Iowa 706 Form

What is the Iowa 706

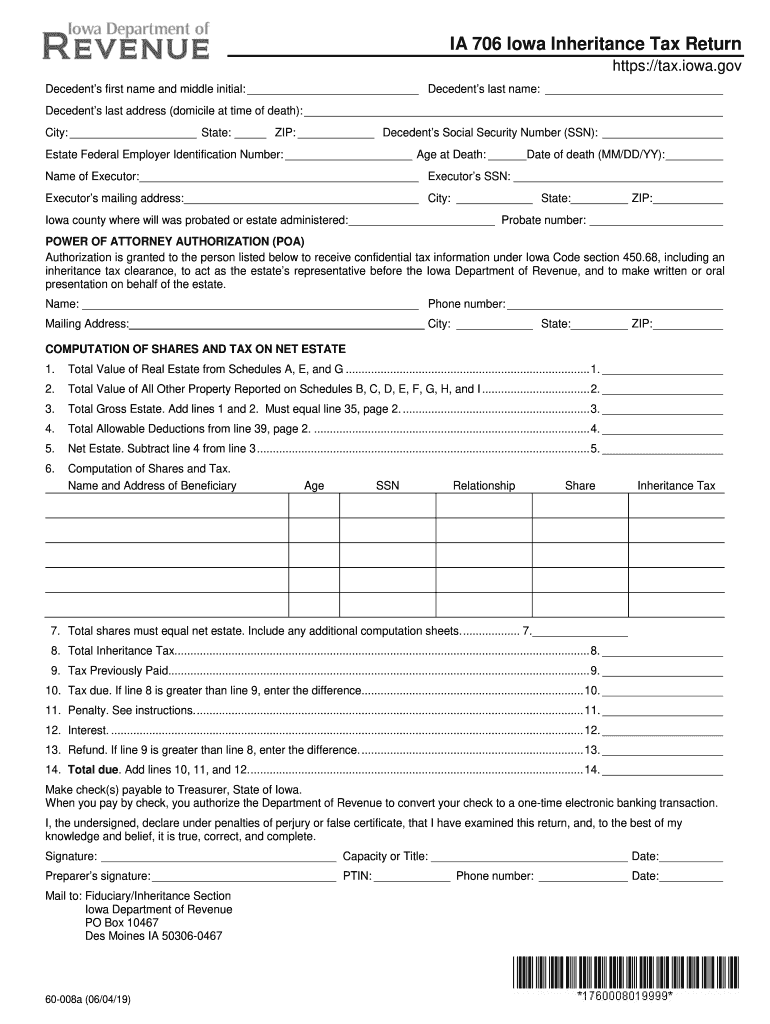

The Iowa 706 form is a state-specific inheritance tax return that must be filed when a person passes away and leaves behind an estate. This form is essential for reporting the value of the estate and determining the amount of inheritance tax owed to the state of Iowa. It is crucial for executors or administrators of estates to understand the requirements and implications of this form, as it plays a significant role in the estate settlement process.

How to use the Iowa 706

Using the Iowa 706 involves several steps to ensure accurate completion and compliance with state laws. First, gather all necessary documentation related to the deceased's assets, liabilities, and beneficiaries. Next, complete the form by providing detailed information about the estate's value and the distribution of assets. After filling out the form, it is important to review it for accuracy before submission. Finally, the completed Iowa 706 must be filed with the appropriate state authorities, along with any required payments for the inheritance tax.

Steps to complete the Iowa 706

Completing the Iowa 706 requires a systematic approach:

- Gather all necessary documents, including the will, asset valuations, and beneficiary information.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total value of the estate and determine the applicable inheritance tax based on Iowa's tax rates.

- Review the completed form for any errors or omissions.

- Submit the form to the Iowa Department of Revenue, along with any payment due.

Legal use of the Iowa 706

The Iowa 706 form is legally binding and must be filled out in accordance with Iowa state laws. It serves as an official record of the estate's value and the taxes owed, which can be scrutinized by tax authorities. Proper completion and submission of this form are essential to avoid penalties and ensure compliance with inheritance tax regulations. Executors should be aware of the legal implications of inaccuracies or omissions in the form.

Required Documents

When preparing to file the Iowa 706, several documents are necessary to support the information provided in the form. These typically include:

- The deceased's will or trust documents.

- Death certificate.

- Asset valuations, such as appraisals for real estate and personal property.

- Documentation of any debts or liabilities owed by the estate.

- Information on beneficiaries and their relationship to the deceased.

Filing Deadlines / Important Dates

Filing the Iowa 706 is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the form must be filed within nine months of the date of death. If additional time is needed, executors may request an extension, but this must be done before the original deadline. It is important to keep track of these deadlines to ensure compliance and avoid unnecessary complications.

Quick guide on how to complete decedents first name and middle initial decedents last name

Prepare Iowa 706 effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to draft, adjust, and eSign your documents promptly without delays. Handle Iowa 706 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Iowa 706 with ease

- Locate Iowa 706 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Iowa 706 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the decedents first name and middle initial decedents last name

How to create an eSignature for your Decedents First Name And Middle Initial Decedents Last Name online

How to generate an electronic signature for your Decedents First Name And Middle Initial Decedents Last Name in Google Chrome

How to generate an electronic signature for putting it on the Decedents First Name And Middle Initial Decedents Last Name in Gmail

How to generate an eSignature for the Decedents First Name And Middle Initial Decedents Last Name from your smartphone

How to generate an electronic signature for the Decedents First Name And Middle Initial Decedents Last Name on iOS

How to make an eSignature for the Decedents First Name And Middle Initial Decedents Last Name on Android devices

People also ask

-

What is the form document a305 1986 fillable?

The form document a305 1986 fillable is a standardized form used for construction project documentation. It allows users to fill out necessary details electronically, streamlining the submission process. Using airSlate SignNow, you can easily create and manage this fillable form.

-

How can I create a form document a305 1986 fillable with airSlate SignNow?

Creating a form document a305 1986 fillable with airSlate SignNow is simple. Just upload your document, use our editing tools to set it as fillable, and share it with your team or clients for quick completion. The platform's intuitive interface makes it easy to set up.

-

Is there a cost for using the form document a305 1986 fillable features?

airSlate SignNow offers various pricing plans that include features for creating and managing form document a305 1986 fillable options. You can choose a plan that best suits your business needs. There is also a free trial available for new users to explore these features.

-

What are the benefits of using the form document a305 1986 fillable?

Using the form document a305 1986 fillable enhances efficiency in collecting and processing construction-related data. It reduces paperwork and minimizes errors through electronic completion. Additionally, having a digital copy ensures better organization and easy access to necessary information.

-

Can I integrate the form document a305 1986 fillable with other tools?

Yes, airSlate SignNow allows seamless integration of the form document a305 1986 fillable with various tools and applications, such as CRMs and project management software. This ensures that your workflow remains uninterrupted and efficient, eliminating the need for data re-entry.

-

How secure is my data when using the form document a305 1986 fillable on airSlate SignNow?

When using the form document a305 1986 fillable on airSlate SignNow, your data is protected with industry-standard security measures, including encryption and secure access controls. Your information is safe, ensuring compliance with legal standards for document handling.

-

Is it easy to share the form document a305 1986 fillable with others?

Absolutely! Sharing the form document a305 1986 fillable is straightforward with airSlate SignNow. You can send the document via email or provide a shareable link, allowing multiple users to access and complete the form simultaneously or at their convenience.

Get more for Iowa 706

- Assembly committee on transportation leg state nv form

- Pre appointment information sheet

- Hog mileage program form

- Exigent circumstances for immediate action template form

- Cell transport review worksheet pdf form

- Co petition for dissolution of courts oregon form

- Stat dec vic for handwriting docx form

- Requirements contract template form

Find out other Iowa 706

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors