Utility Users Tax Form

What is the Utility Users Tax

The Utility Users Tax (UUT) is a local tax imposed on the consumption of utility services within specific jurisdictions, including cities like Los Angeles. This tax applies to various utilities, such as electricity, gas, water, and telecommunications. The revenue generated from the UUT is typically used to fund essential public services, including infrastructure maintenance, public safety, and community programs. Understanding the UUT is crucial for residents and businesses to ensure compliance and to take advantage of any available exemptions.

Eligibility Criteria

To qualify for the Utility Users Tax exemption, individuals or businesses must meet specific eligibility criteria set by local authorities. Generally, these criteria may include:

- Residency within the jurisdiction imposing the tax.

- Demonstrating financial need or qualifying under specific income thresholds.

- Utilizing the utility services for residential purposes rather than commercial activities.

It is important to review the local regulations to confirm eligibility, as criteria may vary by location.

Steps to Complete the Utility Users Tax

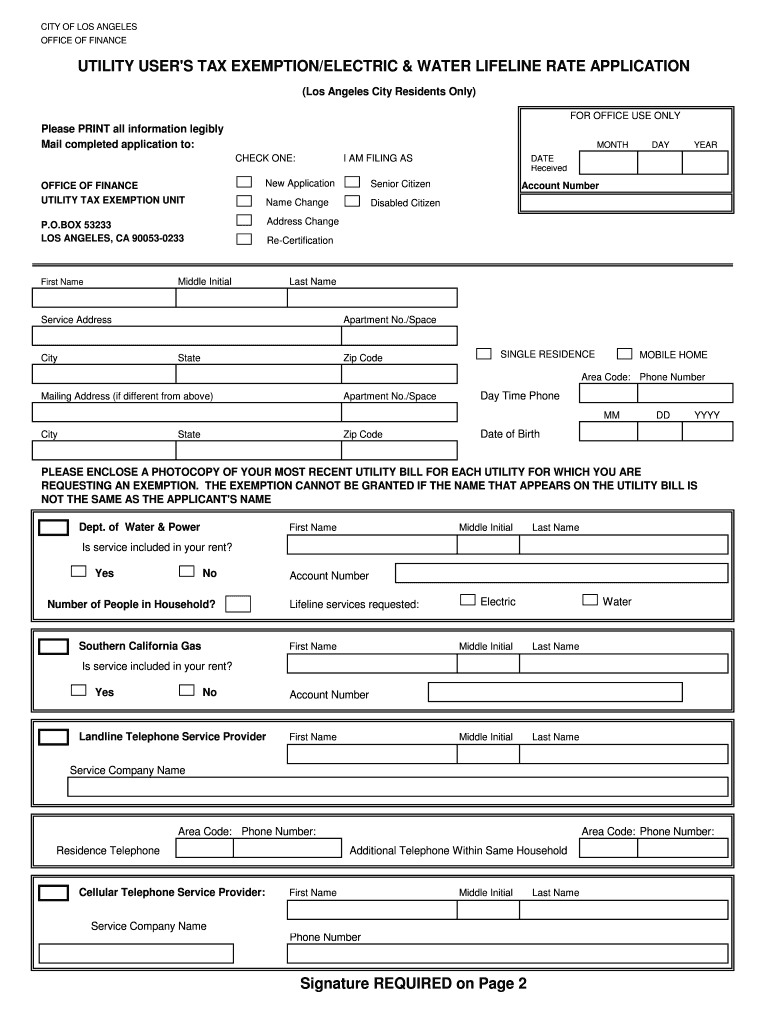

Completing the Utility Users Tax exemption application involves several steps to ensure accurate submission. Here is a general outline of the process:

- Gather necessary documentation, including proof of residency and income statements.

- Obtain the appropriate application form, which may be available online or at local government offices.

- Fill out the application form carefully, ensuring all information is accurate and complete.

- Submit the application via the designated method, which may include online submission, mail, or in-person delivery.

- Keep a copy of the submitted application for your records.

Following these steps can help ensure a smooth application process and timely approval.

Required Documents

When applying for the Utility Users Tax exemption, several documents may be required to support your application. Commonly required documents include:

- Proof of residency, such as a utility bill or lease agreement.

- Income verification documents, like pay stubs or tax returns.

- Completed application form, which may include a declaration of eligibility.

It is advisable to check with local authorities for any additional documentation that may be necessary for your specific situation.

Form Submission Methods

The Utility Users Tax exemption application can typically be submitted through various methods, allowing flexibility for applicants. Common submission methods include:

- Online submission through the local government’s official website.

- Mailing the completed application to the designated office.

- In-person submission at local government offices or designated locations.

Choosing the most convenient submission method can help expedite the processing of your application.

Legal Use of the Utility Users Tax

Understanding the legal framework surrounding the Utility Users Tax is essential for compliance. The UUT must be implemented according to local laws, and any exemptions must align with established regulations. Residents and businesses are encouraged to familiarize themselves with these laws to avoid penalties. Additionally, maintaining accurate records of utility usage and tax payments can help ensure compliance and support any claims for exemption.

Quick guide on how to complete agreement between the city of los angeles muniservices llc

Easily Prepare Utility Users Tax on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Utility Users Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Utility Users Tax Effortlessly

- Find Utility Users Tax and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Edit and eSign Utility Users Tax and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the agreement between the city of los angeles muniservices llc

How to create an eSignature for your Agreement Between The City Of Los Angeles Muniservices Llc online

How to generate an eSignature for the Agreement Between The City Of Los Angeles Muniservices Llc in Google Chrome

How to create an eSignature for signing the Agreement Between The City Of Los Angeles Muniservices Llc in Gmail

How to create an electronic signature for the Agreement Between The City Of Los Angeles Muniservices Llc straight from your smartphone

How to create an electronic signature for the Agreement Between The City Of Los Angeles Muniservices Llc on iOS

How to make an eSignature for the Agreement Between The City Of Los Angeles Muniservices Llc on Android devices

People also ask

-

What is the angeles exemption electric download feature in airSlate SignNow?

The angeles exemption electric download feature allows users to easily manage and download documents related to electric exemption forms. This feature streamlines the process, making it more efficient for businesses to handle their compliance documentation.

-

How does airSlate SignNow help with the angeles exemption electric download process?

airSlate SignNow simplifies the angeles exemption electric download process by offering a user-friendly interface that enables seamless document signing and management. Users can quickly upload, send, and sign documents, reducing the time spent on paperwork.

-

Is there a cost associated with using the angeles exemption electric download feature?

airSlate SignNow offers flexible pricing plans that include access to the angeles exemption electric download feature. You can choose a plan that best fits your business needs, ensuring you get the most value out of our services.

-

What benefits does airSlate SignNow provide for managing the angeles exemption electric download?

Using airSlate SignNow for the angeles exemption electric download helps enhance productivity by automating the document signing process. It also increases security, as all documents are stored safely and can be accessed anytime, ensuring compliance with regulatory requirements.

-

Can I integrate airSlate SignNow with other software for my angeles exemption electric download needs?

Yes, airSlate SignNow supports various integrations with popular software, making it easy to incorporate the angeles exemption electric download feature into your existing workflow. This flexibility allows for better data management and improved collaboration across your teams.

-

How secure is the angeles exemption electric download process in airSlate SignNow?

The angeles exemption electric download process in airSlate SignNow is highly secure, with advanced encryption protocols in place. We prioritize your data protection, ensuring that all documents are transmitted safely and remain confidential.

-

What types of businesses can benefit from the angeles exemption electric download feature?

Any business that requires handling electric exemption forms can benefit from the angeles exemption electric download feature in airSlate SignNow. Whether you are a small business or a large corporation, our solutions are designed to meet various industry needs.

Get more for Utility Users Tax

- Fillable online form it 607 claim for excelsior jobs

- Sale of business contract template form

- Sale of business wa contract template form

- Sale of goods contract template form

- Sale of car contract template form

- Sale of home contract template form

- Sale of house contract template form

- Sale of land contract template form

Find out other Utility Users Tax

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free