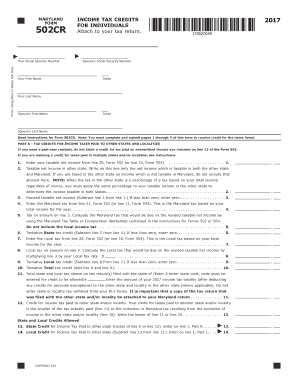

INCOME TAX CREDITS for INDIVIDUALS Attach to Your Tax Return Form

What is the form or 40?

The form or 40 is a specific tax form used by individuals to report their income and claim tax credits on their federal tax returns. This form is essential for taxpayers to accurately declare their earnings and determine their tax liability. It serves as a comprehensive document that consolidates various income sources, deductions, and credits, ensuring compliance with IRS regulations. Understanding the purpose and components of the form or 40 is crucial for effective tax filing.

How to use the form or 40

Using the form or 40 involves several key steps. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Next, fill out the form accurately, ensuring that all income sources are reported and applicable deductions are claimed. After completing the form, review it for any errors or omissions before submitting it to the IRS. This careful process helps ensure that your tax return is processed smoothly and efficiently.

Steps to complete the form or 40

Completing the form or 40 requires a systematic approach. Start by downloading the latest version of the form from the IRS website. Follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, dividends, and interest.

- Claim any eligible deductions, such as student loan interest or mortgage interest.

- Calculate your tax liability based on the information provided.

- Include any tax credits you qualify for, which can reduce your overall tax bill.

- Sign and date the form before submitting it to the IRS.

Eligibility criteria for the form or 40

To be eligible to use the form or 40, taxpayers must meet specific criteria set by the IRS. Generally, this form is intended for individuals who have earned income and are required to file a federal tax return. Eligibility may also depend on factors such as filing status, income level, and age. It is essential to review IRS guidelines to ensure compliance and determine if this form is the appropriate choice for your tax situation.

IRS guidelines for the form or 40

The IRS provides detailed guidelines for completing and submitting the form or 40. These guidelines cover various aspects, including filing deadlines, acceptable methods of submission, and record-keeping requirements. Taxpayers should familiarize themselves with these regulations to avoid penalties and ensure accurate reporting. Staying informed about any changes to tax laws or procedures is also vital for successful tax filing.

Form submission methods for the form or 40

Taxpayers can submit the form or 40 through several methods, including online filing, mailing a paper form, or in-person submission at designated IRS offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. When mailing the form, it is important to use the correct address based on your location and ensure that the form is sent well before the filing deadline. Understanding the available submission methods can help streamline the tax filing process.

Quick guide on how to complete income tax credits for individuals attach to your tax return

Complete INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return with ease

- Obtain INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that use.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or mistakes requiring you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

What is ITR1 form?

Income Tax ReturnTax return is a form that you are required to file and contains information about your income as well as tax liability thereon. You are required to file these tax return forms with the Income Tax Department. The Income Tax Act, 1961, obligates the citizens of India to file their tax returns, at the end of every Financial Year, with the I-T Department. However, it is not mandatory for every citizen. There are different types of ITR form and each form is applicable to a certain section of assessee. These forms need to be filed on a specified due date. Income Tax Department will process only those tax returns which are filed in proper forms and within the due date.ITR Form 1The single Income Tax Return (ITR) form, notified by the CBDT on April 5, has been put on its website, e-Filing Home Page, Income Tax Department, Government of India"Other ITRs will be available shortly," said the Income Tax e-filing website.The new ITR forms for the assessment year 2018-19 mandate the salaried class assessees to provide their salary breakup, and businessmen their GST number and turnover.The Central Board of Direct Taxes (CBDT), that frames policy for the tax department, had said some fields have been "rationalised" in the latest forms and that there is no change in the manner of filing the ITRs as compared to the last year.The form this time seeks an assessees salary details in separate fields and in a breakup format such as allowances that are not exempted, value of perquisites, profit in lieu of salary and deductions claimed under section 16.These details are provided in the Form 16 of a salaried employee and a senior tax official said that these are now meant to be mentioned in the ITR for clarity of deductions.The CBDT had said that the ITR-1 can be filed by an individual who "is resident other than not ordinarily resident and having an income of up to Rs 50 lakh."Which ITR Form to File?The Finance Minister has promised to the individual tax payer that he will make tax filing simpler for them, fulfilling this promise CBDT has now introduced a simplified ITR 1 Form applicable only for individuals having income up to Rs. 50 lakh. But taxpayers having dividend income above Rs. 10 lakh or unexplained credit can’t opt for ITR-1. The ITR-2A introduced in 2016 has now been withdrawn and even the old ITR-3 is merged with ITR-2. As such all the individual taxpayers (except those who are eligible to use ITR-1 or those earning business incomes) would be required to file ITR-2 only.Old ITR-4 is now replaced by ITR-3 as such the individual taxpayer earning income from business or profession are now required to use ITR-3. Taxpayers opting for presumptive taxation were required to file ITR-4S but now they are required to file ‘ITR-4 SUGAM’ for presumptive income.What is the structure of ITR 1 Form?Part A – General InformationPart B – Gross total IncomePart C – Deductions and taxable total incomePart D – Computation of Tax PayablePart E – Other InformationSchedule IT – Detail of Advance tax and Self-Assessment Tax paymentsSchedule TDS – Detail of TDS/TCSWho is eligible to file the ITR-1 FormITR -1 should be filed for an assessment year, when Total Income of an Individual includes:Income from Salary/PensionIncome from One House Property (excluding cases where loss is brought forward from previous years)Income from Other Sources (excluding winning from Lottery and Income from Race Horses)In case of clubbed Income Tax Returns, where a spouse or a minor is included, this can be done only if their income too is limited to the above specifications.When Should ITR – 1 be filed?ITR-1 form is to be used when the assessee has income that is within Rs. 50 Lakhs and when the source of income falls into any of the below categories:Income from Salary/ PensionIncome from just one house propertyIncome from other sources excluding Winning from Lottery, Race Horses, income from foreign assets, Capital Gains, Business or Profession, Agricultural income that exceeds Rs. 5000.Who can’t use Form ITR 1?Return in ITR 1 cannot be used by an individual if he:Is resident and ordinarily resident of India and has, –Any asset (including financial interest in any entity) located outside India; orSigning authority in any account located outside India; orIncome from any source outside India.Has earned income from capital gains or business or professionHas income from more than one house propertyHas losses under the head income from other sourcesHas total income above Rs 50 lakhsHas dividend income above Rs 10 lakhs taxable under Section 115BBDAHas unexplained credit or investment taxable at 60% under Section 115BBE.Has agricultural income exceeding Rs 5000Has income from winning from lottery or horse raceHas claimed any relief u/s. 90 or 90A or 91AHow do I file my ITR-1 Form?You can submit your ITR-1 Form either online or offline.Offline:Only following persons have the option to file the return in paper formAn individual at the age of 80 years or more at any time during the previous yearAn individual or HUF whose income does not exceed Rs 5 lakhs and who has not claimed any refund in the return of incomeFor offline ,the return is furnished in a physical paper form.The Income Tax Department will issue you an acknowledgment at the time of submission of your physical paper return.Online/Electronically:By transmitting the data electronically and then submitting the verification of the return in the form of ITR-V to CPC, Bengaluru.By filing the return online and e-verifying the ITR-V through net banking/adhaar OTP/EVC.If you submit your ITR-1 Form electronically, the acknowledgment will be sent to your registered email id. You can also choose to download it manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing. Alternatively, you can e-verify your return.The Major Changes which are made in the ITR 1 for the AY 2018-19 are:Earlier ITR-1 was applicable for both Residents, Residents Not ordinarily resident (RNOR) and also Non-residents. Now this from has been made applicable only for resident individuals.The condition of the individual having income from salaries, one house property, other income and having total income upto Rs 50 lakhs continuesThere is a requirement to furnish a break-up of salary. Until now, these details would appear only in Form 16 and the requirement to disclose them in the return had never arisen.There is also a requirement to furnish a break up of Income under House Property which was earlier mandatory only for ITR -2 and other formsTerms to know in ITR Form 1:Revised Return: If you have already filed your income tax return but you later discover that you have made a mistake in it, you can re-file. This is called a Revised Return. For the Financial Year 2017-18, you can file your Revised Return till March 31, 2019.Notice Number: You should fill this in only if you are filing your return in response to a notice from the Income Tax Department.Advance Tax: For salaried individuals, TDS mostly takes care of advance tax payments. However you might have other forms of income – like interest on savings bank accounts, fixed deposits, rental income, bonds or capital gains. If tax on income is more than Rs. 10,000 per year, you are required to estimate your income and pay Advance Tax. This has to be paid in quarterly installments in June, September, December and March.Self-Assessment Tax Payments: This is the difference between tax payable and tax paid and it needs to be paid before you file your return. When you fill out the form for the first time, you won’t know whether Self-Assessment Tax has to be paid or not. So, fill out the form first along with the Advance Tax details, if paid. Compute your income and if after computing, you find that tax is still payable, pay it and then fill in the details in self-assessment tax paid section in the return.Annexure-less Return: ITR-1 Form is an Annexure-less return. This means that you do not have to attach any documents (such as Form 16/Form 26AS) with the ITR-1 Form.Important information required to file ITR:PAN card is mandatory for all the assesseesAadhaar card has now been made mandatory for individual tax filers. In case of non-individual tax payers, the Aadhaar card of the authorized person is required to be providedIncome from salary, agriculture, other sources, house property, profession, capital gainsPersonal details like name, mobile number, address, type of employmentDeductions under chapter 10, chapter VI-A and many other sections like Section 80U, 80C, 80DComplete bank account details including branch, IFSC number along with account numberSelf-assessment tax paid, advance tax paid, TCS and TDS will be updated automaticallyDetails of cash deposited of the old, demonetized notes made between 9th November to 31st December 2016 and exceeding Rs. 2 lakhYou can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

What is ITR Form 2?

Income Tax Return-2 FormIncome tax Department has categorized taxpayers on the basis of income, source of income and many other factors to ensure easy compliance. Taxpayers having incomes from different categories, thus, have to download and fill different Income Tax Return forms. For instance, the ITR-2 Form is for taxpaying persons and HUFs who do not earn from and independent profession or business.When filing income tax returns, each category of persons, has a different form that must be used. The government has issued ITR 2 form for individuals and HUF’s who derive income from other sources, including their salary or pension. The previously used ITR 2A has been removed and now only ITR 2 form only exists, to be used by individuals meeting the requirements outlined in this guide.Given that ITR-1 is not applicable for the RNORs and the non-residents, they have to necessarily go with ITR-2 for filing their return of incomeThe applicability of ITR-2 has been made more clear in as much as now it is applicable for individuals and HUF having income other than income under the head “Profits and Gains from Business or Profession”The field of “Profits and Gains from Business or Profession” which was earlier featuring under Part B – TI has now been removed.Following this, Schedule-IF (Income from Firm) and Schedule-BP have also been removed. This now means, anyone earning income from a partnership firm, now has to file ITR-3 and not ITR -2Additionally, under Schedule AL, the field pertaining to “Interest held in the assets of a firm or association of persons (AOP) as a partner or member thereof” has been done away withSimilar to ITR -1, even in ITR-2, under the Schedule on TDS, there is also an additional field for furnishing details of TDS as per Form 26QC for TDS made on rent. Also, provision for quoting of PAN of Tenant for such rent cases has also been madeWho is eligible to file ITR 2 for AY 2018-19?ITR Form 2 is for Individuals and HUF receiving income other than income from “Profits and Gains from Business or Profession”. Thus persons having income from following sources are eligible to file Form ITR 2:Salary/pensionHouse property from one or moreCapital Gains/Loss on sale of investments/property (both short-term and long-term)Other sources (lottery, gambling and other legal channels)Being a partner in the firm (earlier there was separate ITR form 3 for this, the ITD has discontinued that form and merged into ITR 2)Foreign Assets/Foreign IncomeDividend income exceeding Rs 10 lakhs taxable u/s 115BBDAUnexplained credit or unexplained investment taxable at 60% u/s 68, 69, 69A, etc.Share of profit of partner from a partnership firmAgricultural income exceeding Rs 5,000When to file ITR Form 2ITR-2 form is to be used when the assessee has income that falls into the below category:Accrued income through the sale of assets or property (Capital Gains)Income from more than one housing propertyIncome from countries outside of IndiaIncome as a partner in any firm (not proprietorship)Income from agriculture above Rs 5,000Income from any windfall such as lotteries or horse racingIncome from Salary/Pension, Housing Property, Other sources that exceeds Rs. 50 LakhsWhat is the Structure of ITR 2?ITR-2 is divided into:Part A: General InformationPart B-TI: Computation of Total IncomePart B-TTI: Computation of tax liability on total incomeDetails to be filled if the return has been prepared by a Tax Return PreparerSchedule S: Details of income from salariesSchedule HP: Details of income from House PropertySchedule CG:. Computation of income under Capital gainsSchedule OS: Computation of income under Income from other sourcesSchedule CYLA: Statement of income after set off of current year’s lossesSchedule BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier yearsSchedule CFL: Statement of losses to be carried forward to future yearsSchedule VIA: Statement of deductions (from total income) under Chapter VIASchedule 80G: Statement of donations entitled for deduction under section 80GSchedule SPI: Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of assessee in Schedules-HP, CG and OSSchedule SI: Statement of income which is chargeable to tax at special ratesSchedule EI: Details of Exempt IncomeSchedule PTI : Pass through income details from business trust or investment fund as per Section 115UA, 115UBSchedule FSI: Statement of income accruing or arising outside India.Schedule TR: Details of taxes paid outside IndiaSchedule FA: Details of Foreign AssetsSchedule 5A : Statement of apportionment of income between spouses governed by Portuguese Civil CodeSchedule AL: Asset and liability at the year-end (applicable in case income exceeds Rs 50 lakhs)Who can use ITR Form 2?ITR-2 must be filed by individuals and HUFs who are not eligible to file ITR-1 Sahaj form, because of following reasons:Income exceeding Rs. 50 LakhsHaving foreign assets / incomeHaving agricultural income which is more than Rs. 5,000,Having taxable capital gainsHaving income from business or profession as a partnerHaving more than one house propertyHow to file ITR 2?You can submit your ITR-2 Form either online or offline.Offline:Only following persons can file their ITR offline:Individual who are of the age 80 years or above.Individual whose income is less than Rs 5 lakhs per year and who do not have to claim refund in the return.Return can be filed offline by:By furnishing a return in a physical paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment at the time of submission of your physical paper return.Online/Electronically:By furnishing the return electronically under digital signatureBy transmitting the data electronically and then submitting the verification of the return in Return Form ITR-VIf you submit your ITR-2 Form electronically under digital signature, the acknowledgment will be sent to your registered email id. You can also choose to download it manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Remember that ITR-2 is an annexure-less form i.e. you do not have to attach any documents when you send it.How do I fill out my ITR-2 Form?Here are a few general guidelines to keep in mind while filling your ITR-2 form:If any schedule is not applicable to you, strike it out and write —NA— across itIf any item is not applicable to you, write NA against itIndicate nil figures by “Nil”Put a “-” sign before negative figuresAll figures are to be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those are to be rounded off to the nearest multiple of ten.If you are an individual, under the Employer Category you should tick Government if you are a Central/State Government employee. You should tick PSU if you work in a public sector company of the Central/State Government.The ITR-2 Form can also not be used if you are claiming double taxation relief under Section 90/90A/91.Who cannot file ITR 2 for AY 2018-19?Any individual or HUF having income from Business or ProfessionIndividuals who are eligible to fill out the ITR-1 FormYou can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

May I work for non-government jobs. Do I have to fill the income tax return form?

I do not understand your first question. Regarding your second question everyone who has invome above the threhhold exempt limit of 2.5 lakhs has to file an income tax return exceot if you are a farmer and your sole source of income is farming, or if you belong to a list of people who have been exempted from income tax as per the Act.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the income tax credits for individuals attach to your tax return

How to create an eSignature for your Income Tax Credits For Individuals Attach To Your Tax Return in the online mode

How to create an electronic signature for your Income Tax Credits For Individuals Attach To Your Tax Return in Chrome

How to make an electronic signature for signing the Income Tax Credits For Individuals Attach To Your Tax Return in Gmail

How to create an electronic signature for the Income Tax Credits For Individuals Attach To Your Tax Return straight from your mobile device

How to create an eSignature for the Income Tax Credits For Individuals Attach To Your Tax Return on iOS devices

How to generate an eSignature for the Income Tax Credits For Individuals Attach To Your Tax Return on Android

People also ask

-

What are INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return?

INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return are specific credits that reduce the amount of tax you owe, helping to lower your overall tax burden. These credits can include various deductions and benefits that individuals may qualify for based on their income, family size, and other factors. Understanding these credits is essential for maximizing your tax savings.

-

How can I claim INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return using airSlate SignNow?

To claim INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return with airSlate SignNow, you can easily prepare your tax documents and eSign them securely. Our platform allows you to attach necessary documentation directly to your tax return, ensuring that you don’t miss out on any potential credits. Plus, the user-friendly interface makes the process quick and straightforward.

-

What features does airSlate SignNow offer for managing INCOME TAX CREDITS FOR INDIVIDUALS?

airSlate SignNow provides a range of features that simplify the process of managing INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return. You can create customizable templates, automate workflows, and securely eSign documents, making tax preparation efficient. These tools help ensure that you have all the necessary forms and documentation ready to maximize your tax credits.

-

Are there any costs associated with using airSlate SignNow for tax credits?

Yes, airSlate SignNow offers various pricing plans to suit different needs. While there may be subscription fees, the cost is often outweighed by the potential savings from INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return. Investing in our platform can streamline your tax preparation process and help you secure valuable deductions.

-

What types of INCOME TAX CREDITS FOR INDIVIDUALS can I apply for?

There are several types of INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return, including credits for education, child care, and earned income. Each credit has specific eligibility requirements, so it’s important to review them carefully. Using airSlate SignNow can help you organize and submit the necessary documents to claim these credits effectively.

-

Is airSlate SignNow compatible with tax software for filing INCOME TAX CREDITS FOR INDIVIDUALS?

Yes, airSlate SignNow seamlessly integrates with various tax software solutions, enabling you to file INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return efficiently. This integration allows you to easily import and export documents, ensuring a smooth workflow. You can manage your tax documents and credits all in one place.

-

How does airSlate SignNow ensure the security of my documents related to INCOME TAX CREDITS FOR INDIVIDUALS?

airSlate SignNow prioritizes the security of your documents, especially those related to INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return. We utilize industry-leading encryption and secure storage protocols to protect your sensitive information. You can trust that your documents are safe while using our platform.

Get more for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return

Find out other INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Return

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now