Itps Coa Form

What is the ITPS COA?

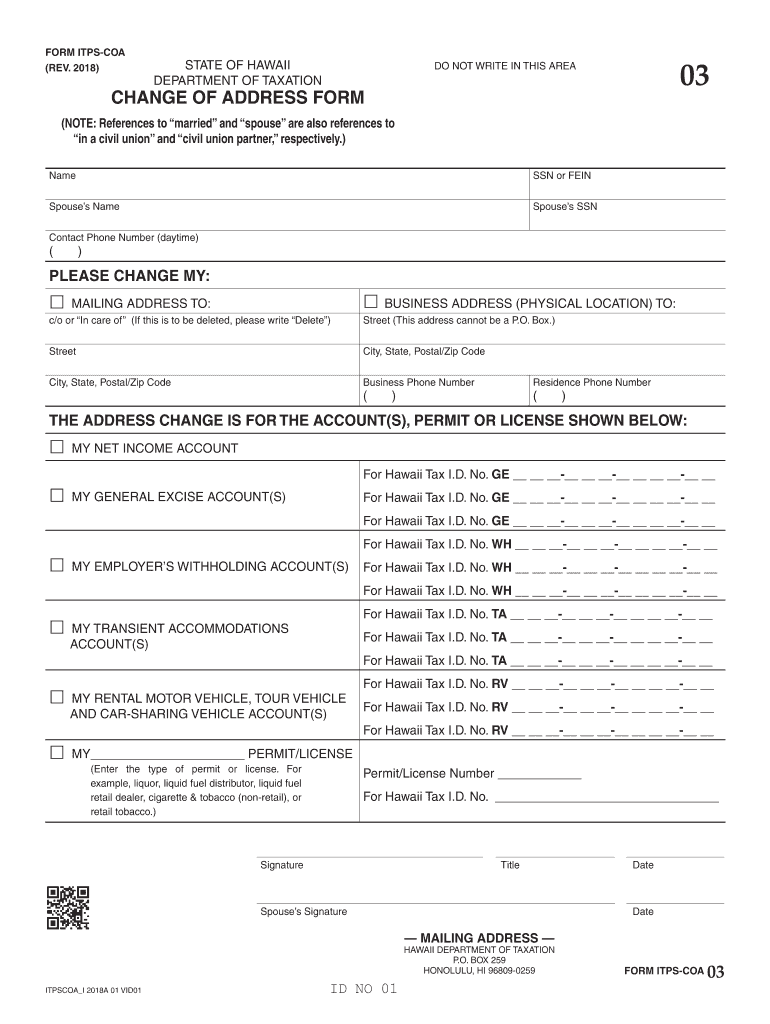

The ITPS COA, or Income Tax Preparer Signature Change of Address form, is a document used by tax preparers to officially notify the Internal Revenue Service (IRS) of a change in their business address. This form is crucial for ensuring that the IRS has up-to-date contact information for tax professionals, which helps maintain compliance and facilitates communication regarding tax matters. The ITPS COA is specifically designed for tax preparers who are registered with the IRS and need to update their address to continue receiving important notifications and correspondence.

Steps to Complete the ITPS COA

Completing the ITPS COA involves several straightforward steps to ensure that the form is filled out correctly. Here is a brief overview of the process:

- Obtain the form: Access the ITPS COA form from the IRS website or through authorized sources.

- Provide personal information: Fill in your name, Tax Identification Number (TIN), and the previous address associated with your IRS registration.

- Enter the new address: Clearly write the new business address where you want IRS correspondence to be sent.

- Sign and date: Ensure you sign the form to validate the information provided and include the date of submission.

- Submit the form: Send the completed form to the appropriate IRS address as indicated in the instructions.

Legal Use of the ITPS COA

The ITPS COA is a legally recognized document that must be completed accurately to ensure compliance with IRS regulations. It is essential for tax preparers to maintain updated records with the IRS to avoid potential penalties or miscommunication regarding tax filings. The form serves as a formal notification of address changes and is protected under privacy laws, ensuring that the information provided is handled securely by the IRS.

Required Documents

When completing the ITPS COA, no additional documents are typically required to accompany the form itself. However, tax preparers should ensure they have the following information readily available:

- Tax Identification Number (TIN)

- Previous address on file with the IRS

- New address for correspondence

Having this information at hand will facilitate a smooth completion of the form and help avoid any delays in processing.

Form Submission Methods

The ITPS COA can be submitted to the IRS through various methods, ensuring flexibility for tax preparers. The primary submission methods include:

- Mail: Send the completed form to the designated IRS address as specified in the form instructions.

- Online: Depending on IRS updates, check if there is an online submission option available for convenience.

- In-Person: Visit a local IRS office to submit the form directly, if preferred.

Who Issues the Form

The ITPS COA is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Tax preparers must use this form to communicate address changes to the IRS, ensuring that their records are accurate and up-to-date. This helps facilitate the efficient processing of tax returns and correspondence.

Quick guide on how to complete form itps coa rev 2018 change of address form forms 2018

Complete Itps Coa effortlessly on any gadget

Digital document management has become trendy among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the proper form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files quickly without delays. Handle Itps Coa on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Itps Coa with ease

- Obtain Itps Coa and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Itps Coa and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form itps coa rev 2018 change of address form forms 2018

How to make an eSignature for your Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 in the online mode

How to generate an eSignature for the Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 in Chrome

How to create an electronic signature for signing the Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 in Gmail

How to create an eSignature for the Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 from your smartphone

How to create an electronic signature for the Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 on iOS

How to create an electronic signature for the Form Itps Coa Rev 2018 Change Of Address Form Forms 2018 on Android

People also ask

-

What is a COA form and how is it used?

A COA form, or Certificate of Analysis, is a document that provides information about the quality and composition of a product. It is commonly used in industries like pharmaceuticals and food manufacturing to assure customers of safety and compliance.

-

How can airSlate SignNow help with COA form management?

airSlate SignNow streamlines the process of completing and signing COA forms by providing a digital platform for easy eSigning and document management. Users can create, send, and track COA forms seamlessly, reducing time and errors associated with manual processes.

-

What are the key features of the COA form in airSlate SignNow?

Key features for managing COA forms in airSlate SignNow include customizable templates, automated workflows, and the ability to integrate with other software. These features enhance efficiency and ensure compliance during the handling of critical documentation.

-

Is there a cost associated with using airSlate SignNow for COA forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, all designed to provide a cost-effective solution for managing COA forms. Depending on the plan you choose, you can enjoy a range of features, helping you to optimize your document workflows.

-

Can I integrate airSlate SignNow with other applications for COA form handling?

Absolutely! airSlate SignNow supports a range of integrations with popular applications such as Google Drive, Salesforce, and more. This allows businesses to seamlessly incorporate their COA form management into their existing workflows for enhanced productivity.

-

What are the benefits of using airSlate SignNow for COA forms?

Using airSlate SignNow for COA forms offers several benefits, including faster turnaround times, improved accuracy, and easier tracking of document statuses. This leads to better compliance and operational efficiency, which is vital for businesses dealing with sensitive documentation.

-

How secure is the COA form data in airSlate SignNow?

airSlate SignNow prioritizes data security and offers robust measures to protect COA form information. With features like encryption, secure cloud storage, and compliance with industry standards, you can trust that your sensitive documents are safe.

Get more for Itps Coa

- Wells fargo internet and mobile accolades wells fargo labs form

- Boone county fiscal court www boonecountyky org 29 form

- Fillable form virginia drivers license renewal

- Permanent handicap placard maryland fill online printable form

- Application for tinted window exemption used to apply for a medical exemption from the restrictions on the amount of tint form

- Professional certification branch cdph ca gov form

- Acu extension form fill out amp sign online

- Relationship funny contract template form

Find out other Itps Coa

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors