Texas Sales Tax Application PDF Form

What is the Texas Sales Tax Application PDF?

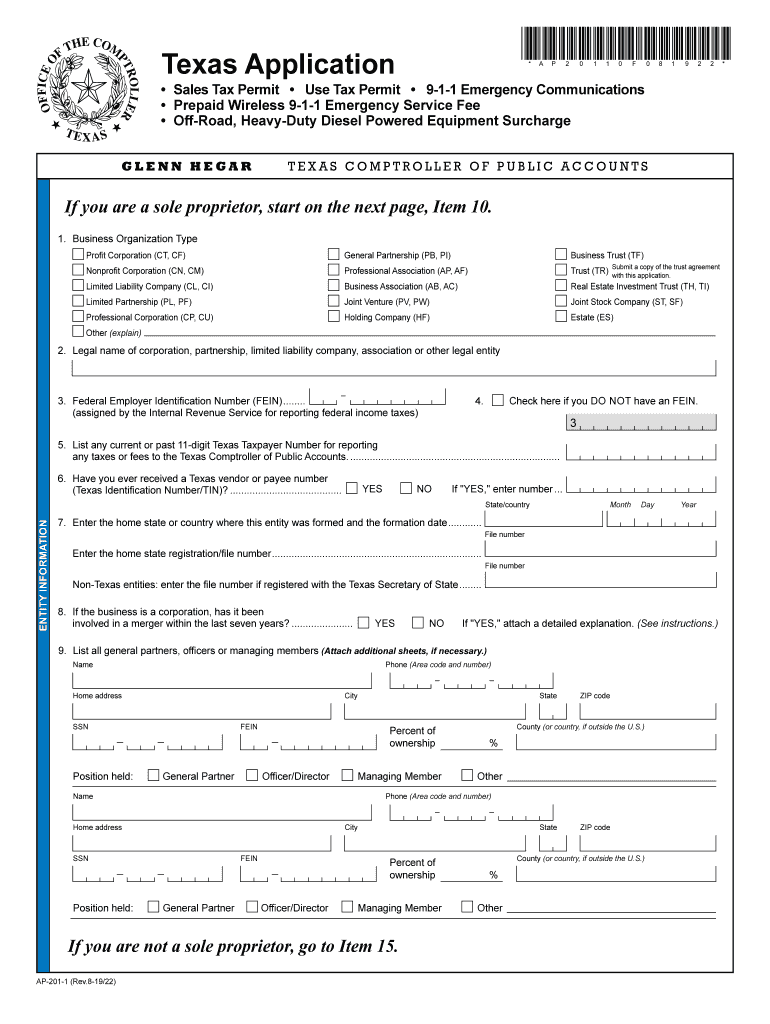

The Texas Sales Tax Application PDF is an official document used by businesses in Texas to apply for a sales tax permit. This permit allows businesses to collect sales tax on taxable sales and services. The application form is essential for compliance with state tax regulations and is part of the Texas Comptroller of Public Accounts' requirements. Completing this form accurately ensures that businesses can operate legally within the state and fulfill their tax obligations.

Steps to Complete the Texas Sales Tax Application PDF

Completing the Texas Sales Tax Application PDF involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information: Collect details about your business, including the legal structure, business name, and address.

- Provide ownership details: Include information about the owners or partners, such as names, addresses, and Social Security numbers.

- Describe business activities: Clearly outline the types of products or services your business offers.

- Complete the application: Fill out the form accurately, ensuring all required fields are completed.

- Review for accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit the application: Follow the submission instructions, whether online or by mail, to send your completed form to the appropriate authority.

Legal Use of the Texas Sales Tax Application PDF

The Texas Sales Tax Application PDF is legally binding when completed and submitted according to state regulations. It is crucial for businesses to understand that providing false information on this application can lead to penalties, including fines and revocation of the sales tax permit. Therefore, ensuring the accuracy and truthfulness of all information is vital for legal compliance and maintaining good standing with the Texas Comptroller of Public Accounts.

Required Documents for the Texas Sales Tax Application PDF

When filling out the Texas Sales Tax Application PDF, certain documents may be required to support your application. These documents include:

- Proof of identity: This may include a driver's license or Social Security card.

- Business formation documents: Depending on your business structure, you may need to provide articles of incorporation or partnership agreements.

- Federal Employer Identification Number (EIN): If applicable, include your EIN issued by the IRS.

- Lease agreements: If you operate from a physical location, provide a lease or rental agreement as proof of business address.

Form Submission Methods

The Texas Sales Tax Application PDF can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission: Businesses can fill out and submit the application electronically through the Texas Comptroller's website.

- Mail: Completed applications can be printed and mailed to the designated address provided on the form.

- In-person: Applicants may also choose to submit their forms in person at local Comptroller offices, where assistance may be available.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Texas Sales Tax Application is essential for compliance. While there is no specific deadline for applying for a sales tax permit, businesses should apply before they begin making taxable sales. This ensures they can collect sales tax from the outset. Additionally, businesses must be aware of ongoing filing deadlines for sales tax returns, which are typically due monthly, quarterly, or annually, depending on the volume of sales.

Quick guide on how to complete e911 prepaid wireless fee idaho state tax commission

Complete Texas Sales Tax Application Pdf seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Texas Sales Tax Application Pdf on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Texas Sales Tax Application Pdf effortlessly

- Obtain Texas Sales Tax Application Pdf and then click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Sales Tax Application Pdf while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e911 prepaid wireless fee idaho state tax commission

How to generate an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission in the online mode

How to generate an eSignature for your E911 Prepaid Wireless Fee Idaho State Tax Commission in Google Chrome

How to make an electronic signature for signing the E911 Prepaid Wireless Fee Idaho State Tax Commission in Gmail

How to create an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission from your mobile device

How to generate an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission on iOS

How to make an electronic signature for the E911 Prepaid Wireless Fee Idaho State Tax Commission on Android

People also ask

-

What is the Texas Sales Tax Application Pdf and how can it be used?

The Texas Sales Tax Application Pdf is a document used by businesses in Texas to apply for a sales tax permit. This form allows you to report and pay sales tax effectively. By utilizing airSlate SignNow, you can easily fill out and eSign this PDF, streamlining your application process.

-

How does airSlate SignNow simplify the Texas Sales Tax Application Pdf process?

airSlate SignNow simplifies the Texas Sales Tax Application Pdf process by providing an intuitive platform for filling out and signing documents electronically. Our solution eliminates the need for printing and mailing, allowing you to complete your sales tax application quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Texas Sales Tax Application Pdf?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. We provide a cost-effective solution for managing your Texas Sales Tax Application Pdf, ensuring you have access to essential features without breaking the bank.

-

What features does airSlate SignNow offer for managing the Texas Sales Tax Application Pdf?

airSlate SignNow offers a range of features for managing the Texas Sales Tax Application Pdf, including customizable templates, secure cloud storage, and electronic signature capabilities. These features help ensure a seamless and efficient application process.

-

Can I integrate airSlate SignNow with other software to manage the Texas Sales Tax Application Pdf?

Absolutely! airSlate SignNow integrates seamlessly with various software tools, including CRM and accounting systems. This integration allows you to efficiently manage your Texas Sales Tax Application Pdf alongside your other business operations.

-

How secure is the information I submit on the Texas Sales Tax Application Pdf with airSlate SignNow?

Your security is our priority. airSlate SignNow employs advanced encryption and security measures to protect the information submitted on the Texas Sales Tax Application Pdf. You can rest assured that your sensitive data is safe and secure.

-

Can I track the status of my Texas Sales Tax Application Pdf once submitted through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Texas Sales Tax Application Pdf. You’ll receive notifications and updates, ensuring you stay informed throughout the process.

Get more for Texas Sales Tax Application Pdf

- State louisiana form

- Fl 123 response domestic partnershipmarriage judicial council forms courtinfo ca

- Real estate cancellation contract template form

- Real estate contract template form

- Real estate consult contract template form

- Real estate for deed contract template form

- Real estate development contract template form

- Real estate for sale by owner contract template form

Find out other Texas Sales Tax Application Pdf

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free