Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of the Internal Revenue Code 2022

Understanding the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

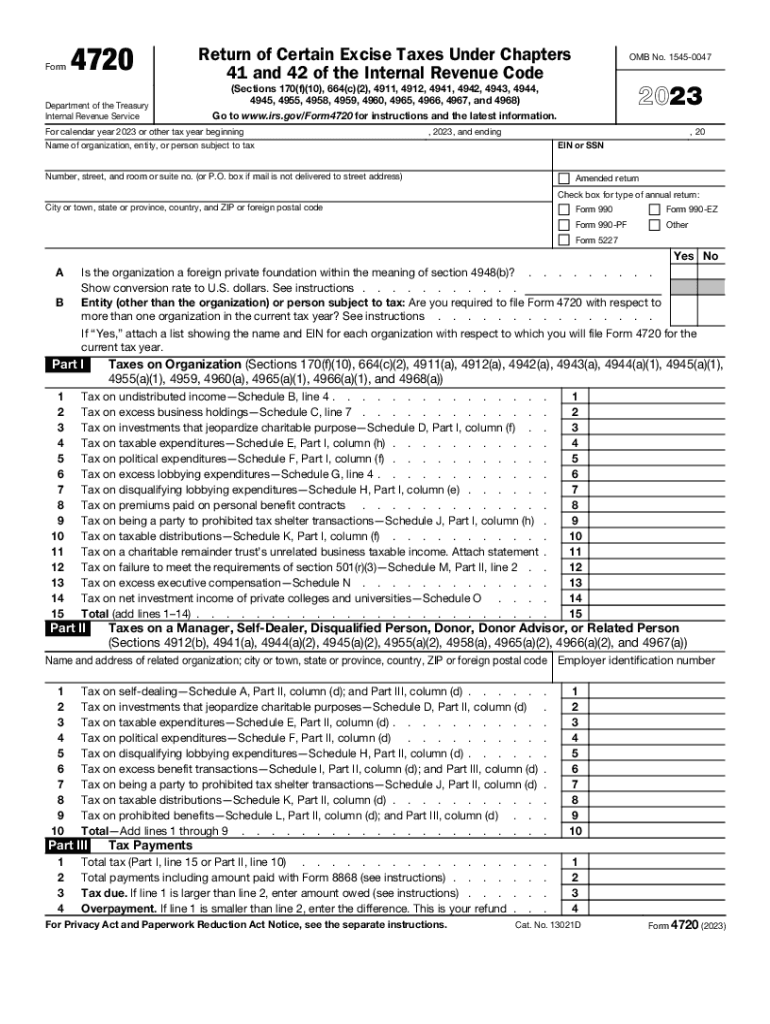

The Form 4720 is a crucial document for certain organizations that need to report excise taxes under Chapters 41 and 42 of the Internal Revenue Code. This form is primarily used by private foundations and other tax-exempt organizations to disclose specific excise taxes related to excess business holdings, self-dealing, and other activities that may incur tax liabilities. Understanding the purpose of this form is essential for compliance and to avoid penalties.

Steps to Complete the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

Completing the Form 4720 involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial information related to the organization’s activities that may trigger excise taxes. Next, carefully fill out the form, providing details on the specific excise taxes applicable. It is important to review the instructions provided by the IRS to ensure all sections are completed correctly. Finally, double-check the information for accuracy before submission.

Filing Deadlines for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

The filing deadlines for Form 4720 are critical to avoid penalties. Generally, the form must be filed by the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is advisable to mark these dates on your calendar and prepare the form in advance to ensure timely filing.

Required Documents for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

To complete the Form 4720, organizations must have several documents on hand. These include financial statements that detail income and expenditures, records of any transactions that may be subject to excise taxes, and previous tax filings. Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance with the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

Failure to file Form 4720 or inaccuracies in the form can lead to significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, organizations may face excise taxes on the specific activities that triggered the requirement to file. Understanding these potential penalties emphasizes the importance of timely and accurate submissions.

How to Obtain the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

The Form 4720 can be obtained directly from the IRS website. It is available for download in PDF format, allowing organizations to print and fill it out manually. Additionally, some tax preparation software may offer the option to complete this form digitally, streamlining the process for users. Organizations should ensure they are using the most current version of the form to comply with the latest IRS regulations.

Quick guide on how to complete form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 702384259

Manage Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code effortlessly on any device

Digital document administration has gained traction with organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary format and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without holdups. Handle Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code seamlessly

- Locate Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code, ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 702384259

Create this form in 5 minutes!

How to create an eSignature for the form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 702384259

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

The Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code is a tax form used by organizations to report certain excise taxes. This form is critical for non-profits and other entities that may be subject to these specific excise taxes. It ensures compliance with IRS regulations and helps avoid potential penalties.

-

How does airSlate SignNow support the completion of the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow simplifies the process of completing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code by providing an intuitive eSignature solution. Users can easily fill out the required fields, sign, and securely send documents without any hassle. The platform integrates essential tools to streamline tax documentation.

-

What are the pricing options for using airSlate SignNow for my tax documents?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. The cost-effective solution allows users to access essential features for handling the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code without breaking the bank. You can choose from monthly or annual subscription models based on your needs.

-

Are there any features specifically designed for tax professionals using the Form 4720?

Yes, airSlate SignNow offers features tailored for tax professionals managing documents like the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. These include advanced templates, automated workflows, and collaboration tools that enhance efficiency and accuracy, making it easier to meet deadlines.

-

Can airSlate SignNow integrate with my existing accounting software for tax filings?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, allowing seamless data transfer when completing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. This feature saves time and reduces errors by ensuring your information is consistent across platforms.

-

Is there a way to track the status of my Form 4720 Return submission?

Yes, airSlate SignNow provides tracking capabilities for documents sent for eSignature, including the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. Users receive notifications on the status of submissions, ensuring they are informed throughout the process and can follow up as needed.

-

What are the benefits of using airSlate SignNow for excise tax returns?

Using airSlate SignNow for excise tax returns, like the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code, offers signNow benefits. The platform provides a user-friendly interface to streamline the eSigning process, saves time by automating repetitive tasks, and enhances security through encryption, protecting sensitive tax information.

Get more for Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- Www pdffiller com22914883 fillable city ofget the city of tustin government claim for damages form

- Attorney for superior court of california county form

- In the united states district courtfor the eastern district form

- Affidavit for collection of personal property under form

- Please be advised these instructions only apply if your marriage record is on file with the form

- Uniform domestic relations form 14 judgment entry decree of divorce without children

- Child support affidavit 488698216 form

- Formscircuit court for baltimore city

Find out other Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed