Form Withholding

What is the Form Withholding

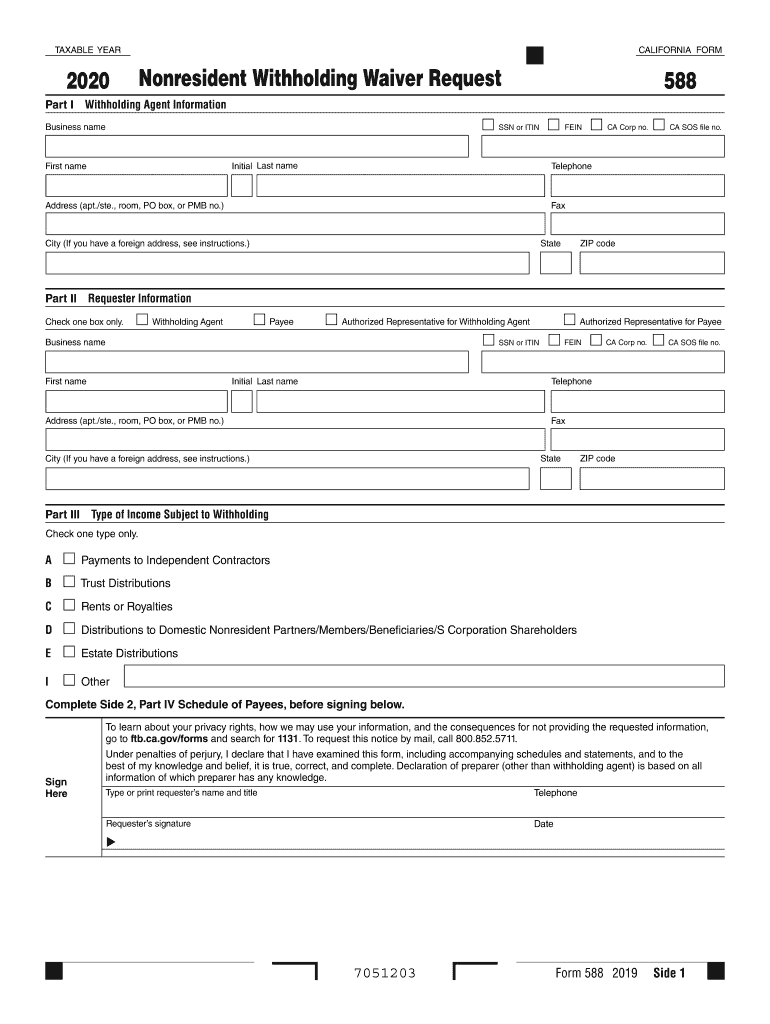

The 2020 California FTB form, commonly referred to as the 2020 form 588, is a crucial document used for withholding tax purposes. This form is specifically designed for non-residents and part-year residents of California who earn income within the state. It allows individuals to claim a waiver of withholding on certain types of income, ensuring that the correct amount of tax is withheld based on their residency status and applicable tax treaties.

How to use the Form Withholding

To effectively use the 2020 California FTB form, individuals must first determine their eligibility for the withholding waiver. This involves reviewing the type of income earned and any relevant tax treaties that may apply. Once eligibility is established, the form must be accurately completed, providing necessary details such as personal identification information and the specific income types for which the waiver is requested. After completion, the form should be submitted to the appropriate withholding agent or employer to ensure correct processing.

Steps to complete the Form Withholding

Completing the 2020 California FTB form involves several key steps:

- Gather necessary personal information, including your Social Security number or Individual Taxpayer Identification Number.

- Identify the income types that qualify for the withholding waiver, such as wages, dividends, or rental income.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your employer or the relevant withholding agent.

Legal use of the Form Withholding

The legal use of the 2020 California FTB form is governed by state tax laws and regulations. To be considered valid, the form must be filled out completely and accurately, reflecting the individual's true residency status and income types. Additionally, it must comply with the requirements set forth by the California Franchise Tax Board (FTB) to ensure that the waiver of withholding is recognized and honored by the withholding agent.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 California FTB form are critical to ensure compliance and avoid penalties. Generally, the form should be submitted to the withholding agent before the first payment is made for the income type being claimed. Specific deadlines may vary based on individual circumstances, such as the type of income or the taxpayer's residency status. It is advisable to check the California FTB website or consult a tax professional for the most current deadlines.

Form Submission Methods (Online / Mail / In-Person)

The 2020 California FTB form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the withholding agent. Options include:

- Online submission via the California FTB’s electronic filing system, if available.

- Mailing a printed copy of the completed form directly to the withholding agent or employer.

- In-person submission at designated locations, if applicable.

Penalties for Non-Compliance

Failure to properly complete and submit the 2020 California FTB form can result in penalties. These may include increased withholding amounts, fines, or additional taxes owed. It is essential for individuals to understand their obligations and ensure timely and accurate filing to avoid potential financial repercussions.

Quick guide on how to complete fillable online 2014 municipal data sheet riverton new

Prepare Form Withholding effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly. Manage Form Withholding on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered workflow today.

The easiest way to modify and eSign Form Withholding without hassle

- Find Form Withholding and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form Withholding and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online 2014 municipal data sheet riverton new

How to create an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New in the online mode

How to generate an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New in Chrome

How to generate an eSignature for putting it on the Fillable Online 2014 Municipal Data Sheet Riverton New in Gmail

How to generate an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New from your smart phone

How to make an eSignature for the Fillable Online 2014 Municipal Data Sheet Riverton New on iOS

How to create an eSignature for the Fillable Online 2014 Municipal Data Sheet Riverton New on Android OS

People also ask

-

What is the significance of the 2020 California FTB tax filing?

The 2020 California FTB tax filing is crucial for California residents as it affects your tax obligations and potential refunds. By understanding the specific requirements related to the 2020 California FTB, you can ensure that you submit accurate and timely documents, optimizing your financial outcomes.

-

How does airSlate SignNow assist with the 2020 California FTB documentation process?

airSlate SignNow streamlines the document signing process, making it easier to handle the 2020 California FTB forms. Users can send, sign, and securely store their tax documents all in one place, simplifying compliance and reducing the chances of errors.

-

What are the pricing options for airSlate SignNow related to handling 2020 California FTB documents?

airSlate SignNow offers various pricing plans catering to diverse business needs, including features specifically for managing 2020 California FTB documents. By choosing the right plan, you can benefit from cost-effective solutions tailored to your tax documentation requirements.

-

Can airSlate SignNow integrate with other tools for the 2020 California FTB tax process?

Yes, airSlate SignNow provides seamless integrations with popular accounting and financial software, enhancing your workflow when dealing with the 2020 California FTB documents. This interoperability helps ensure consistent data flow and reduces manual entry errors.

-

What features does airSlate SignNow offer for securely signing 2020 California FTB documents?

airSlate SignNow includes robust security features such as encryption and secure cloud storage for signing 2020 California FTB documents. These measures ensure that your sensitive tax information is protected while maintaining compliance with legal standards.

-

How can I track the status of my 2020 California FTB forms within airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 2020 California FTB forms in real-time. The platform provides notifications and status updates, giving you peace of mind by keeping you informed throughout the signing process.

-

Does airSlate SignNow provide templates for the 2020 California FTB forms?

Yes, airSlate SignNow offers customizable templates specifically designed for the 2020 California FTB forms. These templates allow you to fill out necessary information quickly and accurately, saving time and reducing stress during tax season.

Get more for Form Withholding

- Valet parking services agreement form

- Commonwealth of massachusetts affiliation notice mass form

- Commonwealth of massachusetts affiliation notice mass gov form

- State of alabama unified judicial system 5482933 form

- Retainer for graphic designer contract template form

- Retreat contract template form

- Return puppy to breeder contract template form

- Revenue share contract template form

Find out other Form Withholding

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament