Kentucky Form 10a100 2023-2026

What is the Kentucky Form 10a100

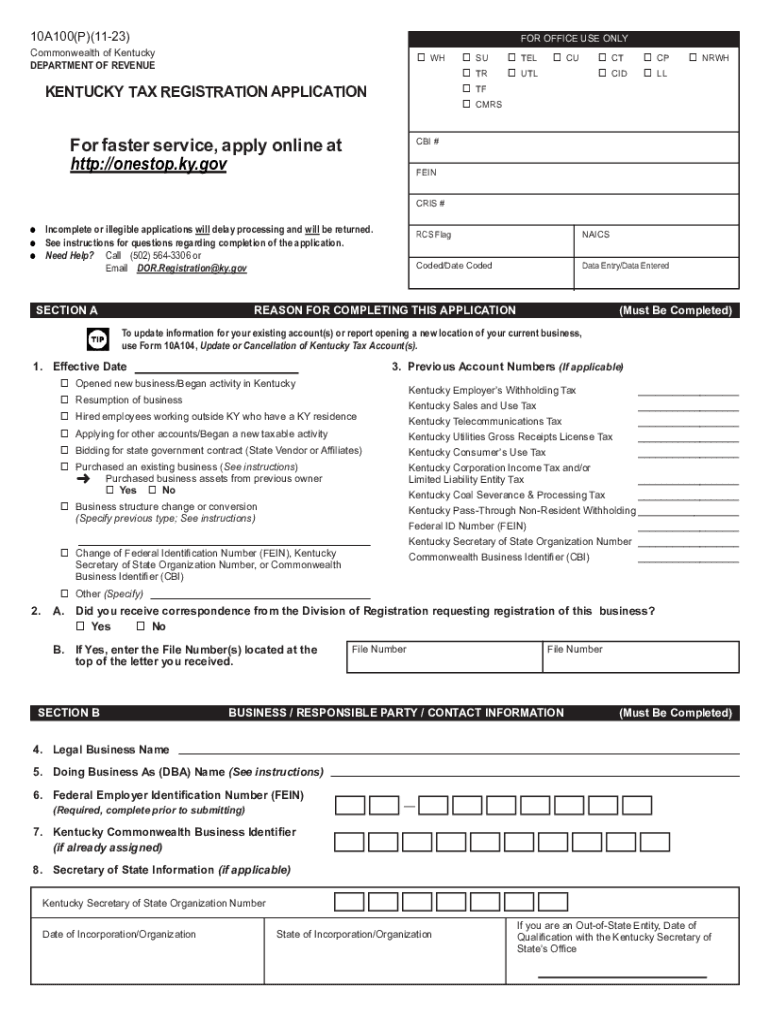

The Kentucky Form 10a100 is a crucial document used for registering a business for sales tax purposes in the state of Kentucky. This form is essential for businesses that plan to sell tangible personal property or taxable services. Completing this form allows businesses to obtain a sales tax permit, which is necessary for collecting sales tax from customers. The form is specifically designed for various business entity types, including sole proprietorships, partnerships, and corporations.

How to obtain the Kentucky Form 10a100

To obtain the Kentucky Form 10a100, individuals can visit the official Kentucky Department of Revenue website. The form is available for download in PDF format, making it easy to access and print. Additionally, businesses can request a physical copy of the form by contacting their local Department of Revenue office. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to complete the Kentucky Form 10a100

Completing the Kentucky Form 10a100 involves several key steps:

- Begin by providing your business name and address at the top of the form.

- Indicate the type of business entity you are registering, such as a sole proprietorship or corporation.

- Fill in the federal employer identification number (EIN) if applicable.

- List the nature of your business activities, specifying what products or services you will sell.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, it is essential to review all information for accuracy before submission.

Legal use of the Kentucky Form 10a100

The Kentucky Form 10a100 is legally required for businesses that intend to collect sales tax in Kentucky. Using this form ensures compliance with state tax laws, allowing businesses to operate legally within the state. Failure to file this form may result in penalties, including fines and the inability to collect sales tax from customers. Therefore, it is crucial for business owners to understand the legal implications of this form and to submit it accurately and on time.

Form Submission Methods

The Kentucky Form 10a100 can be submitted through multiple methods, providing flexibility for business owners. The options include:

- Online Submission: Businesses can complete the form electronically through the Kentucky Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Business owners may also choose to submit the form in person at their local Department of Revenue office.

Choosing the right submission method can help expedite the registration process.

Eligibility Criteria

To be eligible for the Kentucky Form 10a100, businesses must meet certain criteria. These include:

- Having a physical presence in Kentucky, such as a storefront or office.

- Intending to sell taxable goods or services.

- Completing all required sections of the form accurately.

Understanding these criteria is essential for ensuring that the registration process goes smoothly.

Quick guide on how to complete kentucky form 10a100

Effortlessly Complete Kentucky Form 10a100 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Kentucky Form 10a100 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Kentucky Form 10a100 with ease

- Find Kentucky Form 10a100 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that require new document prints. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Kentucky Form 10a100 and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky form 10a100

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 10a100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky sales tax form PDF?

The Kentucky sales tax form PDF is a document used by businesses in Kentucky to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations and can be easily downloaded and filled out to ensure accurate reporting.

-

How can I obtain the Kentucky sales tax form PDF?

You can obtain the Kentucky sales tax form PDF by visiting the Kentucky Department of Revenue's website. From there, you can locate the necessary forms and download them directly to your device, allowing for convenient access and completion.

-

Does airSlate SignNow offer integration for the Kentucky sales tax form PDF?

Yes, airSlate SignNow provides seamless integration options that allow users to upload and eSign the Kentucky sales tax form PDF. This feature enhances efficiency by streamlining the process of completing and submitting tax forms electronically.

-

What are the benefits of using airSlate SignNow for the Kentucky sales tax form PDF?

Using airSlate SignNow for the Kentucky sales tax form PDF offers numerous benefits, including reducing paperwork, saving time, and ensuring secure electronic signatures. Additionally, the platform enables easy tracking of submitted documents, enhancing overall compliance and organization.

-

Is there a cost associated with using airSlate SignNow for the Kentucky sales tax form PDF?

While airSlate SignNow operates on a subscription model, it is cost-effective compared to traditional methods of document handling. The pricing plans are designed to accommodate various business needs, ranging from individual freelancers to larger organizations needing to manage multiple Kentucky sales tax form PDFs.

-

Can I edit the Kentucky sales tax form PDF after signing it with airSlate SignNow?

Once the Kentucky sales tax form PDF is signed and completed in airSlate SignNow, it becomes a legally binding document and cannot be altered. However, you can save the signed version for your records or create a new form for further adjustments if necessary.

-

How does airSlate SignNow ensure the security of my Kentucky sales tax form PDF?

airSlate SignNow employs robust security measures to protect your Kentucky sales tax form PDF, including data encryption, secure cloud storage, and compliance with industry regulations. This ensures that your sensitive information remains confidential and safe throughout the signing process.

Get more for Kentucky Form 10a100

- Special events application city of white bear lake form

- Kentucky wic formula form fill online printable

- Navmc 136 form

- Judgment agency appeal form

- Ca articles organization form

- Get az request for residential wastewater fee adjustment form

- Idaho st 133 fillable form

- Your nameclient id or social security numberchange form

Find out other Kentucky Form 10a100

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself