F 5000 24 Pre Printed Excise Tax Return Dot Ttb 2012

What is the F 5000 24 Pre Printed Excise Tax Return

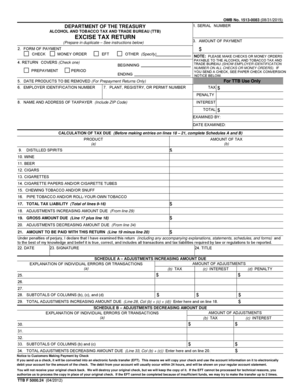

The F 5000 24 Pre Printed Excise Tax Return is a specific form used by businesses to report excise taxes to the Alcohol and Tobacco Tax and Trade Bureau (TTB) in the United States. This form is essential for entities involved in the manufacturing, importing, or distribution of alcohol and tobacco products. It helps ensure compliance with federal tax regulations and provides a structured way to report taxable activities and calculate the owed excise tax.

How to use the F 5000 24 Pre Printed Excise Tax Return

To use the F 5000 24 Pre Printed Excise Tax Return, businesses must first gather all relevant financial data concerning their excise tax liabilities. This includes sales figures, production quantities, and any applicable exemptions. Once the necessary information is compiled, it should be entered into the appropriate sections of the form. After completing the form, it must be reviewed for accuracy before submission to the TTB, ensuring that all required signatures and supporting documents are included.

Steps to complete the F 5000 24 Pre Printed Excise Tax Return

Completing the F 5000 24 Pre Printed Excise Tax Return involves several key steps:

- Gather financial records related to excise tax obligations.

- Fill out the form with accurate data, ensuring all sections are addressed.

- Calculate the total excise tax owed based on the reported figures.

- Review the completed form for errors or omissions.

- Sign the form and attach any necessary documentation.

- Submit the form to the TTB by the designated deadline.

Key elements of the F 5000 24 Pre Printed Excise Tax Return

The F 5000 24 Pre Printed Excise Tax Return includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Details of the products subject to excise tax, including quantities and values.

- Calculation of the total excise tax owed.

- Signature of the authorized representative of the business.

- Date of submission.

Legal use of the F 5000 24 Pre Printed Excise Tax Return

The F 5000 24 Pre Printed Excise Tax Return must be used in accordance with federal regulations governing excise taxes. Businesses are legally required to file this form if they engage in activities that incur excise tax liabilities. Failure to submit the form accurately and on time can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations and ensure compliance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the F 5000 24 Pre Printed Excise Tax Return vary based on the specific tax period being reported. Generally, businesses must submit the form on a monthly or quarterly basis, depending on their tax liability. It is essential to keep track of these deadlines to avoid late fees and maintain compliance with TTB regulations. Marking important dates on a calendar can help ensure timely submissions.

Create this form in 5 minutes or less

Find and fill out the correct f 5000 24 pre printed excise tax return dot ttb

Create this form in 5 minutes!

How to create an eSignature for the f 5000 24 pre printed excise tax return dot ttb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

The F 5000 24 Pre Printed Excise Tax Return dot Ttb is a specific form used for reporting excise taxes to the TTB. This form is essential for businesses involved in the production or distribution of alcohol, tobacco, and certain other products. Using this pre-printed form simplifies the filing process and ensures compliance with federal regulations.

-

How can airSlate SignNow help with the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the F 5000 24 Pre Printed Excise Tax Return dot Ttb. This streamlines the submission process, reduces paperwork, and enhances efficiency. With our solution, you can ensure that your forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide access to features specifically designed for handling forms like the F 5000 24 Pre Printed Excise Tax Return dot Ttb. Visit our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for managing the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

Our platform includes features such as customizable templates, secure e-signatures, and real-time tracking for the F 5000 24 Pre Printed Excise Tax Return dot Ttb. These tools help ensure that your documents are completed correctly and efficiently. Additionally, you can easily store and retrieve your forms for future reference.

-

Are there any benefits to using airSlate SignNow for the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

Using airSlate SignNow for the F 5000 24 Pre Printed Excise Tax Return dot Ttb offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. Our platform allows for quick document turnaround, which can save your business time and resources. Furthermore, the secure nature of our service ensures that your sensitive information is protected.

-

Can I integrate airSlate SignNow with other software for the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

Yes, airSlate SignNow offers integrations with various software applications to streamline your workflow for the F 5000 24 Pre Printed Excise Tax Return dot Ttb. This includes popular accounting and document management systems, allowing you to manage your forms seamlessly. Check our integrations page for a complete list of compatible applications.

-

Is it easy to use airSlate SignNow for the F 5000 24 Pre Printed Excise Tax Return dot Ttb?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage the F 5000 24 Pre Printed Excise Tax Return dot Ttb. Our intuitive interface guides you through the process of creating, signing, and sending documents without any technical expertise required. You'll be able to complete your tasks quickly and efficiently.

Get more for F 5000 24 Pre Printed Excise Tax Return dot Ttb

- Ar1000tc fileyourtaxes com form

- Fertilizer and pesticide authority application form

- City of mount dora tree removal permit ci mount dora fl form

- Texas affidavit of fact pdf form

- Minnesota dependent diabetic waiver form

- Microsoft word physical plant waiver form 2

- Trailer hire agreement template form

- Trailer purchase agreement template form

Find out other F 5000 24 Pre Printed Excise Tax Return dot Ttb

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online