Texas Sales Tax Application PDF Form

What is the Texas Sales Tax Application PDF?

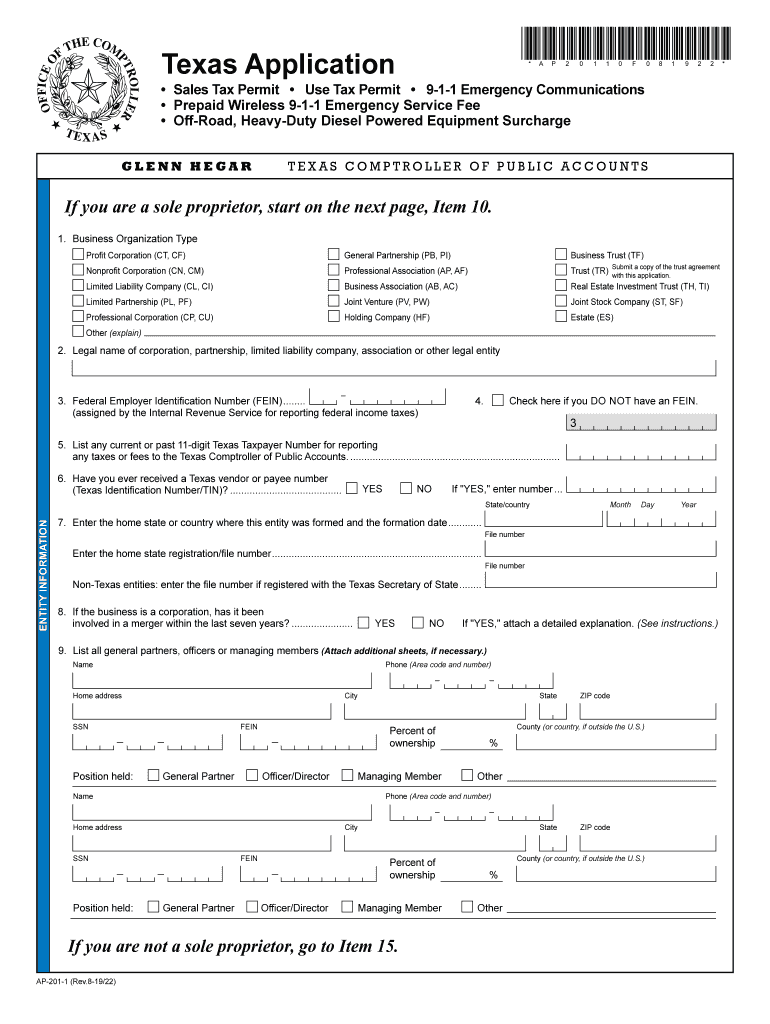

The Texas Sales Tax Application PDF is an official document used by businesses in Texas to apply for a sales tax permit. This permit allows businesses to collect sales tax on taxable sales and services. The application form is essential for compliance with state tax regulations and is part of the Texas Comptroller of Public Accounts' requirements. Completing this form accurately ensures that businesses can operate legally within the state and fulfill their tax obligations.

Steps to Complete the Texas Sales Tax Application PDF

Completing the Texas Sales Tax Application PDF involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information: Collect details about your business, including the legal structure, business name, and address.

- Provide ownership details: Include information about the owners or partners, such as names, addresses, and Social Security numbers.

- Describe business activities: Clearly outline the types of products or services your business offers.

- Complete the application: Fill out the form accurately, ensuring all required fields are completed.

- Review for accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit the application: Follow the submission instructions, whether online or by mail, to send your completed form to the appropriate authority.

Legal Use of the Texas Sales Tax Application PDF

The Texas Sales Tax Application PDF is legally binding when completed and submitted according to state regulations. It is crucial for businesses to understand that providing false information on this application can lead to penalties, including fines and revocation of the sales tax permit. Therefore, ensuring the accuracy and truthfulness of all information is vital for legal compliance and maintaining good standing with the Texas Comptroller of Public Accounts.

Required Documents for the Texas Sales Tax Application PDF

When filling out the Texas Sales Tax Application PDF, certain documents may be required to support your application. These documents include:

- Proof of identity: This may include a driver's license or Social Security card.

- Business formation documents: Depending on your business structure, you may need to provide articles of incorporation or partnership agreements.

- Federal Employer Identification Number (EIN): If applicable, include your EIN issued by the IRS.

- Lease agreements: If you operate from a physical location, provide a lease or rental agreement as proof of business address.

Form Submission Methods

The Texas Sales Tax Application PDF can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission: Businesses can fill out and submit the application electronically through the Texas Comptroller's website.

- Mail: Completed applications can be printed and mailed to the designated address provided on the form.

- In-person: Applicants may also choose to submit their forms in person at local Comptroller offices, where assistance may be available.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Texas Sales Tax Application is essential for compliance. While there is no specific deadline for applying for a sales tax permit, businesses should apply before they begin making taxable sales. This ensures they can collect sales tax from the outset. Additionally, businesses must be aware of ongoing filing deadlines for sales tax returns, which are typically due monthly, quarterly, or annually, depending on the volume of sales.

Quick guide on how to complete e911 prepaid wireless fee idaho state tax commission

Complete Texas Sales Tax Application Pdf seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Texas Sales Tax Application Pdf on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Texas Sales Tax Application Pdf effortlessly

- Obtain Texas Sales Tax Application Pdf and then click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Sales Tax Application Pdf while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e911 prepaid wireless fee idaho state tax commission

How to generate an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission in the online mode

How to generate an eSignature for your E911 Prepaid Wireless Fee Idaho State Tax Commission in Google Chrome

How to make an electronic signature for signing the E911 Prepaid Wireless Fee Idaho State Tax Commission in Gmail

How to create an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission from your mobile device

How to generate an eSignature for the E911 Prepaid Wireless Fee Idaho State Tax Commission on iOS

How to make an electronic signature for the E911 Prepaid Wireless Fee Idaho State Tax Commission on Android

People also ask

-

What is 201 use tax and how does it apply to my business?

The 201 use tax refers to a tax imposed on the use of certain goods in your jurisdiction after purchase. For businesses, understanding the 201 use tax is crucial to ensure compliance when acquiring equipment or services. airSlate SignNow helps streamline your document processes, making it easier to manage tax-related documentation.

-

How can airSlate SignNow help me with 201 use tax documentation?

airSlate SignNow offers features that simplify the process of documenting 201 use tax-related transactions. You can easily create, send, and eSign documents necessary for tax compliance. This not only saves time but also minimizes the risk of errors in your tax filings.

-

What pricing plans are available for airSlate SignNow, especially for businesses dealing with 201 use tax?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes, making it cost-effective for those managing 201 use tax obligations. Each plan includes robust features to assist with compliance and documentation. You can select a plan that matches your needs without overspending.

-

Are there specific features in airSlate SignNow that support 201 use tax compliance?

Yes, airSlate SignNow includes features such as automated reminders and templates for tax-related documents, which can be particularly beneficial when dealing with 201 use tax compliance. These functionalities enable businesses to stay organized and timely with their tax submissions. Additionally, the platform ensures secure storage of all documents for easy access.

-

Can I integrate airSlate SignNow with my existing accounting software for 201 use tax tracking?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software platforms, enhancing your process for tracking 201 use tax. This integration allows for streamlined data flow between your documentation and accounting needs, ensuring all tax obligations are accurately managed.

-

What are the benefits of using airSlate SignNow for managing 201 use tax?

Utilizing airSlate SignNow for managing 201 use tax offers numerous benefits, including improved efficiency and accuracy in your documentation process. The platform empowers businesses to digitalize their paperwork, reducing the hassle associated with paper-based methods. Enhanced security and compliance options provide peace of mind when handling sensitive tax information.

-

Is airSlate SignNow user-friendly for new users unfamiliar with 201 use tax?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with 201 use tax. The intuitive interface guides users through the document creation and signing process, ensuring that everyone can manage their tax documentation confidently. Additionally, the platform offers support resources to assist new users.

Get more for Texas Sales Tax Application Pdf

- State louisiana form

- Fl 123 response domestic partnershipmarriage judicial council forms courtinfo ca

- Real estate cancellation contract template form

- Real estate contract template form

- Real estate consult contract template form

- Real estate for deed contract template form

- Real estate development contract template form

- Real estate for sale by owner contract template form

Find out other Texas Sales Tax Application Pdf

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form