Michigan Form 4567

What is the Michigan Form 4567

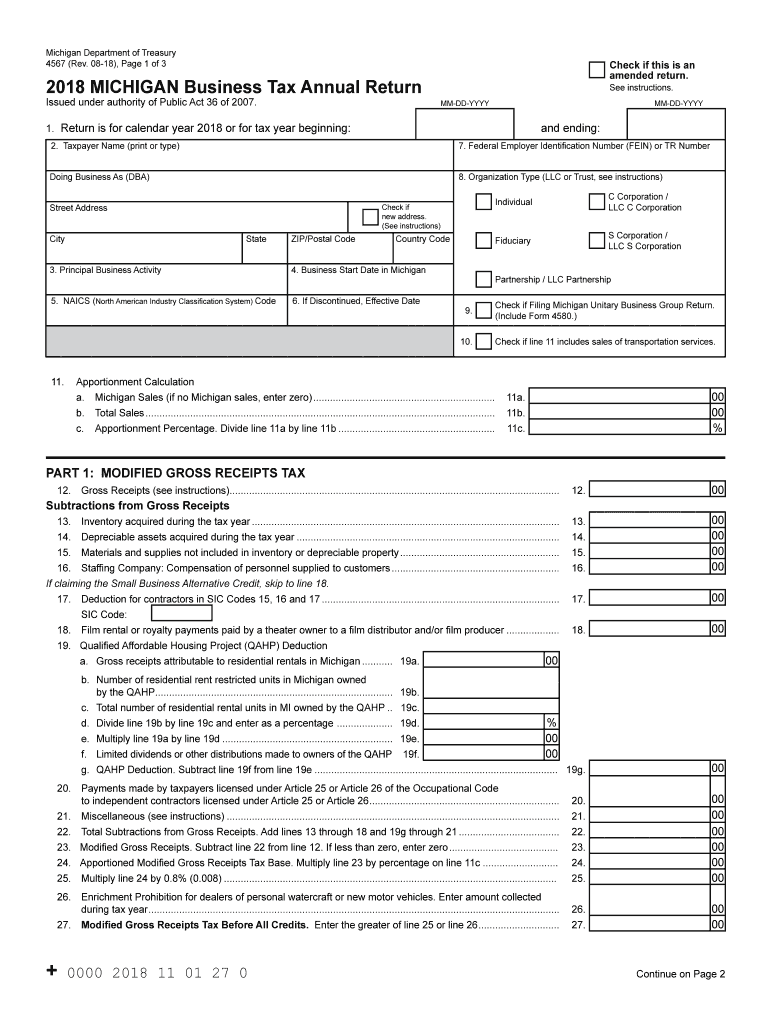

The Michigan Form 4567 is a business tax return form used by corporations, partnerships, and limited liability companies operating within the state of Michigan. This form is essential for reporting income, deductions, and tax liabilities to the Michigan Department of Treasury. It helps ensure compliance with state tax laws and provides a clear overview of a business's financial activities for the tax year.

Steps to complete the Michigan Form 4567

Completing the Michigan Form 4567 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Fill out the form accurately, providing details about your business's income, deductions, and credits.

- Review the completed form for any errors or omissions to ensure accuracy.

- Sign and date the form, confirming that the information provided is true and complete.

- Submit the form by the designated filing deadline, either electronically or by mail.

Legal use of the Michigan Form 4567

The Michigan Form 4567 is legally binding when completed and submitted according to state regulations. It must be signed by an authorized representative of the business, affirming that the information is accurate. Compliance with the form's requirements ensures that businesses fulfill their tax obligations and avoid potential penalties.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the Michigan Form 4567. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the deadline is April 15. It is crucial to mark these dates on your calendar to avoid late fees or penalties.

Required Documents

To complete the Michigan Form 4567, businesses need to gather several key documents:

- Income statements detailing revenue generated during the tax year.

- Balance sheets that reflect the business's financial position.

- Records of any deductions or credits claimed.

- Prior year tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Form 4567 can be submitted through various methods. Businesses can file online through the Michigan Department of Treasury's e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated locations. It is important to choose the method that best suits your business's needs while ensuring compliance with submission guidelines.

Quick guide on how to complete 4600 2017 michigan department of treasury state of michigan

Complete Michigan Form 4567 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Form 4567 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Michigan Form 4567 with ease

- Locate Michigan Form 4567 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Thoroughly review all details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Michigan Form 4567 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4600 2017 michigan department of treasury state of michigan

How to make an electronic signature for your 4600 2017 Michigan Department Of Treasury State Of Michigan online

How to make an eSignature for your 4600 2017 Michigan Department Of Treasury State Of Michigan in Google Chrome

How to create an electronic signature for putting it on the 4600 2017 Michigan Department Of Treasury State Of Michigan in Gmail

How to generate an eSignature for the 4600 2017 Michigan Department Of Treasury State Of Michigan right from your smartphone

How to generate an electronic signature for the 4600 2017 Michigan Department Of Treasury State Of Michigan on iOS devices

How to make an electronic signature for the 4600 2017 Michigan Department Of Treasury State Of Michigan on Android

People also ask

-

What is the process for filing a Michigan business tax return 2010 using airSlate SignNow?

To file a Michigan business tax return 2010 with airSlate SignNow, simply upload your completed tax documents to our platform. Once uploaded, you can eSign and send them directly to the appropriate tax authorities. Our user-friendly interface ensures that the process is quick and hassle-free.

-

What features does airSlate SignNow offer for handling Michigan business tax returns?

airSlate SignNow provides features like secure eSigning, automated workflows, and document templates that simplify the management of your Michigan business tax return 2010. Additionally, our platform allows you to track the status of documents in real-time, ensuring you never miss a filing deadline.

-

Is airSlate SignNow cost-effective for managing my Michigan business tax return 2010?

Yes, airSlate SignNow is a cost-effective solution for managing your Michigan business tax return 2010. We offer flexible pricing plans that cater to businesses of all sizes, allowing you to choose the level of service that best meets your needs without overspending.

-

Can I integrate airSlate SignNow with other software for my Michigan business tax return 2010?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Michigan business tax return 2010. This integration ensures that all your financial data is synchronized and accurate, streamlining your filing process.

-

What are the benefits of using airSlate SignNow for my Michigan business tax return 2010?

Using airSlate SignNow for your Michigan business tax return 2010 provides numerous benefits, including reduced paper usage, improved efficiency, and enhanced security for your sensitive documents. You'll also experience quicker turnaround times, ensuring that you meet all deadlines without stress.

-

How secure is airSlate SignNow for filing Michigan business tax returns?

Security is a top priority at airSlate SignNow. When filing your Michigan business tax return 2010, your documents are protected with industry-leading encryption and secure cloud storage. This ensures that your sensitive data remains confidential and is only accessible by authorized users.

-

What support does airSlate SignNow provide for users filing Michigan business tax return 2010?

airSlate SignNow offers comprehensive support to assist users with their Michigan business tax return 2010 filing. Our support team is available via chat, email, and phone to help you with any questions regarding the platform or the tax filing process, ensuring you get the assistance you need.

Get more for Michigan Form 4567

- Louisiana l 3 transmittal form

- Louisiana estimated tax declaration voucher for in form

- Form it 6 sny metropolitan commuter transportation mobility

- Real estate installment sale contract template form

- Real estate land contract template form

- Real estate investor contract template form

- Real estate investment contract template form

- Real estate of sale contract template form

Find out other Michigan Form 4567

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure