Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

What is the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

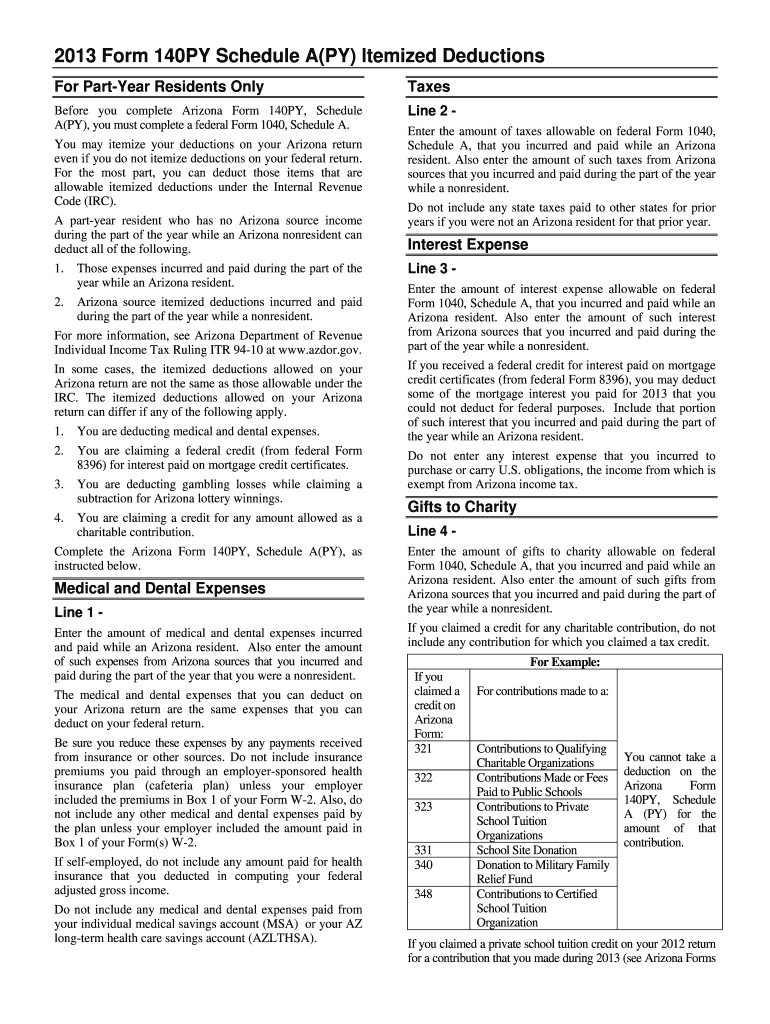

The Form 140PY Schedule APY is a tax document specifically designed for Arizona residents who wish to itemize their deductions when filing their state income tax returns. This form allows taxpayers to report various deductible expenses, such as medical expenses, mortgage interest, and charitable contributions. By using this form, taxpayers can potentially reduce their taxable income, leading to a lower overall tax liability.

How to use the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

To effectively use the Form 140PY Schedule APY, taxpayers should first gather all relevant documentation related to their itemized deductions. This includes receipts, statements, and any other proof of expenses incurred throughout the tax year. Once all necessary information is collected, taxpayers can fill out the form by entering their deductible expenses in the appropriate sections. It is crucial to ensure accuracy to avoid any issues with the Arizona Department of Revenue.

Steps to complete the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

Completing the Form 140PY Schedule APY involves several key steps:

- Gather all documentation related to itemized deductions.

- Fill in personal information, including name, address, and Social Security number.

- List all itemized deductions in the designated sections, ensuring accuracy and completeness.

- Calculate the total amount of itemized deductions.

- Transfer the total to your Arizona tax return.

Key elements of the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

Key elements of the Form 140PY Schedule APY include sections for various types of deductions. These typically encompass:

- Medical and dental expenses

- State and local taxes paid

- Mortgage interest

- Charitable contributions

- Casualty and theft losses

Each section requires specific details, such as amounts and dates, to ensure proper reporting.

State-specific rules for the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

Arizona has unique rules regarding itemized deductions that differ from federal regulations. For instance, certain expenses that are deductible at the federal level may not be allowed in Arizona. Taxpayers should be aware of the state-specific limits and requirements for each category of deduction. Additionally, Arizona may have specific forms or schedules that need to be filed alongside the 140PY Schedule APY.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of important deadlines when submitting the Form 140PY Schedule APY. Typically, the filing deadline aligns with the federal tax deadline, which is usually April 15. However, it is advisable to confirm any changes or extensions that may apply for the current tax year. Filing on time helps avoid penalties and ensures compliance with state tax laws.

Quick guide on how to complete form 140py schedule apy itemized deductions arizona taxhow

Complete [SKS] effortlessly on any platform

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any system using airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you prefer to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 140py schedule apy itemized deductions arizona taxhow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow?

The Form 140PY Schedule APY Itemized Deductions Arizona Taxhow is a tax form used by Arizona residents to report itemized deductions on their state tax returns. This form allows taxpayers to detail their eligible deductions, which can help reduce their taxable income. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow?

airSlate SignNow provides a seamless platform for electronically signing and sending the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow. With our user-friendly interface, you can easily manage your tax documents and ensure they are securely signed and submitted on time. This streamlines the tax filing process, making it more efficient.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Our plans are designed to be cost-effective, ensuring you get the best value for managing documents like the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow. These features enhance productivity and ensure compliance with tax regulations. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow compliant with tax regulations for Arizona?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow. Our platform ensures that your documents are securely handled and that you meet all legal requirements when filing your taxes. This compliance helps protect your business and personal information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easier to manage the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow alongside your other financial documents. This integration streamlines your workflow and enhances efficiency, allowing you to focus on your tax strategy rather than document management.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the Form 140PY Schedule APY Itemized Deductions Arizona Taxhow, provides numerous benefits such as increased efficiency, enhanced security, and reduced paper usage. Our platform simplifies the signing process, allowing you to complete your tax filings quickly and securely. This not only saves time but also minimizes the risk of errors.

Get more for Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

Find out other Form 140PY Schedule APY Itemized Deductions Arizona Taxhow

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free