Mississippi Sales Tax Form

What is the Mississippi Sales Tax Form

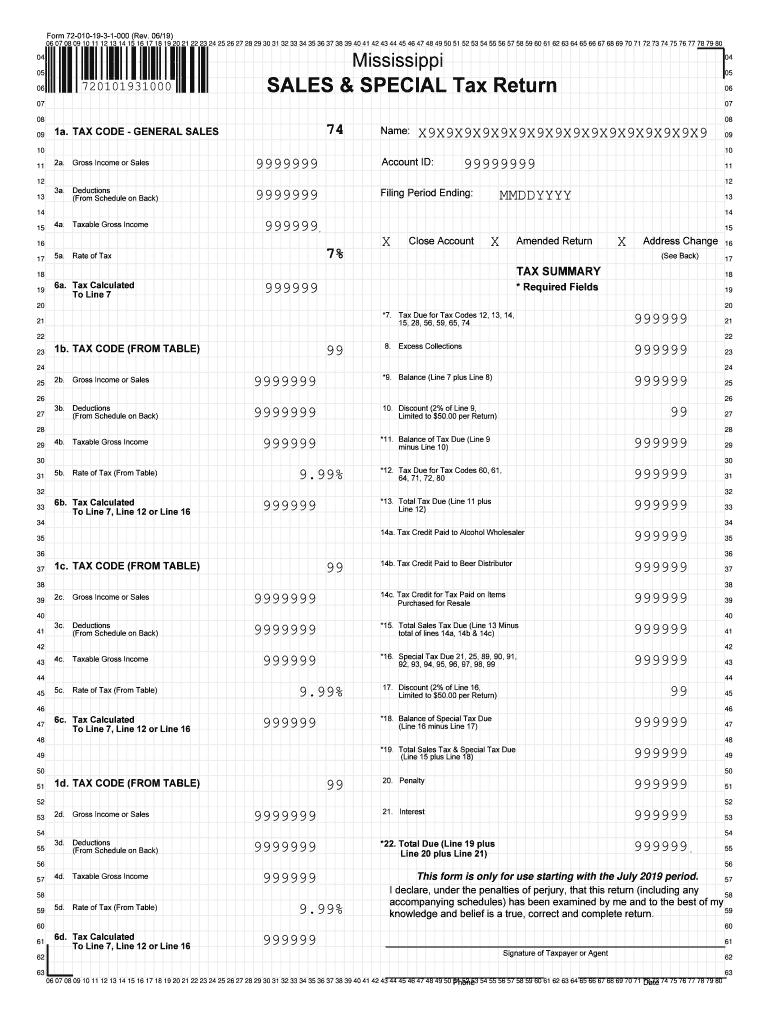

The Mississippi monthly sales tax reporting form is a crucial document for businesses operating within the state. It is used to report the sales tax collected on taxable sales and to remit the appropriate amount to the state. This form ensures that businesses comply with state tax laws and regulations. The form typically includes sections for reporting gross sales, exempt sales, and the total sales tax due. Understanding this form is essential for maintaining compliance and avoiding penalties.

Steps to Complete the Mississippi Sales Tax Form

Completing the Mississippi monthly sales tax reporting form involves several key steps:

- Gather Sales Records: Compile all sales data for the reporting period, including gross sales and any exempt sales.

- Calculate Taxable Sales: Determine the total amount of taxable sales by subtracting exempt sales from gross sales.

- Compute Sales Tax Due: Apply the appropriate state sales tax rate to the taxable sales amount to calculate the total sales tax owed.

- Fill Out the Form: Enter the calculated figures into the designated fields on the form, ensuring accuracy.

- Review and Submit: Double-check all entries for correctness before submitting the form online or via mail.

Legal Use of the Mississippi Sales Tax Form

The Mississippi monthly sales tax reporting form must be completed and submitted in accordance with state laws to ensure its legal validity. This includes adhering to deadlines for submission and accurately reporting all sales transactions. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their legal obligations when using this form.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the Mississippi monthly sales tax reporting form. Typically, the form is due on the 20th day of the month following the reporting period. For example, sales made in January must be reported by February 20. Missing these deadlines can lead to penalties and interest charges, making timely submission critical for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Mississippi monthly sales tax reporting form can be submitted through various methods. Businesses have the option to file online through the Mississippi Department of Revenue's website, which is often the most efficient method. Alternatively, forms can be mailed to the appropriate tax office or submitted in person. Each method has its own advantages, such as immediate confirmation of receipt for online submissions.

Key Elements of the Mississippi Sales Tax Form

Understanding the key elements of the Mississippi monthly sales tax reporting form is essential for accurate completion. The form typically includes:

- Business Information: Name, address, and tax identification number of the business.

- Sales Information: Sections for reporting gross sales, exempt sales, and taxable sales.

- Sales Tax Calculation: Fields to calculate the total sales tax due based on the taxable sales amount.

- Signature Line: A space for the authorized representative to sign and date the form, certifying its accuracy.

Who Issues the Form

The Mississippi monthly sales tax reporting form is issued by the Mississippi Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses. The department provides resources and guidance to help businesses understand their tax obligations and properly complete the form.

Quick guide on how to complete matthew lombardi statshockey referencecom

Complete Mississippi Sales Tax Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hindrance. Manage Mississippi Sales Tax Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign Mississippi Sales Tax Form effortlessly

- Find Mississippi Sales Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or errors that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Adapt and electronically sign Mississippi Sales Tax Form while ensuring effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the matthew lombardi statshockey referencecom

How to create an electronic signature for your Matthew Lombardi Statshockey Referencecom in the online mode

How to make an electronic signature for your Matthew Lombardi Statshockey Referencecom in Chrome

How to make an eSignature for signing the Matthew Lombardi Statshockey Referencecom in Gmail

How to make an eSignature for the Matthew Lombardi Statshockey Referencecom straight from your smartphone

How to create an electronic signature for the Matthew Lombardi Statshockey Referencecom on iOS devices

How to make an eSignature for the Matthew Lombardi Statshockey Referencecom on Android devices

People also ask

-

What is the Mississippi Sales Tax Form and how is it used?

The Mississippi Sales Tax Form is a document used by businesses to report and remit sales tax collected on taxable sales. This form must be filed regularly, ensuring compliance with state tax regulations. By using airSlate SignNow, you can easily eSign and submit your Mississippi Sales Tax Form, streamlining your tax processes.

-

How can airSlate SignNow help with my Mississippi Sales Tax Form submissions?

airSlate SignNow simplifies the process of completing and submitting your Mississippi Sales Tax Form by providing a user-friendly platform for eSigning documents. You can access templates, fill in required fields, and securely send your forms without hassle. This ensures timely submissions and helps avoid penalties for late filings.

-

Are there any costs associated with using airSlate SignNow for my Mississippi Sales Tax Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for unlimited document signing. The cost-effective solutions ensure that you can efficiently manage your Mississippi Sales Tax Form submissions without breaking your budget. Explore our pricing page to find the best plan for your business.

-

Can I integrate airSlate SignNow with other software to manage my Mississippi Sales Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, allowing you to manage your Mississippi Sales Tax Form alongside your financial records. This integration enhances efficiency by reducing manual data entry and ensuring all your tax documents are organized in one place.

-

What features does airSlate SignNow offer for handling the Mississippi Sales Tax Form?

airSlate SignNow includes features like customizable templates, secure eSigning, and automated reminders to help you manage your Mississippi Sales Tax Form effectively. These tools simplify the preparation and filing process, making it easier to stay compliant with state tax laws.

-

Is airSlate SignNow secure for submitting my Mississippi Sales Tax Form?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including your Mississippi Sales Tax Form, are protected with encryption and secure access controls. You can trust that your sensitive tax information will be handled safely and confidentially throughout the submission process.

-

How do I get started with airSlate SignNow for my Mississippi Sales Tax Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, explore our templates for the Mississippi Sales Tax Form, and begin filling them out. Our intuitive platform guides you through the eSigning process, making it simple to meet your tax obligations.

Get more for Mississippi Sales Tax Form

- Kentucky form 10a100

- Form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 702384259

- Poms gn 03905 015 form ssa 1694 request for

- Indiana state form 56520 fill out amp sign online

- Italian citizenship by marriage or civil union form

- Renewal of contract template form

- Renewal proposal contract template form

- Renewal reminder email contract template form

Find out other Mississippi Sales Tax Form

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile