust and eSign Ifta 105 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta final fuel use tax rate and rate code

How to create an eSignature for your Ifta Final Fuel Use Tax Rate And Rate Code in the online mode

How to generate an electronic signature for your Ifta Final Fuel Use Tax Rate And Rate Code in Google Chrome

How to generate an electronic signature for putting it on the Ifta Final Fuel Use Tax Rate And Rate Code in Gmail

How to make an electronic signature for the Ifta Final Fuel Use Tax Rate And Rate Code right from your smartphone

How to create an electronic signature for the Ifta Final Fuel Use Tax Rate And Rate Code on iOS

How to make an electronic signature for the Ifta Final Fuel Use Tax Rate And Rate Code on Android devices

People also ask

-

What is IFTA 105 and how does it relate to airSlate SignNow?

IFTA 105 refers to the form used by motor carriers to report their fuel use across jurisdictions. With airSlate SignNow, businesses can easily eSign and send IFTA 105 documents, streamlining the filing process and ensuring compliance with transportation regulations.

-

How does airSlate SignNow help with filing IFTA 105 forms?

AirSlate SignNow simplifies the filing of IFTA 105 forms by allowing users to upload, eSign, and dispatch their documents quickly. This reduces the risk of errors and ensures that your filings are submitted on time, helping you stay compliant with your reporting obligations.

-

What are the pricing options for using airSlate SignNow for IFTA 105?

AirSlate SignNow offers flexible pricing plans, allowing businesses to choose a model that fits their needs for processing IFTA 105 forms. Whether you’re a small business or a large fleet operator, there are cost-effective solutions available to help you manage your document signing and workflow.

-

Can I integrate airSlate SignNow with my existing fleet management software for IFTA 105?

Yes, airSlate SignNow can seamlessly integrate with various fleet management software solutions. This integration facilitates the automatic generation and signing of IFTA 105 forms, making your workflow much more efficient while minimizing administrative burdens.

-

What features does airSlate SignNow provide for managing IFTA 105 documents?

AirSlate SignNow offers features such as cloud storage, document tracking, and customizable templates specifically for IFTA 105 forms. These features enhance your ability to manage and organize important documents, ensuring that you have everything at your fingertips when it's time to file.

-

What are the benefits of using airSlate SignNow for IFTA 105 filings?

Using airSlate SignNow for IFTA 105 filings means faster processing times and improved efficiency. By digitizing your paperwork, you reduce the likelihood of human errors, save costs on mailing, and ensure that important documents are securely stored and easily accessible.

-

Is airSlate SignNow compliant with regulations for IFTA 105 signatures?

Absolutely, airSlate SignNow complies with all relevant regulations regarding electronic signatures for IFTA 105 forms. By using our platform, you can be assured that your eSignatures are legally binding and meet industry standards, safeguarding your compliance needs.

Get more for Ifta 105 Form

- May 10 at 130 pm at the doe turlington building conference room 170307 form

- Root planing informed consent periodontal scaling and

- Peacehealth financial assistance application form

- Private passenger auto insurance application form

- Cardiac cta worksheet form

- Screenwriter contract template form

- School uni contract template form

- Seamstress contract template form

Find out other Ifta 105 Form

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF