Louisiana L 3 Transmittal 2023-2026

What is the Louisiana L 3 Transmittal

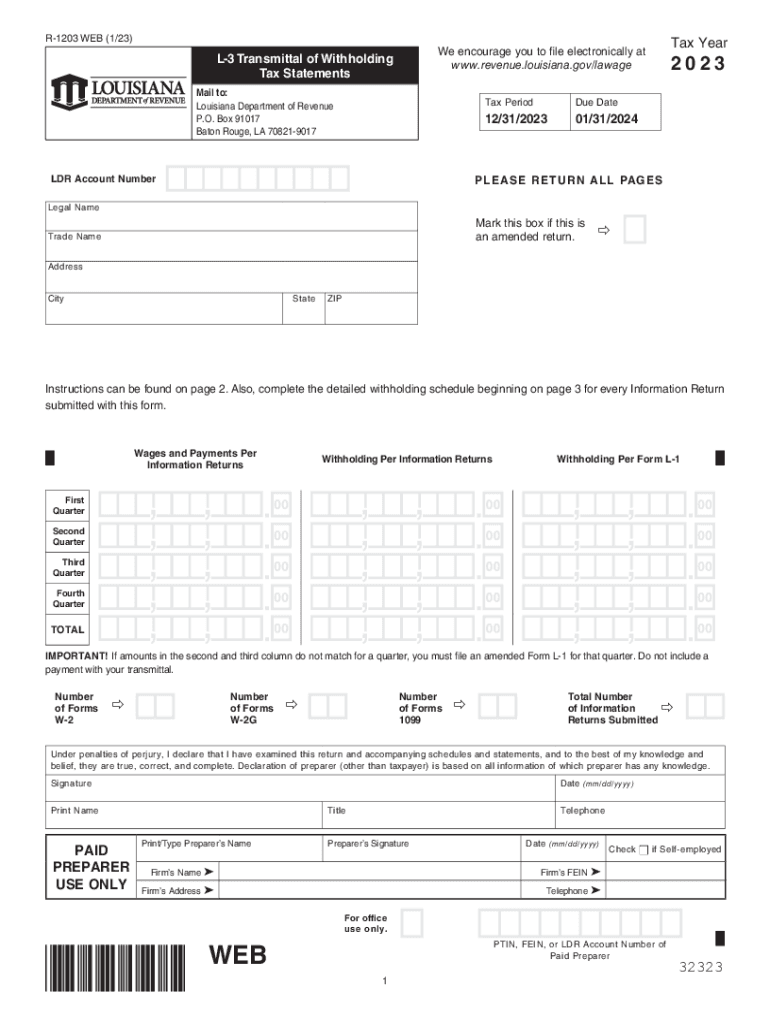

The Louisiana L 3 Transmittal is a crucial form used for reporting withholding tax statements in the state of Louisiana. This form is specifically designed for employers who need to submit annual withholding information to the Louisiana Department of Revenue. It serves as a summary of the withholding tax statements, including details such as the total amount withheld and the number of employees for whom the employer has withheld taxes. Proper completion and submission of the L 3 Transmittal are essential for compliance with state tax regulations.

How to use the Louisiana L 3 Transmittal

Using the Louisiana L 3 Transmittal involves several steps to ensure accurate reporting of withholding taxes. Employers must first gather all necessary information from their employees' W-2 forms or other withholding statements. Next, they should fill out the L 3 Transmittal, ensuring that all fields are completed accurately. This includes entering the total amount of state income tax withheld, the number of statements being submitted, and any other required information. Once completed, the form can be submitted to the Louisiana Department of Revenue either online or by mail.

Steps to complete the Louisiana L 3 Transmittal

Completing the Louisiana L 3 Transmittal involves a series of systematic steps:

- Gather all relevant employee withholding information, including W-2 forms.

- Access the L 3 Transmittal form from the Louisiana Department of Revenue website or through authorized tax software.

- Fill in the required fields, including employer information, total withholding amounts, and the number of employees.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or via postal mail.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana L 3 Transmittal are critical to avoid penalties. Employers must submit the form by February 28 of the year following the tax year for which the withholding is reported. It is essential to stay updated on any changes to deadlines, as the Louisiana Department of Revenue may announce adjustments or extensions. Marking these dates on a calendar can help ensure timely submission.

Penalties for Non-Compliance

Failure to submit the Louisiana L 3 Transmittal by the deadline can result in penalties imposed by the Louisiana Department of Revenue. These penalties may include fines based on the amount of tax due or a flat fee for late submissions. Additionally, non-compliance can lead to increased scrutiny from tax authorities, which may result in audits or further legal action. Therefore, it is vital for employers to adhere to submission guidelines and deadlines.

Required Documents

To complete the Louisiana L 3 Transmittal, employers must have several documents on hand. These include:

- Employee W-2 forms or other withholding statements that detail the amounts withheld.

- The Louisiana L 3 Transmittal form itself, which can be obtained from the Louisiana Department of Revenue.

- Any previous year’s transmittal forms, if applicable, for reference.

Having these documents ready will streamline the process and help ensure accurate reporting.

Quick guide on how to complete louisiana l 3 transmittal

Effortlessly prepare Louisiana L 3 Transmittal on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without complications. Manage Louisiana L 3 Transmittal on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and electronically sign Louisiana L 3 Transmittal with ease

- Obtain Louisiana L 3 Transmittal and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your document, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Louisiana L 3 Transmittal to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana l 3 transmittal

Create this form in 5 minutes!

How to create an eSignature for the louisiana l 3 transmittal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Louisiana Department of Revenue letter?

A Louisiana Department of Revenue letter is an official document sent by the state revenue department that may relate to tax notices, issues, or confirmations regarding a taxpayer's account. It's important to understand this letter to ensure compliance and address any tax obligations. airSlate SignNow can help you seamlessly eSign and send any responses or documents related to your Louisiana Department of Revenue letter.

-

How can airSlate SignNow help with responding to a Louisiana Department of Revenue letter?

With airSlate SignNow, you can quickly and securely eSign documents that are required in response to a Louisiana Department of Revenue letter. This platform allows you to manage all your communications in one place, ensuring that your responses are timely and legally valid. Plus, the user-friendly interface makes the process efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing documents related to your Louisiana Department of Revenue letter offers several benefits, including enhanced security, ease of use, and speed of execution. You can easily track document status, gather signatures promptly, and manage storage—saving you time and reducing stress during tax season.

-

Is airSlate SignNow cost-effective for small businesses dealing with Louisiana Department of Revenue letters?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, making it easy to handle tasks associated with Louisiana Department of Revenue letters without incurring high overhead costs. The affordable pricing plans provide access to all necessary features, ensuring that you can manage your documents efficiently while keeping budgets in check.

-

Can airSlate SignNow integrate with other tools to help manage Louisiana Department of Revenue letters?

Absolutely! airSlate SignNow offers integrations with various tools and software that can help streamline the management of Louisiana Department of Revenue letters. These integrations allow you to automate workflows, sync data effortlessly, and improve overall efficiency in handling documents and communications.

-

What security measures does airSlate SignNow implement for handling sensitive documents like Louisiana Department of Revenue letters?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and robust compliance measures to protect sensitive information within Louisiana Department of Revenue letters. The platform adheres to industry-standard security practices, ensuring that your data is safe from unauthorized access while you manage eSigning and document workflows.

-

Does airSlate SignNow offer customer support for issues related to Louisiana Department of Revenue letters?

Yes, airSlate SignNow provides excellent customer support to assist you with any issues or questions regarding your Louisiana Department of Revenue letters. Whether you need help with eSigning, document management, or specific concerns, their support team is available to guide you through the process at any time.

Get more for Louisiana L 3 Transmittal

Find out other Louisiana L 3 Transmittal

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer