Form 1120 CM

What is the Form 1120 CM

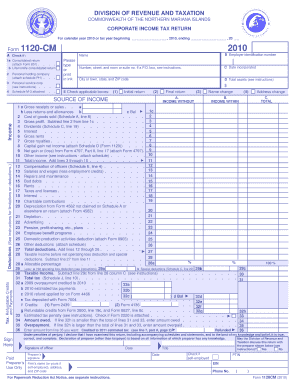

The Form 1120 CM is a tax form used by corporations in the United States to report their income, gains, losses, deductions, and credits. Specifically, it is designed for corporations that are subject to the corporate income tax and need to provide detailed financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and helps in calculating the corporation's tax liability.

How to use the Form 1120 CM

To effectively use the Form 1120 CM, corporations must gather all necessary financial data, including income statements and balance sheets. The form requires detailed entries regarding revenue, expenses, and other financial activities. It is crucial to accurately fill out each section to reflect the corporation's financial status for the tax year. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to complete the Form 1120 CM

Completing the Form 1120 CM involves several key steps:

- Gather all relevant financial documents, including income statements and balance sheets.

- Fill in the corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts and other income sources.

- Deduct allowable expenses, such as operating costs and salaries, to determine taxable income.

- Calculate the tax due based on the applicable corporate tax rate.

- Sign and date the form before submission.

Legal use of the Form 1120 CM

The Form 1120 CM must be used in accordance with IRS regulations. It is legally required for corporations to file this form annually to report their income and pay any taxes owed. Failure to file or inaccuracies in the form can lead to penalties and interest charges. Therefore, it is important for corporations to understand their obligations under U.S. tax law when using this form.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 CM is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also request an extension, but it is crucial to file the extension request before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 CM can be submitted to the IRS through various methods. Corporations have the option to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether payment is included. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete form 1120 cm

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Alter and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 CM

Create this form in 5 minutes!

How to create an eSignature for the form 1120 cm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 CM and why is it important?

Form 1120 CM is a tax form used by corporations to report their income, deductions, and tax liability. It is essential for ensuring compliance with federal tax regulations and helps businesses accurately calculate their tax obligations. Using airSlate SignNow can streamline the process of preparing and submitting Form 1120 CM.

-

How can airSlate SignNow help with Form 1120 CM?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 1120 CM. With its intuitive interface, users can quickly prepare their documents, ensuring that all necessary information is included. This not only saves time but also reduces the risk of errors in the submission process.

-

What are the pricing options for using airSlate SignNow for Form 1120 CM?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need a basic plan for occasional use or a comprehensive solution for frequent submissions of Form 1120 CM, there is an option that fits your needs. Visit our pricing page for detailed information on each plan.

-

Are there any features specifically designed for Form 1120 CM?

Yes, airSlate SignNow includes features tailored for Form 1120 CM, such as customizable templates and automated workflows. These features help users efficiently manage their tax documents and ensure that all necessary fields are completed accurately. Additionally, users can track the status of their submissions in real-time.

-

Can I integrate airSlate SignNow with other software for Form 1120 CM?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage Form 1120 CM alongside your other financial documents. This seamless integration helps streamline your workflow and ensures that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for Form 1120 CM?

Using airSlate SignNow for Form 1120 CM provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. The platform allows for quick electronic signatures, which speeds up the submission process. Additionally, it offers secure storage for your documents, ensuring that your sensitive information is protected.

-

Is airSlate SignNow secure for handling Form 1120 CM?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Form 1120 CM. The platform employs advanced encryption and security protocols to protect your documents and personal information. You can confidently manage your tax submissions knowing that your data is secure.

Get more for Form 1120 CM

- Marriage license thurston county form

- Dda training form

- Notice of intended marriage form nt gov

- West virginia power of attorney form

- Motion application to intervene minnesota form

- Minnesota board of dentistry self assessment form

- Apgfcu skip a pay form

- The child abuse material instrument cami ranconsulting form

Find out other Form 1120 CM

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT