Form Withholding

What is the Form Withholding

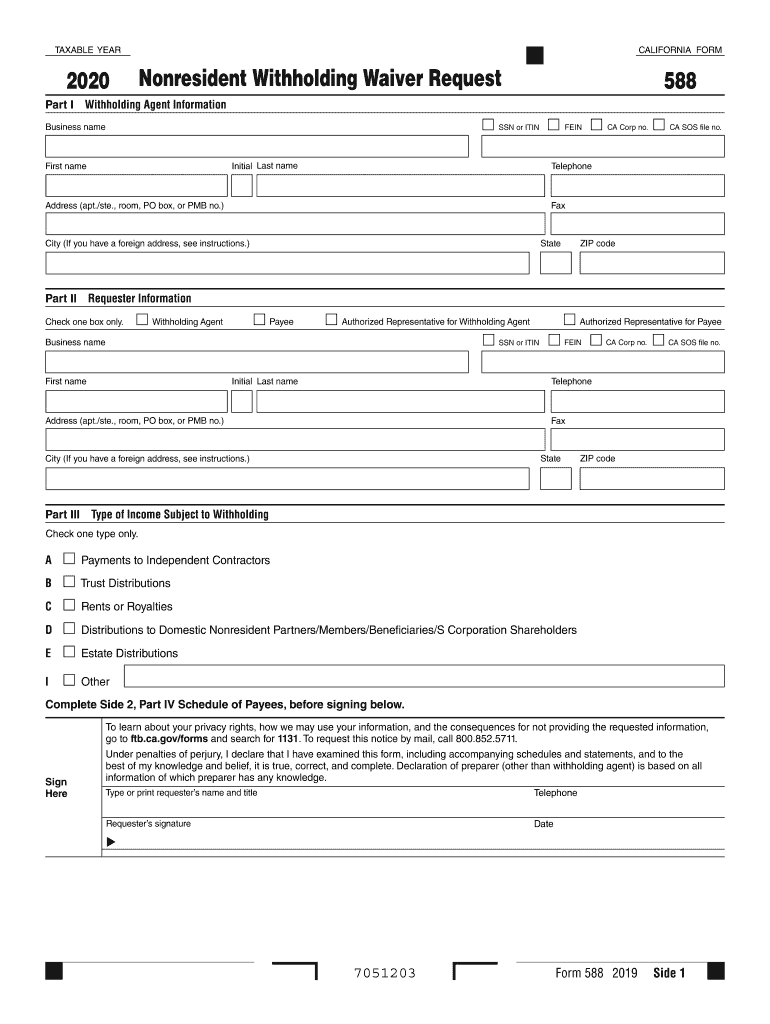

The 2020 California FTB form, commonly referred to as the 2020 form 588, is a crucial document used for withholding tax purposes. This form is specifically designed for non-residents and part-year residents of California who earn income within the state. It allows individuals to claim a waiver of withholding on certain types of income, ensuring that the correct amount of tax is withheld based on their residency status and applicable tax treaties.

How to use the Form Withholding

To effectively use the 2020 California FTB form, individuals must first determine their eligibility for the withholding waiver. This involves reviewing the type of income earned and any relevant tax treaties that may apply. Once eligibility is established, the form must be accurately completed, providing necessary details such as personal identification information and the specific income types for which the waiver is requested. After completion, the form should be submitted to the appropriate withholding agent or employer to ensure correct processing.

Steps to complete the Form Withholding

Completing the 2020 California FTB form involves several key steps:

- Gather necessary personal information, including your Social Security number or Individual Taxpayer Identification Number.

- Identify the income types that qualify for the withholding waiver, such as wages, dividends, or rental income.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your employer or the relevant withholding agent.

Legal use of the Form Withholding

The legal use of the 2020 California FTB form is governed by state tax laws and regulations. To be considered valid, the form must be filled out completely and accurately, reflecting the individual's true residency status and income types. Additionally, it must comply with the requirements set forth by the California Franchise Tax Board (FTB) to ensure that the waiver of withholding is recognized and honored by the withholding agent.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 California FTB form are critical to ensure compliance and avoid penalties. Generally, the form should be submitted to the withholding agent before the first payment is made for the income type being claimed. Specific deadlines may vary based on individual circumstances, such as the type of income or the taxpayer's residency status. It is advisable to check the California FTB website or consult a tax professional for the most current deadlines.

Form Submission Methods (Online / Mail / In-Person)

The 2020 California FTB form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the withholding agent. Options include:

- Online submission via the California FTB’s electronic filing system, if available.

- Mailing a printed copy of the completed form directly to the withholding agent or employer.

- In-person submission at designated locations, if applicable.

Penalties for Non-Compliance

Failure to properly complete and submit the 2020 California FTB form can result in penalties. These may include increased withholding amounts, fines, or additional taxes owed. It is essential for individuals to understand their obligations and ensure timely and accurate filing to avoid potential financial repercussions.

Quick guide on how to complete fillable online 2014 municipal data sheet riverton new

Prepare Form Withholding effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly. Manage Form Withholding on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered workflow today.

The easiest way to modify and eSign Form Withholding without hassle

- Find Form Withholding and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form Withholding and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online 2014 municipal data sheet riverton new

How to create an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New in the online mode

How to generate an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New in Chrome

How to generate an eSignature for putting it on the Fillable Online 2014 Municipal Data Sheet Riverton New in Gmail

How to generate an electronic signature for the Fillable Online 2014 Municipal Data Sheet Riverton New from your smart phone

How to make an eSignature for the Fillable Online 2014 Municipal Data Sheet Riverton New on iOS

How to create an eSignature for the Fillable Online 2014 Municipal Data Sheet Riverton New on Android OS

People also ask

-

What is Form Withholding in airSlate SignNow?

Form Withholding in airSlate SignNow refers to the process by which businesses can manage and automate the withholding of certain forms during document signing. This feature allows users to ensure compliance and proper documentation is maintained while streamlining the eSigning process. With airSlate SignNow, you can easily customize forms to suit your withholding needs.

-

How does airSlate SignNow handle Form Withholding?

airSlate SignNow simplifies Form Withholding by providing intuitive tools that allow you to create, send, and manage forms requiring withholding automatically. Users can set conditions for when withholding should occur, ensuring that all necessary forms are completed correctly before finalizing signatures. This automation helps reduce errors and enhances compliance.

-

What pricing plans does airSlate SignNow offer for Form Withholding features?

airSlate SignNow offers several pricing plans tailored to different business needs, which include capabilities for Form Withholding. Each plan provides access to essential features, including eSignature, document management, and form customization. You can choose a plan that best fits your budget and the scale of your Form Withholding requirements.

-

Can I integrate airSlate SignNow with other software for Form Withholding?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your Form Withholding process. Popular integrations include CRM systems, project management tools, and cloud storage services, allowing you to streamline your workflow. This connectivity ensures that your Form Withholding processes are efficient and effective.

-

What are the benefits of using airSlate SignNow for Form Withholding?

Using airSlate SignNow for Form Withholding provides numerous benefits, including reduced paperwork and faster turnaround times. The platform’s user-friendly interface allows for easy customization of forms, ensuring that all required withholding is handled accurately. Additionally, the automated reminders and notifications help keep your team on track.

-

Is airSlate SignNow secure for managing Form Withholding documents?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption to protect all documents, including those related to Form Withholding. The platform also complies with various regulations, ensuring that your data remains confidential and secure throughout the signing process.

-

How can I get support for using Form Withholding features in airSlate SignNow?

airSlate SignNow provides comprehensive support for users managing Form Withholding. You can access a variety of resources, including tutorials, FAQs, and a dedicated customer support team ready to assist you with any inquiries. This ensures that you can effectively utilize all features related to Form Withholding.

Get more for Form Withholding

- Valet parking services agreement form

- Commonwealth of massachusetts affiliation notice mass form

- Commonwealth of massachusetts affiliation notice mass gov form

- State of alabama unified judicial system 5482933 form

- Retainer for graphic designer contract template form

- Retreat contract template form

- Return puppy to breeder contract template form

- Revenue share contract template form

Find out other Form Withholding

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document