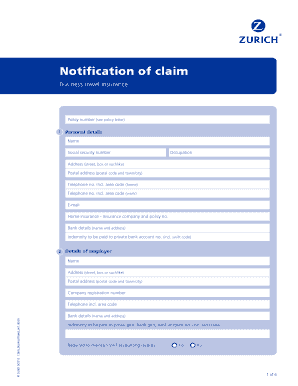

Business Travel Insurance Form

Understanding Business Travel Insurance

Business travel insurance is designed to protect employees and employers from financial losses associated with business trips. This type of insurance typically covers unexpected events such as trip cancellations, medical emergencies, lost luggage, and other travel-related incidents. It is essential for companies to consider this insurance to ensure that their employees are safeguarded while traveling for work purposes.

How to Obtain Business Travel Insurance

Obtaining business travel insurance involves several steps. First, businesses should assess their travel needs and the level of coverage required. Next, they can research various insurance providers to compare policies, coverage limits, and premiums. After selecting a suitable policy, businesses will need to fill out an application, providing necessary details about the trip, such as destinations, duration, and the number of travelers. Finally, payment can be made to activate the policy, ensuring coverage is in place before the trip begins.

Key Elements of Business Travel Insurance

Several key elements define business travel insurance. These typically include:

- Trip Cancellation Coverage: Reimburses non-refundable expenses if a trip is canceled due to unforeseen circumstances.

- Medical Coverage: Provides financial assistance for medical emergencies that may occur during travel.

- Emergency Evacuation: Covers the costs associated with transporting an injured or ill traveler to the nearest medical facility.

- Lost or Delayed Baggage: Offers compensation for lost, stolen, or delayed luggage, ensuring travelers have access to essential items.

Steps to Complete the Business Travel Insurance Application

Completing the application for business travel insurance is a straightforward process. Begin by gathering all necessary information, including travel dates, destinations, and the number of travelers. Fill out the application form accurately, ensuring that all details are correct to avoid issues with claims later. Review the policy terms and conditions before submission. Finally, submit the application along with any required payment to finalize the insurance coverage.

Legal Considerations for Business Travel Insurance

Understanding the legal implications of business travel insurance is crucial for compliance and protection. Companies should ensure that their policies meet state regulations and federal requirements. It is also important to review the terms of coverage to understand exclusions and limitations, as well as the process for filing claims. By being aware of these legal aspects, businesses can better protect themselves and their employees during travel.

Eligibility Criteria for Business Travel Insurance

Eligibility for business travel insurance typically depends on several factors, including the nature of the trip, the number of employees traveling, and the duration of the travel. Most insurers require that the trip be for business purposes, and some may have specific requirements regarding the destinations covered. Businesses should review the eligibility criteria of different policies to ensure they select the right coverage for their needs.

Examples of Business Travel Insurance Usage

Business travel insurance can be beneficial in various scenarios. For instance, if an employee's flight is canceled due to severe weather, the insurance can cover the costs of rebooking. In another case, if a traveler falls ill while on a business trip, the medical coverage can provide necessary treatment without financial strain. These examples highlight the importance of having adequate coverage to mitigate risks associated with business travel.

Quick guide on how to complete business travel insurance

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents quickly and without delays. Handle [SKS] on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Travel Insurance

Create this form in 5 minutes!

How to create an eSignature for the business travel insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Business Travel Insurance and why do I need it?

Business Travel Insurance is a specialized coverage designed to protect employees while traveling for work. It provides financial protection against unforeseen events such as trip cancellations, medical emergencies, or lost luggage. Opting for Business Travel Insurance ensures that your employees can focus on their tasks without worrying about potential travel-related issues.

-

How much does Business Travel Insurance cost?

The cost of Business Travel Insurance varies depending on factors such as the destination, duration, and the number of travelers. Typically, pricing is calculated per trip or on an annual basis. It's important to compare different plans to find the most cost-effective solution that meets your business needs.

-

What features should I look for in Business Travel Insurance?

When choosing Business Travel Insurance, look for essential features like medical coverage, trip cancellation protection, and coverage for lost belongings. Additional benefits like emergency assistance and coverage for travel delays can also enhance the value of your policy. Selecting a plan with comprehensive features ensures your employees are well-protected during their travels.

-

How does Business Travel Insurance benefit my company?

Investing in Business Travel Insurance offers signNow benefits including financial security, peace of mind for employees, and reduced corporate liability. It helps mitigate risks associated with business travel, ensuring that your workforce is covered in case of emergencies. This fosters a safer environment, promoting employee satisfaction and productivity.

-

Are there specific exclusions in Business Travel Insurance policies?

Yes, Business Travel Insurance policies often have exclusions that can vary by provider. Common exclusions include pre-existing medical conditions, high-risk activities, or travel to certain countries. It's crucial to read the policy details carefully to understand what is and isn't covered.

-

Can Business Travel Insurance cover remote work travels?

Yes, many Business Travel Insurance policies can extend coverage to remote work travels. This is particularly relevant for employees who travel while working from different locations. It's advisable to check with your insurance provider to ensure that your remote work activities are covered.

-

How can I integrate Business Travel Insurance with my existing travel management system?

Integrating Business Travel Insurance with your travel management system can streamline the booking and claims process. Many insurance providers offer APIs or partnerships that facilitate easy integration. This collaboration enhances efficiency and ensures that employees are always protected during their trips.

Get more for Business Travel Insurance

Find out other Business Travel Insurance

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form