Boone County Fiscal Court Www BooneCountyKy Org 29 2023-2026

Understanding the Boone County Net Profit Tax Return

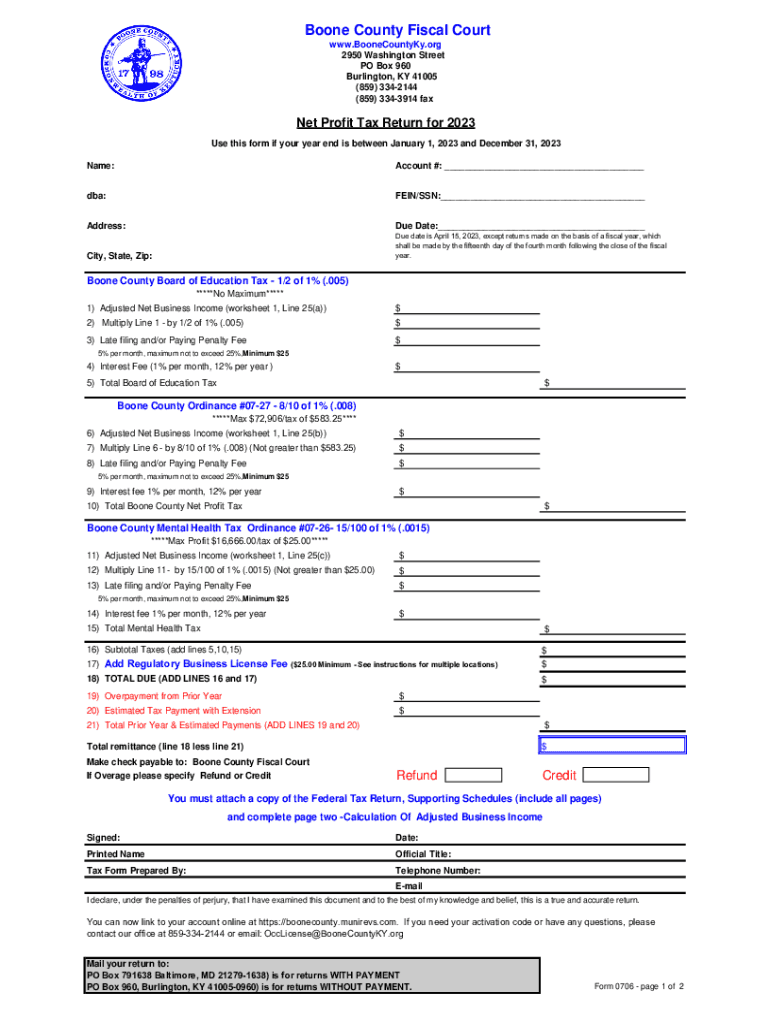

The Boone County net profit tax return is a crucial document for businesses operating within Boone County, Kentucky. This form is essential for reporting the net profit earned by a business during the tax year. All businesses, including corporations, partnerships, and sole proprietorships, must file this return to comply with local tax regulations. The form captures various financial details, including gross receipts, allowable deductions, and the resulting net profit, which ultimately determines the tax owed to the county.

Filing Deadlines and Important Dates

Timely filing of the Boone County net profit tax return is vital to avoid penalties. The standard deadline for submission aligns with the federal tax deadline, typically April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Businesses should also be aware of any extensions that may apply, ensuring they file the return or request an extension before the due date to maintain compliance.

Required Documents for Filing

To complete the Boone County net profit tax return accurately, businesses must gather several key documents. These typically include:

- Financial statements, such as profit and loss statements

- Receipts for deductible expenses

- Previous tax returns for reference

- Any relevant schedules that detail income sources

Having these documents ready will streamline the filing process and help ensure that all income and deductions are reported correctly.

Form Submission Methods

Businesses have several options for submitting the Boone County net profit tax return. The form can be filed online through the Boone County Fiscal Court's official website, which offers a user-friendly interface for electronic submission. Alternatively, businesses may choose to mail the completed form to the appropriate county office or submit it in person. Each method has its advantages, and businesses should select the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the Boone County net profit tax return on time can result in significant penalties. These may include late fees and interest on any unpaid taxes. In some cases, non-compliance can lead to further legal action by the county. It is crucial for businesses to understand these consequences and prioritize timely filing to avoid unnecessary financial burdens.

Taxpayer Scenarios

Different types of taxpayers may have unique considerations when filing the Boone County net profit tax return. For instance:

- Self-employed individuals must report their business income and expenses accurately to determine their net profit.

- Corporations may have additional reporting requirements, including details on shareholders and dividends.

- Partnerships need to ensure that income is reported correctly among partners to prevent discrepancies.

Understanding these scenarios can help taxpayers navigate the filing process more effectively.

Quick guide on how to complete boone county fiscal court www boonecountyky org 29

Complete Boone County Fiscal Court Www BooneCountyKy org 29 effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Boone County Fiscal Court Www BooneCountyKy org 29 on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Boone County Fiscal Court Www BooneCountyKy org 29 effortlessly

- Obtain Boone County Fiscal Court Www BooneCountyKy org 29 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Boone County Fiscal Court Www BooneCountyKy org 29 and ensure excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boone county fiscal court www boonecountyky org 29

Create this form in 5 minutes!

How to create an eSignature for the boone county fiscal court www boonecountyky org 29

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Boone County net profit tax return?

A Boone County net profit tax return is a form that businesses must file to report their net income and pay taxes to Boone County. It is essential for companies operating in this area to ensure compliance with local tax regulations and to accurately reflect their earnings.

-

How can airSlate SignNow help with Boone County net profit tax return filings?

airSlate SignNow provides a streamlined solution for preparing, signing, and submitting your Boone County net profit tax return documents. Our platform allows you to create templates, eSign, and securely store your documents, making the filing process efficient and compliant.

-

Is airSlate SignNow cost-effective for handling Boone County net profit tax returns?

Yes, airSlate SignNow offers a cost-effective solution for managing your Boone County net profit tax return. With various pricing plans available, you can choose one that fits your budget while still benefiting from powerful features that simplify document management.

-

What features does airSlate SignNow offer for Boone County businesses?

airSlate SignNow includes features like document templates, in-app payments, eSignature capabilities, and real-time tracking for your Boone County net profit tax return. These tools are designed to enhance productivity and ensure a smooth filing process.

-

Are there integrations available for Boone County net profit tax return processes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for easy import of financial data needed for your Boone County net profit tax return. This integration simplifies the filing process by reducing manual data entry.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your Boone County net profit tax return provides numerous benefits, including enhanced security, reduced turnaround time, and convenience. Our platform ensures that your sensitive information is protected while enabling you to work from anywhere.

-

Can airSlate SignNow handle multiple tax return submissions for a business?

Yes, airSlate SignNow can efficiently handle multiple Boone County net profit tax return submissions for your business. Whether you have several branches or various business entities, our platform can accommodate your filing needs with ease.

Get more for Boone County Fiscal Court Www BooneCountyKy org 29

- Hamot medical center medical power of attorney forms

- Full address sanfordhealth form

- Provider treatment attending plan form

- Branch clinic immunization consent form

- A basic grocery list from marshfield clinic and form

- Return information to mail financial assistance

- Prospecting material overprint order form mutual of omaha

- The fisher wallace stimulator authorization form shopify

Find out other Boone County Fiscal Court Www BooneCountyKy org 29

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple