State of Hawaii Form N 342

What is the State Of Hawaii Form N 342

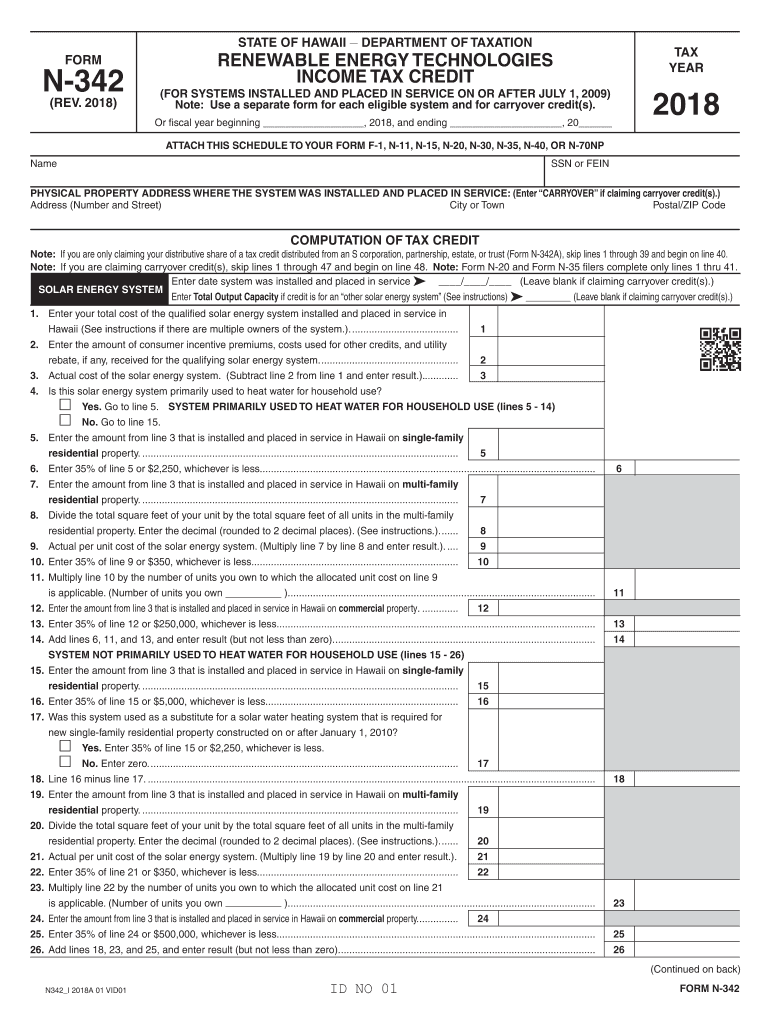

The State of Hawaii Form N 342 is a tax form used for claiming a tax credit for renewable energy technologies. This form is essential for individuals and businesses that have invested in renewable energy systems, allowing them to receive financial benefits through tax deductions. The form is specifically designed to facilitate the reporting of these investments to the state tax authority, ensuring compliance with Hawaii's tax regulations.

How to use the State Of Hawaii Form N 342

Using the State of Hawaii Form N 342 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation related to their renewable energy investments. Next, they should carefully fill out the form, providing details about the technology used, the costs incurred, and any relevant supporting information. Once completed, the form can be submitted alongside the taxpayer's annual state tax return, either electronically or via mail.

Steps to complete the State Of Hawaii Form N 342

Completing the State of Hawaii Form N 342 requires attention to detail. Follow these steps:

- Gather all relevant documents, including receipts and proof of installation for renewable energy systems.

- Fill out the taxpayer information section, ensuring accuracy in personal or business details.

- Provide information about the renewable energy technologies, including installation dates and costs.

- Calculate the eligible tax credit based on the guidelines provided in the form instructions.

- Review the completed form for any errors or omissions before submission.

Legal use of the State Of Hawaii Form N 342

The legal use of the State of Hawaii Form N 342 is governed by state tax laws that outline the eligibility criteria for claiming tax credits. It is crucial for taxpayers to ensure that they meet all requirements set forth by the Hawaii Department of Taxation. This includes providing accurate information and maintaining records of renewable energy investments, as failure to comply can result in penalties or denial of the credit.

Filing Deadlines / Important Dates

Filing deadlines for the State of Hawaii Form N 342 align with the general state income tax return deadlines. Typically, taxpayers must submit their forms by April 20 of the year following the tax year in which the renewable energy investment was made. It is essential to stay informed about any changes to deadlines or specific extensions that may apply to certain taxpayers.

Form Submission Methods (Online / Mail / In-Person)

The State of Hawaii Form N 342 can be submitted through various methods to accommodate different taxpayer preferences. Taxpayers may file the form online through the Hawaii Department of Taxation's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Quick guide on how to complete or fiscal year beginning 2018 and ending 20

Manage State Of Hawaii Form N 342 with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to easily access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, edit, and eSign your documents rapidly without any interruptions. Handle State Of Hawaii Form N 342 on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

Steps to modify and eSign State Of Hawaii Form N 342 effortlessly

- Locate State Of Hawaii Form N 342 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and eSign State Of Hawaii Form N 342 to ensure outstanding communication at every phase of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or fiscal year beginning 2018 and ending 20

How to make an eSignature for your Or Fiscal Year Beginning 2018 And Ending 20 in the online mode

How to generate an eSignature for the Or Fiscal Year Beginning 2018 And Ending 20 in Google Chrome

How to make an eSignature for putting it on the Or Fiscal Year Beginning 2018 And Ending 20 in Gmail

How to generate an eSignature for the Or Fiscal Year Beginning 2018 And Ending 20 from your mobile device

How to generate an electronic signature for the Or Fiscal Year Beginning 2018 And Ending 20 on iOS

How to generate an electronic signature for the Or Fiscal Year Beginning 2018 And Ending 20 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to n 342?

airSlate SignNow is a robust eSignature platform that allows businesses to send and eSign documents effortlessly. It enhances workflow efficiency and offers strong compliance measures, making it a fitting choice for organizations needing solutions like n 342.

-

How does airSlate SignNow support n 342 compliance?

airSlate SignNow provides features that help your business meet n 342 compliance requirements. The platform offers secure document storage and audit trails that ensure accountability and legal validity for all signed documents.

-

What are the pricing options for airSlate SignNow in relation to n 342?

airSlate SignNow offers several pricing plans tailored to fit companies of all sizes needing n 342 solutions. These plans are designed to provide maximum value while ensuring you have access to all essential features for your document signing needs.

-

What key features does airSlate SignNow provide for n 342 users?

Key features of airSlate SignNow for n 342 users include user-friendly eSignature tools, customizable templates, and advanced security measures. These functionalities simplify the document signing process while maintaining compliance with n 342.

-

Can I integrate airSlate SignNow with other software for n 342 compliance?

Yes, airSlate SignNow allows integration with various applications that can help you manage n 342 compliance workflows more effectively. You can connect it with CRM systems, cloud storage, and other business tools to streamline your document processes.

-

What benefits does airSlate SignNow offer for businesses focused on n 342?

airSlate SignNow enhances operational efficiency for businesses focused on n 342 by reducing turnaround time for document signing. Its intuitive interface makes it easy for users to adopt and helps organizations maintain compliance without hassle.

-

Is airSlate SignNow suitable for small businesses needing n 342 solutions?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses needing n 342 compliance. With its scalable plans, even the smallest enterprises can benefit from professional eSignature capabilities.

Get more for State Of Hawaii Form N 342

- The nanny tax must be paid for nannies and other form

- How work affects your benefits form

- F 5000 24 pre printed excise tax return dot ttb form

- Renovations contract template form

- Rent a car contract template form

- Rent a chair contract template form

- Rent a house contract template form

- Rent a room contract template form

Find out other State Of Hawaii Form N 342

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document